The Pag-IBIG Fund offers a Calamity Loan program, a financial assistance service designed to aid members who are situated in regions declared under a state of calamity. This cash loan facility is specifically designed to assist those affected by disasters, providing immediate financial relief to help them recover from the aftermath.

Also read: How to Apply for a Housing Loan from Pag-IBIG?

The Calamity Loan comes with an attractively low interest rate of 5.95% per annum, making it an affordable option for those in need. It offers flexible repayment terms, allowing borrowers to repay the loan within a 24 or 36-month period. One of its standout features is the deferred first payment, providing borrowers with ample time to stabilize their situation before beginning repayment.

Benefits of Pag-IBIG Calamity Loan

The Pag-IBIG Calamity Loan offers several advantages to members who are dealing with the aftermath of a disaster:

1. Financial Assistance: The primary benefit is immediate financial assistance, which can be used to cover expenses related to the calamity. This could include repair costs for damaged property, medical bills, or even day-to-day expenses if the member’s income has been affected.

2. Low Interest Rate: The loan comes with a low interest rate of 5.95% per annum, making it a more affordable option compared to other types of loans.

3. Flexible Repayment Terms: With the choice of a 24 or 36-month repayment period, members can choose the term that best fits their financial situation.

4. Deferred First Payment: The first payment for the loan is deferred, giving borrowers some breathing room to get back on their feet before they start repayments.

5. Accessible Application: The application process for the Pag-IBIG Calamity Loan is made accessible with options to apply online or in-person at a Pag-IBIG Fund branch.

6. No Collateral Required: Unlike some loans, the Calamity Loan does not require any collateral, making it more accessible to those in need.

These benefits make the Pag-IBIG Calamity Loan a valuable resource for members who find themselves facing financial hardship due to a disaster.

Who are Qualified for Pag-IBIG Calamity Loan

To be eligible for the Pag-IBIG Calamity Loan, potential borrowers must fulfill the following qualifications:

1. Regular Savings: Applicants should have made at least twenty-four (24) monthly contributions under the Pag-IBIG Regular Savings program.

2. Active Membership: The member must demonstrate active participation in the fund by having made at least one (1) contribution within the last six (6) months before the loan application date.

3. Good Standing: For members with existing obligations such as a Pag-IBIG Housing Loan, Multi-Purpose Loan, and/or Calamity Loan, their accounts must not be in default at the time of the calamity loan application.

4. Proof of Income: Applicants must provide proof of income to demonstrate their ability to repay the loan.

These requirements ensure that the loan is extended to members who are in good standing and have the capacity to repay their obligations. Always verify the latest guidelines with the official Pag-IBIG website or contact their customer service for the most accurate information.

Requirements for Pag-IBIG Calamity Loan (Member)

Applying for a Pag-IBIG Calamity Loan requires several documents. Here’s the checklist:

General Requirements

- Calamity Loan Application Form (CLAF, HQP-SLF-066) – 1 Original

- Valid ID acceptable to the Fund – 1 Photocopy

- Proof of Income

A. Proof of Income for Formally-employed:

- The “Certificate of Net Pay” portion at the back of the application form must be accomplished by the employer or submit a photocopy of one (1) month latest payslip duly authenticated by the company’s authorized signatory.

B. Proof of Income for Self-Employed (any of the following):

- ITR, Audited Financial Statements, and Official Receipt of tax payment from bank supported with DTI Registrant and Mayor’s Permit/Business Permit – 1 Photocopy

- Commission Vouchers reflecting the issuer’s name and contact details (for the last 12 months) – 1 Original

- Bank Statements or passbook for the last 12 months (in case income is sourced from foreign remittance, pension, etc.) – 1 Original

- Certified True Copy of Transport Franchise issued by appropriate government agency (LGU for tricycles, LTRFB for other PUVs) – 1 Original

- Certificate of Engagement issued by the owner of business – 1 Original

- Notarized Affidavit of Income (HQP-SLF-136) – 1 Original

C. Proof of Income for Overseas Filipino Workers (OFW), any of the following:

- Employment Contract between employee and employer – 1 Photocopy; or POEA Standard Contract – 1 Original

- Certificate of Employment and Compensation (CEC) written on the Employer/Company’s official letterhead – 1 Original; or CEC signed by employer (for household staff and similarly situated employees) – 1 Original, supported by a photocopy of the employer’s ID and passport

- Income Tax Return filed with Host Country/Government – 1 Original

Additional Requirements for Members Affected by El Nino Phenomenon Only

- For farmers, including landlords, fisher folks, and livestock farmers: Certification from the Municipal Agricultural Office (MAO) that their products were damaged/killed due to the calamity.

