The Pag-IBIG Fund Multi-Purpose Loan (MPL) is a financial assistance program designed to cater to the immediate financial needs of its members. Whether you’re facing an emergency, planning a small business venture, or dealing with unexpected expenses, the MPL can provide you with the funds you need.

Also read: How to Apply for a Housing Loan from Pag-IBIG?

One of the key features of the MPL is the ability to borrow up to 80% of your total Pag-IBIG Regular Savings. This includes your personal contributions, your employer’s contributions, and any dividends earned. The loan is easily accessible, with a processing time that can be as fast as two days!

Benefits of Multi-Purpose Loan

The Pag-IBIG Multi-Purpose Loan (MPL) offers several benefits to its members:

- Versatility: As the name suggests, the MPL can be used for various purposes, including paying off debts, financing home improvements, funding education or medical expenses, starting a small business, or covering other immediate financial needs.

- High Loanable Amount: Members can borrow up to 80% of their total Pag-IBIG Regular Savings, which include their personal contributions, their employer’s contributions, and accumulated dividends.

- Low Interest Rates: The MPL has competitive interest rates compared to other loan options in the market. This makes it an affordable choice for members who need financial assistance.

- Flexible Repayment Terms: The loan is repayable within 24 months, giving members ample time to repay the loan. Payments can be made through salary deduction, over-the-counter at Pag-IBIG Fund branches, or through accredited collecting partners.

- Fast Processing Time: The MPL has a relatively fast processing time, allowing members to receive their funds as quickly as possible.

- Membership Benefit: Availing of the MPL also serves as a benefit of being a Pag-IBIG member. It’s a way for the fund to give back to its members by providing them with financial assistance when they need it the most.

Remember, it’s important to borrow responsibly and ensure that you have the means to repay the loan on time. Always check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

Qualifications for Pag-IBIG Multi-Purpose Loan

To be eligible for the Pag-IBIG Multi-Purpose Loan, you must meet the following criteria:

A. Membership Savings

You must have at least twenty-four (24) monthly membership savings under the Pag-IBIG Regular Savings program. These contributions can be made continuously or cumulatively.

B. Active Membership

You need to maintain active membership status by having at least one (1) monthly membership savings within the last six (6) months prior to the date of the loan application.

C. No Default on Existing Loans

If you have an existing Pag-IBIG Housing Loan, Multi-Purpose Loan (MPL), and/or Calamity Loan, your accounts must not be in default. This means you have no missed or late payments.

D. Proof of Income

You must provide proof of sufficient income to cover the loan repayments. This could include pay slips, employment contracts, income tax returns, or other documents that show your income.

It’s important to note that meeting these requirements does not guarantee approval of your loan application. The final decision will depend on the assessment of your capacity to pay and compliance with the Pag-IBIG Fund’s policies. Always check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

Also read: How to Apply Pag-IBIG Calamity Loan

What are the Possible Uses or Purposes for the Pag-IBIG MPL

Usage of the Pag-IBIG Multi-Purpose Loan

The Pag-IBIG Multi-Purpose Loan (MPL) is designed to cater to a wide range of financial needs, offering flexibility in how you choose to use the funds.

Here are some common purposes for which you can utilize the MPL:

- Medical Expenses: The loan can be used to cover hospital bills, medication costs, or any other health-related expenses.

- Home Improvement: Whether you need to repair a leaky roof, renovate a room, or carry out minor upgrades around your home, the MPL can provide the necessary funds.

- Business Capital: If you’re starting a small business or looking to expand an existing one, you can use the MPL as capital.

- Education Expenses: The MPL can help cover tuition fees, purchase of books and other school supplies, or other education-related expenses.

- Purchase of Goods: You can use the loan to buy furniture, appliances or electronic gadgets.

- Bill Payments: The MPL can be used to pay off utility bills or credit card debts.

- Travel and Vacation: Planning a holiday? The MPL can cover your travel expenses.

- Special Events: Whether you’re planning a wedding, a birthday party, or another special event, the MPL can help cover the costs.

- Car Repair: If your vehicle needs repair or maintenance, the MPL can provide the necessary funds.

- Other Needs: The MPL can be used for any other immediate financial needs not mentioned above.

Remember, it’s important to use the loan responsibly and only for necessary expenses. Always plan your repayment strategy before availing of the loan.

