Are you struggling to keep up with payments on your housing account? Are the penalties and interest rates piling up and making it seem like the balance will never decrease? The Ginhawa for All Housing Account Restructuring and Condonation Program may be the solution you need.

Also read: Protect Your Property with GSIS Home Shield Fire Insurance: Avail Now!

This program offers current buyers and borrowers a chance to bring their housing accounts up to date while also providing incentives for full payment. With the waiver of penalties and a partial discount on interests, the balance on your housing account can effectively decrease, giving you more breathing room in your finances. This program is designed to bring relief to struggling homeowners and make it easier for them to own their homes without enduring financial stress.

What are the Benefits of Restructuring and Condonation Program?

The benefits of this program include:

- Making it easier for housing buyers and borrowers to restructure or fully pay their housing obligations.

- Spreading unpaid interest equally over the term instead of capitalizing it.

- Offering a partial discount on unpaid interest for those who choose to fully pay.

- Reducing interest rates to as low as 6%.

- Lowering amortization through an extended payment term of up to 10 years.

- Waiving penalties and surcharges.

- Providing a grace period for accounts that have never been restructured due to delayed remittance of the first monthly amortization.

These measures aim to enhance the experience for housing buyers and borrowers, providing more flexibility and favorable terms for managing their housing obligations.

Eligibility

a. Accounts eligible for UPDATING through full payment of arrearages include:

- Deed of Conditional Sale (DCS) accountholders with remaining terms, including accounts that are up-to-date, in arrears (unpaid for six months or less), or in default (unpaid for more than six months).

- Real Estate Loan (REL) borrowers with remaining terms, whose accounts are not yet foreclosed or already foreclosed, but the redemption period has not expired.

b. Accounts eligible for RESTRUCTURING with condonation options include:

- DCS accountholders with accounts that are up-to-date, in arrears (unpaid for six months or less), or in default (unpaid for more than six months). Those with disputed cancelled DCS already uploaded as acquired assets but not yet sold may also apply.

- REL borrowers with foreclosed REL accounts, provided that the certificate of sale (COS) has not yet been annotated on the title. Full settlement of foreclosure expenses and a 20% down payment based on the total outstanding balance (net of penalties and surcharges as of the date of approval) are required.

c. Accounts eligible for full payment with condonation options include:

- DCS accountholders with accounts that are up-to-date, in arrears (unpaid for six months or less), or in default (unpaid for more than six months). Those with disputed cancelled DCS already uploaded as acquired assets but not yet sold may also apply.

- REL borrowers whose accounts are up-to-date, in arrears (unpaid for six months or less), or in default (unpaid for more than six months), and whose properties have been foreclosed, but the redemption period has not yet lapsed.

Also read: GSIS Personal Accident Insurance: Get 24/7 Protection for You and Your Family

What are the Requirements Needed?

A. Application Requirements:

To apply for housing account restructuring and condonation, please submit the following documents:

- Completed application form

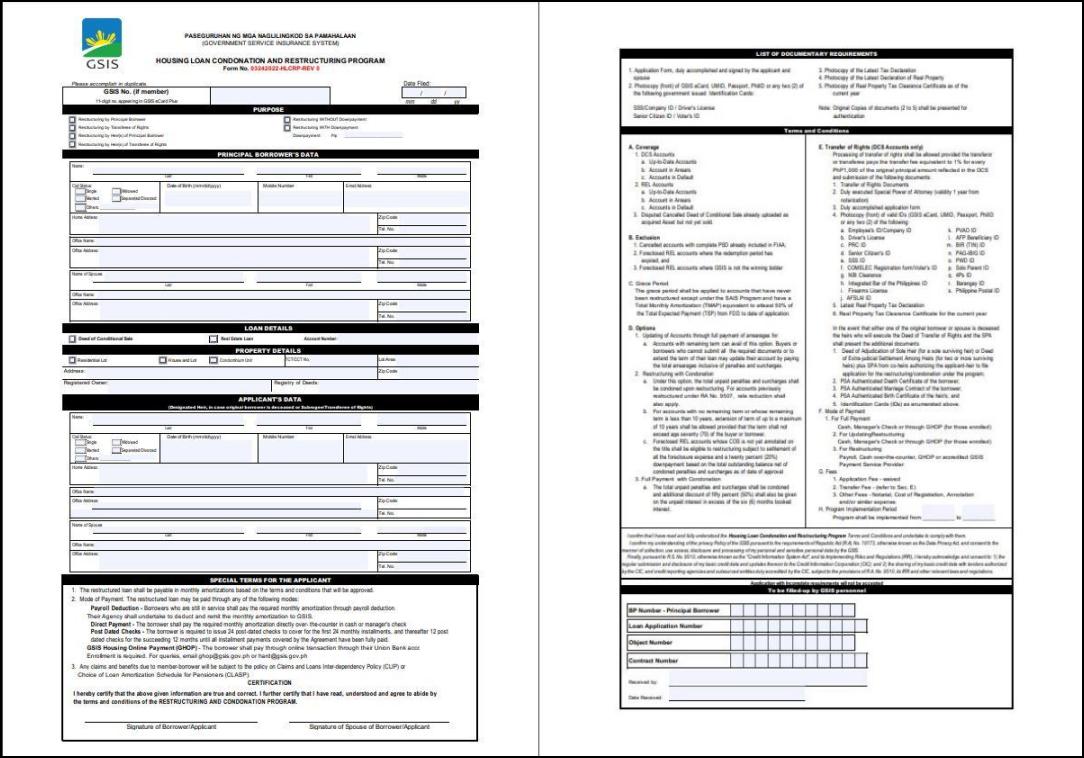

HOUSING LOAN CONDONATION AND RESTRUCTURING PROGRAM

- Valid identification (any of the following):

- PhylSys ID

- Employee/Company ID

- Driver’s license

- Professional Regulation Commission (PRC) ID

- Senior citizen’s ID

- SSS ID

- COMELEC/Voter’s ID/Registration form

- NBI clearance

- Integrated Bar of the Philippines ID

- Firearms license

- AFPSLAI ID

- PVAO ID

- AFP beneficiary ID

- BIR (TIN) ID

- Pag-IBIG ID

- Person with disability ID

- Solo parent ID

- 4Ps ID

- Barangay ID

- PhilPost ID

- Please provide the following documents for the property:

- Latest Real Property Tax Declaration for land and improvement (if applicable).

- Real Property Tax Clearance (Land and Building).

- Proof of buyer or borrower’s paying capacity, including that of the co-maker.

- Latest payslip.

- Certificate of employment with compensation.

- Documentation of any other sources of income.

Please ensure that all required documents are provided for a smooth application process.

B. In the case of a deceased housing account buyer/borrower, the legal heirs or successors-in-interest are required to provide the following additional documentary requirements:

a. For legal heirs:

- Deed of Adjudication of Sole Heir or Deed of Extra-Judicial Settlement (for multiple surviving heirs), along with a Special Power of Attorney (SPA) from co-heirs authorizing the applicant-heir to apply for condonation and receive the title.

- Affidavit of publication of the adjudication and extra-judicial settlement from the publishing company.

- Philippine Statistics Authority (PSA)-issued death certificate of the borrower/buyer.

- PSA-issued marriage contract of the borrower/buyer, if applicable.

- PSA-issued birth certificate of all heirs.