- For business owners/market vendors: Certification from the Market Vendors Association or certification from the Municipal Mayor (if not a member of the association) attesting that he is engaged in the selling of farm products, vegetable, meat, fish, and that his source of livelihood was affected by the calamity.

- For Pag-IBIG Members or any of his immediate family members afflicted by diseases such as diarrhea, cholera, skin diseases, paralytic shellfish poisoning (red tide bloom), heat cramps, heat exhaustion, heat stroke, chickenpox, measles, and hypertension: A Medical Certificate from the Doctor stating that such diseases/illness brought by the onset of calamity.

Note: In all instances, wherein photocopies are submitted, the original documents must be presented for authentication.

- For releasing of loan proceeds thru Payroll Account/Disbursement Card – submit photocopy of the Payroll Account/Disbursement Card.

- For application thru employer – the photocopy of Payroll Account/Disbursement Card shall be duly certified by the employer.

- For individual application – the Payroll Account*/Disbursement Card shall be presented for authentication.

Also read: How to Check Your Pag-IBIG Contributions Online

Requirements to Apply Pag-IBIG Calamity Loan (Through a Representative)

If you’re applying for a Pag-IBIG Calamity Loan through a representative, you need to provide the following:

1. Authorization Letter: This must be signed by you, giving your representative the authority to act on your behalf.

2. Valid IDs: Both you and your representative need to provide one photocopy of a valid ID each.

3. Calamity Loan Application Form (CLAF, HQP-SLF-066): This must be filled out accurately and completely.

Proof of Income:

A. For Formally-employed:

The “Certificate of Net Pay” portion at the back of the application form must be accomplished by the employer or submit a photocopy of one (1) month latest payslip duly authenticated by the company’s authorized signatory.

B. For Self-Employed (any of the following):

- ITR, Audited Financial Statements, and Official Receipt of tax payment from bank supported with DTI Registrant and Mayor’s Permit/Business Permit

- Commission Vouchers reflecting the issuer’s name and contact details (for the last 12 months)

- Bank Statements or passbook for the last 12 months (in case income is sourced from foreign remittance, pension, etc.)

- Certified True Copy of Transport Franchise issued by appropriate government agency (LGU for tricycles, LTRFB for other PUVs)

- Certificate of Engagement issued by the owner of business

- Notarized Affidavit of Income (HQP-SLF-136)

C. For Overseas Filipino Workers (OFW), any of the following:

- Employment Contract between employee and employer; or POEA Standard Contract

- Certificate of Employment and Compensation (CEC) written on the Employer/Company’s official letterhead; or CEC signed by employer (for household staff and similarly situated employees), supported by a photocopy of the employer’s ID and passport

- Income Tax Return filed with Host Country/Government

Additional Requirements for Members Affected by El Nino Phenomenon Only

- For farmers, including landlords, fisher folks, and livestock farmers: Certification from the Municipal Agricultural Office (MAO) that their products were damaged/killed due to the calamity.

- For business owners/market vendors: Certification from the Market Vendors Association or certification from the Municipal Mayor (if not a member of the association) attesting that he is engaged in the selling of farm products, vegetable, meat, fish, and that his source of livelihood was affected by the calamity.

- For Pag-IBIG Members or any of his immediate family members afflicted by diseases such as diarrhea, cholera, skin diseases, paralytic shellfish poisoning (red tide bloom), heat cramps, heat exhaustion, heat stroke, chickenpox, measles, and hypertension: A Medical Certificate from the Doctor stating that such diseases/illness brought by the onset of calamity.