Also read: How to Make Pag-IBIG Payments Online

Requirements for Pag-IBIG MPL (For Members)

To apply for the Pag-IBIG Multi-Purpose Loan (MPL), you’ll need to gather and submit the following documents:

Required Documents

- Multi-Purpose Loan Application Form (MPLAF, HQP-SLF-065): You need to fill out and submit one original copy of this form.

- Valid ID: Submit one photocopy of a valid ID that is acceptable to the Fund. The original must be presented for authentication.

- Proof of Income: Depending on your employment status, you’ll need to submit different documents as proof of income:

A. Proof of Income for Formally-Employed:

The “Certificate of Net Pay” portion at the back of the application form must be accomplished by the employer, or submit a photocopy of your latest one-month payslip, authenticated by the company’s authorized signatory.

B. Proof of Income for Self-Employed:

Submit any of the following:

- Income Tax Return (ITR), Audited Financial Statements, and Official Receipt of tax payment from bank supported with Department of Trade and Industry (DTI) Registration and Mayor’s Permit/Business Permit (1 Photocopy)

- Commission Vouchers reflecting the issuer’s name and contact details (for the last 12 months) (1 Original)

- Bank Statements or passbook for the last 12 months (in case income is sourced from foreign remittance, pension, etc.) (1 Original)

- Certified True Copy of Transport Franchise issued by appropriate government agency (LGU for tricycles, LTRFB for other PUVs) (1 Original)

- Certificate of Engagement issued by the owner of business (1 Original)

- Notarized Affidavit of Income (HQP-SLF-136) (1 Original)

C. Proof of Income for Overseas Filipino Workers (OFW):

Submit any of the following:

- Employment Contract between employee and employer (1 Photocopy); or POEA Standard Contract (1 Original)

- Certificate of Employment and Compensation (CEC) written on the Employer/Company’s official letterhead (1 Original); or CEC signed by employer (for household staff and similarly situated employees) (1 Original), supported by a photocopy of the employer’s ID and passport

- Income Tax Return filed with Host Country/Government (1 Original)

4. For Releasing of Loan Proceeds:

- To release the loan proceeds through your payroll account or disbursement card, you need to provide a photocopy of the payroll account or disbursement card.

- If you are applying through your employer, make sure to have a certified photocopy of your Payroll Account or Disbursement Card.

- To verify individual applications, please present the Payroll Account*/Disbursement Card** for authentication purposes.

Please note that all photocopies submitted must have their corresponding original documents presented for authentication. Always check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

Requirements for Pag-IBIG MPL (Filing through a Representative)

If you’re unable to apply for the Pag-IBIG Multi-Purpose Loan (MPL) in person, you can authorize a representative to file the application on your behalf.

Required Documents

- Authorization Letter: An official letter authorizing the representative to apply for the loan on your behalf.

- Valid IDs: Provide photocopies of valid IDs for both the applicant and the representative. The original IDs must be presented for authentication.

- Multi-Purpose Loan Application Form (MPLAF, HQP-SLF-065): One original copy of this form should be filled out and submitted.

- Proof of Income: Depending on your employment status, different documents are needed as proof of income:

A. Proof of income for Formally-Employed

The “Certificate of Net Pay” portion at the back of the application form must be accomplished by the employer, or submit a photocopy of your latest one-month payslip, authenticated by the company’s authorized signatory.

B. Proof of income for Self-Employed:

Submit any of the following:

- Income Tax Return (ITR), Audited Financial Statements, and Official Receipt of tax payment from bank supported with Department of Trade and Industry (DTI) Registration and Mayor’s Permit/Business Permit (1 Photocopy)

- Commission Vouchers reflecting the issuer’s name and contact details (for the last 12 months) (1 Original)

- Bank Statements or passbook for the last 12 months (in case income is sourced from foreign remittance, pension, etc.) (1 Original)

- Certified True Copy of Transport Franchise issued by appropriate government agency (LGU for tricycles, LTRFB for other PUVs) (1 Original)

- Certificate of Engagement issued by the owner of business (1 Original)

- Notarized Affidavit of Income (HQP-SLF-136) (1 Original)

C. Proof of income for Overseas Filipino Workers (OFW):

Submit any of the following:

- Employment Contract between employee and employer (1 Photocopy); or POEA Standard Contract (1 Original)

- Certificate of Employment and Compensation (CEC) written on the Employer/Company’s official letterhead (1 Original); or CEC signed by employer (for household staff and similarly situated employees) (1 Original), supported by a photocopy of the employer’s ID and passport

- Income Tax Return filed with Host Country/Government (1 Original)

5. For Releasing of Loan Proceeds

- To release the loan proceeds through your payroll account or disbursement card, you need to provide a photocopy of the payroll account or disbursement card.

