Applying for a Pag-IBIG Housing Loan is a significant undertaking for any individual or family. With the increasing cost of living and the rising prices of real estate, obtaining a loan for a home can be a intimidating task. That is why Pag-IBIG Fund has set specific requirements that need to be met before approving a loan application.

Also read: Pag-IBIG Fund Affordable Housing Loan Program for Minimum Wage Earners

These requirements include the submission of valid documents, which serve as proof of the applicant’s capability to pay and willingness to comply with the loan terms. Submitting complete documents is of utmost importance as it increases the likelihood of a successful loan application and ensures that all the necessary details are accounted for.

So if you’re planning to apply for a Pag-IBIG housing loan, make sure you have all the required documents ready to ensure a smooth and hassle-free application process. With the right documents, you’ll be one step closer to achieving your dream of owning your own home.

Benefits

Knowing the complete list of requirements for Pag-IBIG housing loan offers several benefits:

- Smooth loan application process: Having all the required documents ready ensures a hassle-free application process.

- Increased chances of approval: Submitting the correct and complete set of documents improves the chances of loan approval.

- Time and effort savings: Being aware of the required documents in advance helps in gathering them early, saving time and effort.

- Avoidance of delays: By having the complete list of valid documents, you can avoid unnecessary delays in the loan processing.

- Confidence in application: Knowing that you have all the necessary documents gives you confidence in your loan application.

Make sure to obtain and familiarize yourself with the complete list of valid documents for Pag-IBIG housing loan to maximize these benefits.

List of Requirements for Applying for a Pag-IBIG Housing Loan

Before you begin applying for a housing loan, please ensure that you have prepared the following.

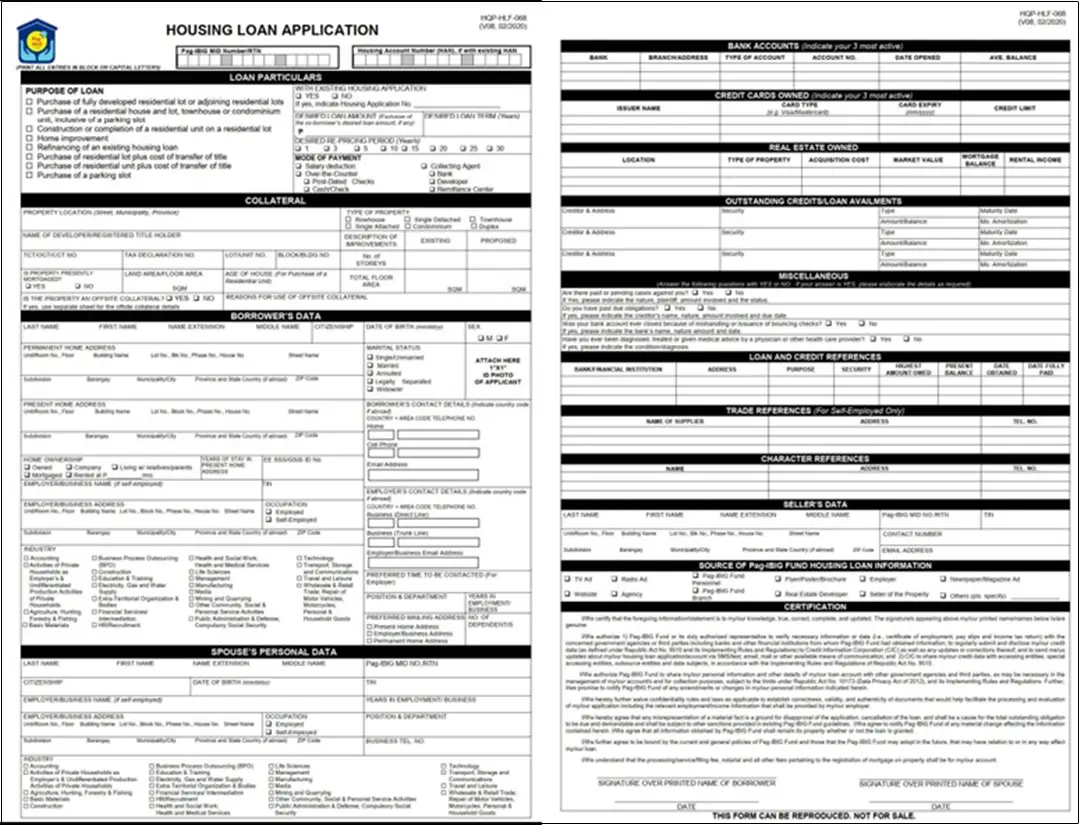

1. LOAN APPLICATION FORM

Successfully completed Housing Loan Application with your “1×1” ID photo.

a. Principal borrowers

Please download the Housing Loan Application form (HLA HQP-HLF-068).