- Valid identification cards (refer to the list of acceptable IDs).

b. For Successors-in-Interest:

- If the original borrower and spouse are still alive, please submit photocopies and present the originals of the following:

- Special Power of Attorney (SPA) from the original housing account buyer/borrower, authorizing the successor-in-interest to apply for and receive the title

- Marriage contract issued by the Philippine Statistics Authority (PSA) for the borrower/buyer, if applicable

- Valid identification documents (refer to the list above)

- If the original buyer, borrower, or spouse is deceased, please submit photocopies and present the originals of the following:

- Special Power of Attorney (SPA) from the original housing account buyer/borrower, authorizing the successor-in-interest to apply for and receive the title

- Deed of Adjudication of Sole Heir or Deed of Extra-Judicial Settlement (for two or more surviving heirs)

- Affidavit of publication of the adjudication and extra-judicial settlement from the publishing company

- Death certificate issued by the Philippine Statistics Authority (PSA) for the original housing account borrower, buyer, or spouse

- Marriage contract issued by the PSA for the original housing account borrower/buyer, if applicable

- Birth certificate issued by the PSA for the heir(s)

- Valid identification documents (refer to the list above)

- For the transfer of rights for DCS accounts, please submit the following:

- Transfer of rights documents such as deeds of sale, conveyance of assignment duly signed by both parties

- Duly executed Special Power of Attorney (SPA) (valid for 1 year from the date of notarization)

- Duly accomplished Condonation and Restructuring Application Form

- Photocopy (present the original) of the GSIS eCard, UMID, passport, PhilID, or any two (2) of the valid identification documents listed above

- Latest real property tax declaration

- Real property tax clearance certificate for the current year

- If the original borrower or spouse is deceased, the heirs who will execute the Deed of Transfer of Rights and Special Power of Attorney (SPA) must present the following:

- Deed of Adjudication of Sole Heir or Deed of Extra-Judicial Settlement (for two or more surviving heirs), along with the SPA from co-heirs authorizing the applicant to apply for condonation

- Death certificate authenticated by the Philippine Statistics Authority (PSA) for the borrower

- Marriage contract authenticated by the PSA for the borrower, if applicable

- Birth certificate authenticated by the PSA for the heir(s)

- Valid identification documents (refer to the list above)

Application Process: Step-by-Step Guide

Step 1: To obtain an updated statement of account (SOA), kindly submit a reconciliation request through any of the following channels:

- Postal mail or courier

- Phone call

- Other GSIS modes or appointment system

Step 2: Please await notification regarding the status of your request.

Step 3: Attend a counseling appointment to discuss the SOA and submit the necessary documents.

What are the Modes of Payment?

Accepted Modes of Payment:

1. Full Payment and Account Update

- Cash

- Manager’s Check

- Debit from Union Bank of the Philippines Account

2. Restructuring

- Deduction from Member’s Salary

- Cash

- Manager’s Check

- Post-dated Checks

- Debit from Union Bank of the Philippines Account

- External Payment Service Provider (Bayad)

For qualified accounts in default with remaining term, full updating of arrearages is allowed without the need to submit condonation and restructuring documents. However, it is important to settle the incurred penalties and surcharges in full.

Also read: How to Apply GSIS Unemployment Benefit: A Complete Guide

Video: Ginhawa for All Housing Account Restructuring and Condonation Program

Watch this video to learn more about the Ginhawa for All Housing Account Restructuring and Condonation Program. This program is designed to help Filipino citizens who are struggling financially due to the pandemic, by restructuring their housing accounts and easing the burden of debt repayment.

The program offers borrowers a number of options including loan restructuring, condonation of interest payments, and debt relief. It also includes social support measures and financial assistance to ensure that all borrowers are able to keep their homes.

Summary

The Ginhawa for All Housing Account Restructuring and Condonation Program opens up an invaluable opportunity for buyers and borrowers to set things right with their housing accounts. With penalties waived and interest rate discounts offered, this program not only reduces outstanding balances but also paves the way for a brighter financial future. Embrace this chance to enhance your well-being and unlock a world of possibilities for you and your loved ones.

Contact Information

Address: Leon Kilat St., Brgy. Kalubihan, Cebu City, 6000

Email: mvpeenriquez@gsis.gov.ph, gsiscebu@gsis.gov.ph

Website: gsis.gov.ph

Insurance Applications: 7-976-4900 local 3431

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers)

or 1-800-10-8474747 (for Smart subscribers)