- If you are applying through your employer, make sure to have a certified photocopy of your Payroll Account or Disbursement Card.

- To verify individual applications, please present the Payroll Account*/Disbursement Card** for authentication purposes.

Please note that all photocopies submitted must have their corresponding original documents presented for authentication. Always check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

Pag-IBIG MPL Loan Application Procedures for Walk-In Applicants

Applying for a Pag-IBIG Multi-Purpose Loan (MPL) is a straightforward process which involves the following steps:

STEP 1: Submit Documents

- Complete the Multi-Purpose Loan Application Form and gather all the required supporting documents. Once everything is ready, submit these to the nearest Pag-IBIG Fund office.

STEP 2: Receive Acknowledgement Receipt

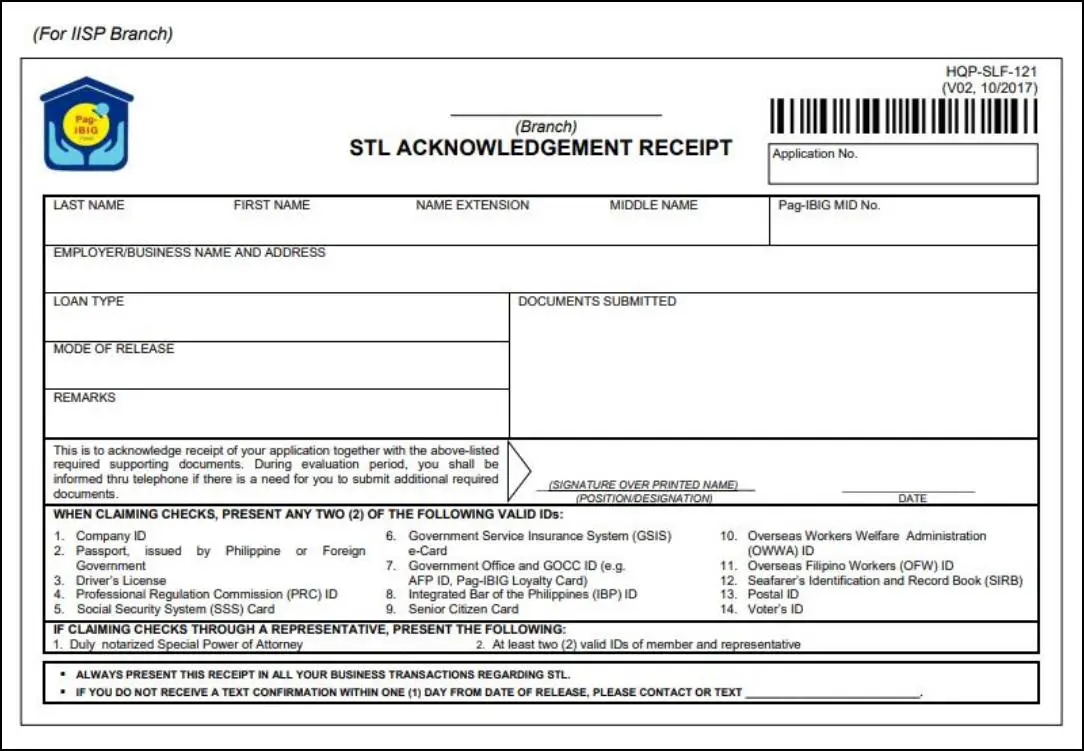

- Upon submission of your application, you will receive an STL Acknowledgement Receipt (HQP-SLF-121). This serves as proof that your application has been received and is currently being processed.

STEP 3: Claim Your Loan Proceeds

- Once your loan application is approved, you will be notified of the date when you can claim your loan proceeds. On the scheduled date, go to the Pag-IBIG Fund office to receive your loan.

Please note that the processing time may vary depending on the volume of applications received and other factors. Always check with the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

How to Apply for Pag-IBIG MPL Online

The online application for the Pag-IBIG Multi-Purpose Loan (MPL) is a convenient option.