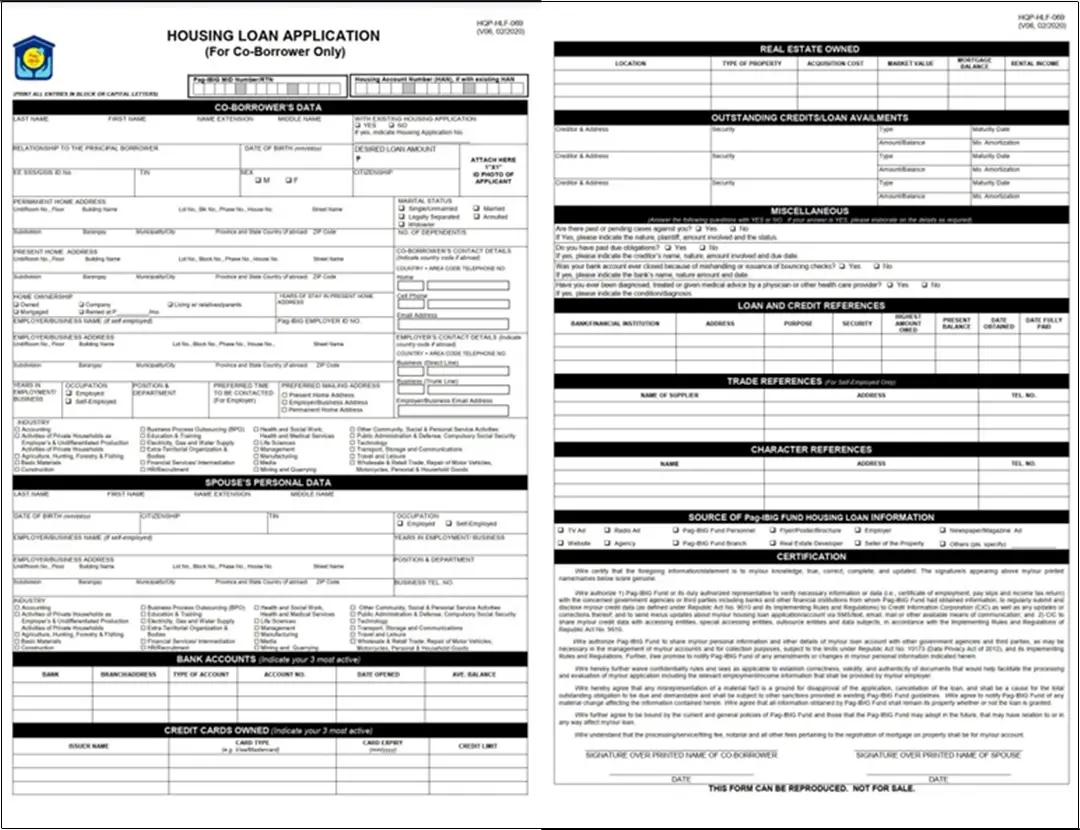

a. Co-borrowers

Please download the Housing Loan Application form (HLA HQP-HLF-069).

To assist you in completing your application form, please refer to the APPLICATION FORM GUIDE:

2. PROOF OF INCOME

a. For Locally Employed

Proof of income for locally employed individuals may include the following:

- Certificate of Employment and Compensation (CEC): This document should indicate your gross monthly income, as well as any monthly allowances or benefits you receive. Please ensure that the CEC is duly signed by an authorized signatory of your employer. If the CEC is generated by a system, it must include the signature of the authorized signatory.

- Latest Income Tax Return (ITR): You should provide the ITR for the year immediately preceding your loan application. Please attach BIR Form No. 2316, which should be duly acknowledged by the BIR or an authorized representative of your employer. Make one photocopy of the ITR.

- One Month Payslip: Include one certified true copy of your payslip from within the last three months prior to your loan application. The payslip should display your name and the signature of the authorized signatory of your employer.

Note: For government employees who will be paying their loan amortization through salary deduction, you must submit the original copy of one month’s payslip from within the last three months, along with the CEC or ITR mentioned above.

b. For Self-employed

Proof of income for self-employed individuals may include the following:

- Income Tax Return (ITR), Audited Financial Statements, and Official Receipt of tax payment from a bank, supported by DTI Registration and Mayor’s Permit/Business Permit.

- Commission Vouchers that reflect the issuer’s name and contact details, covering the past 12 months.