Note: In all instances where photocopies are submitted, the original documents must be presented for authentication.

For releasing of loan proceeds thru Payroll Account/Disbursement Card: Submit a photocopy of the Payroll Account/Disbursement Card. For application through an employer, the photocopy of Payroll Account/Disbursement Card should be certified by the employer. For individual applications, the Payroll Account/Disbursement Card should be presented for authentication.

Keep in mind that these requirements may be subject to changes, so it’s best to check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

Steps on How To Apply for Pag-IBIG Calamity Loan

Applying for a Pag-IBIG Calamity Loan can be done through two main channels: online via Virtual Pag-IBIG and over-the-counter at a Pag-IBIG Fund branch. Here are the steps for each method:

A. Online Application through Virtual Pag-IBIG

- If you already have a Pag-IBIG Loyalty Card Plus or cashcards issued by any of Pag-IBIG Fund’s partner banks, you can upload your completed loan application form and required documents onto the Virtual Pag-IBIG portal.

- For members whose employers are enrolled under the Virtual Pag-IBIG for Employers, you can fill out the Pag-IBIG Calamity Loan application online form. Please note that this option is only available to members with a Pag-IBIG Loyalty Card Plus.

B. Over-the-Counter Application

Applying for a Pag-IBIG Calamity Loan is a straightforward process that can be broken down into the following steps:

Step 1: Application Submission

Fill out the Calamity Loan Application Form accurately and completely. Along with this, submit the necessary supporting documents as required by Pag-IBIG Fund. This could include proof of income, proof of residency in a calamity-stricken area, or other relevant documents.

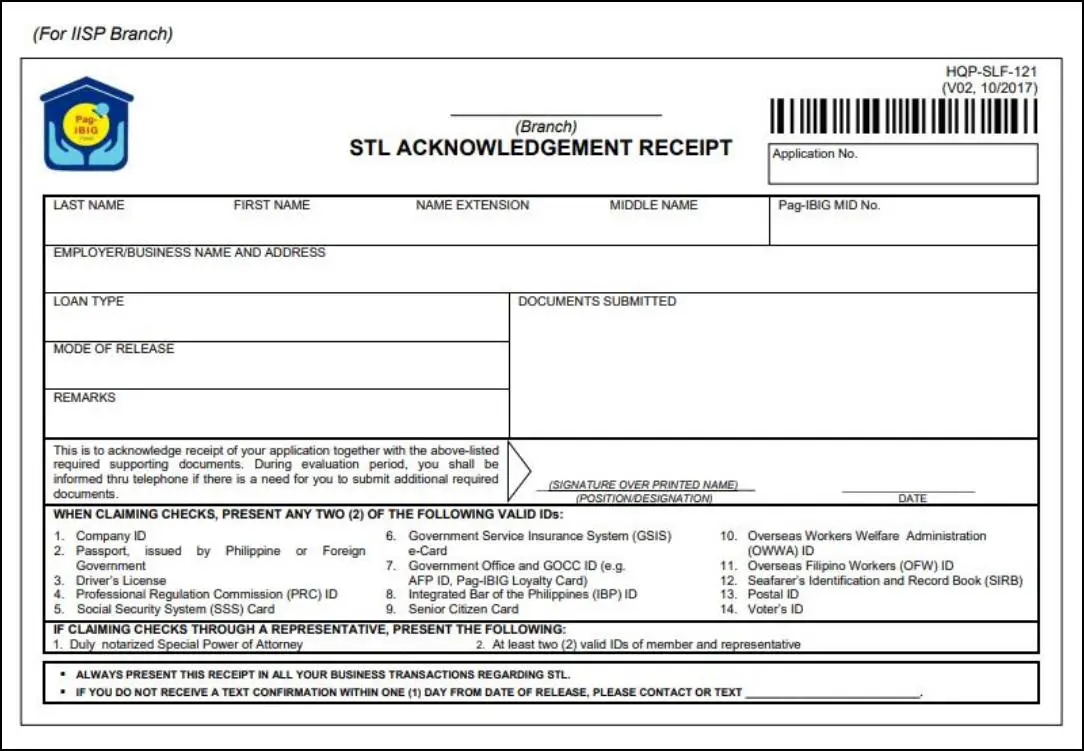

Step 2: Acknowledgement Receipt

After submitting your application, you will receive an STL Acknowledgement Receipt (HQP-SLF-121). This receipt confirms that your application has been received and is being processed. Keep this receipt for your records.