Option 1: Uploading Documents

If you have a Pag-IBIG Loyalty Card Plus or cash cards issued by any of Pag-IBIG Fund’s partner banks, follow these steps:

- Complete the Multi-Purpose Loan Application Form (MPLAF, HQP-SLF-065).

- Gather all the required documents as discussed in previous sections.

- Scan or take clear photos of your completed form and documents.

- Log in to the Virtual Pag-IBIG platform.

- Follow the prompts to upload your scanned or photographed documents.

Option 2: Completing the Online Form

This option is available for members whose employers are enrolled under the Virtual Pag-IBIG for Employers, and they have a Pag-IBIG Loyalty Card Plus:

- Log in to the Virtual Pag-IBIG platform.

- Look for the MPL application form and start filling it out.

- Provide all the necessary information and follow the prompts until you complete the process.

In both cases, after submitting your application, wait for a notification from Pag-IBIG about the status of your loan application. Always check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

List of Valid ID’s Accepted for Pag-IBIG Multi-Purpose Loan (MPL)

When applying for a Pag-IBIG MPL, you need to provide one photocopy of a valid ID.

Here are the IDs accepted by Pag-IBIG:

- Passport

- Driver’s License

- Professional Regulation Commission (PRC) ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Voter’s ID

- Barangay Certification or Barangay IDs or similar documents bearing picture of the member

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) Card

- Senior Citizen Card

- Overseas Workers Welfare Administration (OWWA) ID

- Overseas Filipino Worker ID

- Seaman’s Book or Seafarer’s Identification and Record Book (SIRB)

- Alien Certification of Registration/Immigrant Certificate of Registration

- Government Office and GOCC ID, e.g. AFD ID, Pag-IBIG Loyalty Card

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID

- Company ID issued by Private Entities or Institution Registered with or supervised or regulated either by the BSP, SEC or IC.

Remember, the original ID must be presented for authentication. Always check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information on the application process.

Video: Paano mag-apply ng Multi-Purpose Loan(MPL) sa Pagibigfund | Tutorial 2022

Frequently Asked Questions

1. What is the Pag-IBIG Fund Multi-Purpose Loan Program?

A: The Pag-IBIG Multi-Purpose Loan (MPL) is a cash loan designed to assist eligible Pag-IBIG Fund members who are in immediate financial need.

2. How much can I borrow under the Pag-IBIG MPL?

A: Eligible members can borrow up to 80% of their total Pag-IBIG Regular Savings, including their monthly contributions, their employer’s contributions, and any accumulated dividends. However, if you have an outstanding Pag-IBIG Calamity Loan, the amount you can borrow will be the difference between 80% of your total Pag-IBIG Regular Savings and your outstanding Calamity Loan balance.

3. How much is the interest rate of the Pag-IBIG MPL?

A: The MPL has a low-interest rate of 10.5% per annum. A significant portion of the income generated from the MPL’s interest is returned to its members as dividends.

4. How do I pay my Pag-IBIG MPL?

A: The MPL must be repaid within three years (36 months), with a deferred first payment option. Employed members can pay their loan amortizations through salary deduction, while self-employed individuals or Overseas Filipino Workers (OFWs) can pay through Virtual Pag-IBIG, at any Pag-IBIG Fund branch, or through any accredited collecting partners. Members also have the option to accelerate or advance their payments.

5. When can I renew my MPL?

A: You can renew your MPL after making at least six monthly amortizations and satisfying the eligibility requirements. The outstanding balance of your existing loan will be deducted from the proceeds of your new loan.

Summary

Pag-IBIG multi-purpose loan provides members the opportunity to address various financial concerns without having to break the bank or incur high interest rates. From medical expenses to education costs, this loan program can cover whatever need arises. Members can borrow up to 80% of their Total Accumulated Value (TAV) and repay it in as little as two (2) years or a maximum of 24 months.

The application process is also hassle-free. Just submit the complete requirements and wait for approval within three (3) to five (5) working days. With its flexible repayment terms and low interest rates, it’s easy to see why the Pag-IBIG multi-purpose loan is a reliable financial solution for Filipinos.

Contact Information

Website: pagibigfund.gov.ph

Phone: 02 8724 4244

Email: contactus@pagibigfund.gov.ph

Facebook Page: https://www.facebook.com/PagIBIGFundOfficialPage