- Bank Statements or passbook for the previous 12 months (in cases where income is sourced from foreign remittances, pensions, etc.).

- Copy of the Lease Contract and Tax Declaration (if the income is derived from rental payments).

- Certified True Copy of the Transport Franchise issued by the appropriate government agency (LGU for tricycles, LTFRB for other PUVs).

- Certificate of Engagement issued by the business owner.

- Any other document that validates the source of income.

These documents are essential to demonstrate the legitimacy and stability of self-employed individuals’ income.

c. For OFW

Proof of Income for Overseas Filipino Workers:

1. Employment Contract

- Agreement between employee and employer; or

- Standard Contract issued by POEA

2. Certificate of Employment and Compensation (CEC):

- CEC should be on the Employer/Company’s official letterhead; or

- CEC should be signed by the employer (for household staff and similar employees) and accompanied by a photocopy of the employer’s ID or passport.

3. Ensure that you submit your Income Tax Return to the Host Country/Government.

NOTE: If the documents are in a foreign language, an English translation is necessary.

3. ONE (1) VALID ID WITH SIGNATURE

A photocopy or scanned copy of one (1) valid identification (ID) card.

List of Valid ID’s

- Passport

- Driver’s License

- Professional Regulation Commission (PRC) ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Voter’s ID

- Barangay Certification or Barangay IDs or similar documents bearing picture of the Member

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) Card

- Senior Citizen Card

- Overseas Workers Welfare Administration (OWWA) ID

- Overseas Filipino Worker ID

- Seaman’s Book or Seafarer’s Identification and Record Book (SIRB)

- Alien Certification of Registration/Immigrant Certificate of Registration

- Government Office and GOCC ID, e.g. AFP ID, Pag-IBIG Fund Loyalty Card

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID

- Philippine Identification (PhilID) Card

- Company ID issued by Private Entities or Institutions Registered with or supervised or regulated either by the BSP, SEC or IC.

4. SELFIE PHOTO

Provide a selfie photo along with your ID card.

Sample

These are the comprehensive list of documents you need to prepare for your Pag-IBIG Housing Loan application. Make sure to submit and complete all the requirements to make your application process smoother.

Also read: Pag-IBIG Housing Loan Restructuring: How to Avail and What are the Process

TIPS and Guidelines for a Successful Pag-IBIG Housing Loan Application

Once you have identified the documents that are valid for a Pag-IBIG housing loan application, it is important to adhere to certain tips and guidelines so as to ensure a successful loan.

- Complete and Organize Documents: Ensure that you have all the necessary documents required for the loan application. Organize them in a systematic manner for easy submission and verification.

- Review Eligibility Criteria: Familiarize yourself with the eligibility criteria set by Pag-IBIG. Make sure you meet all the requirements before proceeding with the application.

- Maintain Good Credit Score: A good credit score enhances your chances of getting approved for the loan. Pay your bills on time and avoid defaulting on loans or credit cards to maintain a positive credit history.

- Save for Down Payment: Start saving for the down payment required for the housing loan. Having a substantial down payment can improve your loan application and help you secure better terms.

- Seek Professional Advice: If you are unsure about any aspect of the loan application process, consider consulting with a financial advisor or a housing loan specialist. They can provide guidance and help you make informed decisions.

- Pay Attention to Loan Terms: Understand the terms and conditions of the loan, including interest rates, repayment period, and any associated fees. Compare different loan options to choose the one that best fits your financial situation.

- Submit Accurate and Complete Information: Double-check all the information provided in the application form. Make sure it is accurate and complete to avoid delays or rejection of the loan.

- Follow Up on the Application: Stay proactive and follow up on the status of your loan application. Keep track of any additional documents or information requested by Pag-IBIG and promptly provide them.

Remember, following these tips and guidelines can increase your chances of securing a successful Pag-IBIG housing loan.

Also read: How to Apply Multi-Purpose Loan from Pag-IBIG

Summary

In order to obtain a Pag-IBIG housing loan, one must submit a variety of valid documents, including proof of income, government-issued identification, and proof of ownership of the property to be purchased. While the process of gathering and submitting all necessary documents may seem daunting, it is crucial to ensure that all materials are complete and in order.

Doing so will streamline the approval process and help avoid delays or interruptions in securing the loan. By providing all necessary documents up front, borrowers can increase their chances of being approved for the loan and moving forward with their plans to purchase a home.

Contact Information

Website: pagibigfund.gov.ph

Phone: 02 8724 4244

Email: contactus@pagibigfund.gov.ph

Facebook Page: https://www.facebook.com/PagIBIGFundOfficialPage