Step 3: Loan Disbursement

On the scheduled date, you can collect your loan proceeds. The disbursement method may vary, so it’s important to check with Pag-IBIG on how you will receive your funds.

Regardless of the method you choose, make sure to complete all the necessary paperwork and meet all the requirements to ensure a smooth application process. Always check with the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information.

List of Valid ID’s Accepted for Pag-IBIG Calamity Loan

When applying for a Pag-IBIG Calamity Loan, you need to provide one photocopy of a valid ID.

Here are the IDs accepted by Pag-IBIG:

- Passport

- Driver’s License

- Professional Regulation Commission (PRC) ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Voter’s ID

- Barangay Certification or Barangay IDs or similar documents bearing picture of the member

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) Card

- Senior Citizen Card

- Overseas Workers Welfare Administration (OWWA) ID

- Overseas Filipino Worker ID

- Seaman’s Book or Seafarer’s Identification and Record Book (SIRB)

- Alien Certification of Registration/Immigrant Certificate of Registration

- Government Office and GOCC ID, e.g. AFD ID, Pag-IBIG Loyalty Card

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID

- Company ID issued by Private Entities or Institution Registered with or supervised or regulated either by the BSP, SEC or IC.

Remember, the original ID must be presented for authentication. Always check the official Pag-IBIG website or contact their customer service for the most accurate and up-to-date information on the application process.

Video: How to apply PAG-IBIG CALAMITY LOAN ONLINE?

Frequently Asked Questions

1. What is the Pag-IBIG Calamity Loan?

A: The Pag-IBIG Calamity Loan is a financial assistance program designed to aid Pag-IBIG Fund members who are affected by disasters in areas declared under a state of calamity by the Office of the President or the Sangguniang Bayan.

2. How much may I borrow under the Pag-IBIG Calamity Loan?

A: Eligible members can borrow up to 80% of their total Pag-IBIG Regular Savings, which include their monthly contributions, their employer’s contributions, and accumulated dividends. If they have an outstanding Multi-Purpose and/or Calamity Loan, the loan amount will be the difference between 80% of their total savings and the outstanding balance of their existing loans.

3. How much is the interest rate of the Pag-IBIG Calamity Loan?

A: The interest rate for the Pag-IBIG Calamity Loan is a low 5.95% per annum, making it one of the most affordable loan options in the market.

4. How do I pay my Pag-IBIG Calamity Loan?

A: The loan is repayable within 24 to 36 months, with the first payment due on the third month after the loan release. Payment can be made via salary deduction, through Virtual Pag-IBIG, at any Pag-IBIG Fund branch, or via accredited collecting partners’ outlets or online payment channels.

5. Until when can an eligible member avail of a Pag-IBIG Calamity Loan, once the program is made available?

A: Members can avail of the loan within 90 days from the declaration of a state of calamity in their area of residence.

Summary

Pag-IBIG Calamity Loan is a financial assistance program offered to help Filipinos get back on their feet after a natural disaster or calamity. With this loan, individuals can access funds that can be used to pay for home repair or reconstruction, medical expenses, or even daily expenses. The loan is available to both members and non-members of the Pag-IBIG Fund as long as they meet certain requirements.

The process of applying and availing the loan is quick and hassle-free, making it an excellent option in times of crisis. Overall, the Pag-IBIG Calamity Loan is a lifeline for those who have been affected by a calamity, offering them the opportunity to get back on their feet and rebuild their lives.

Contact Information

Website: pagibigfund.gov.ph

Phone: 02 8724 4244

Email: contactus@pagibigfund.gov.ph

Facebook Page: https://www.facebook.com/PagIBIGFundOfficialPage