Accidents are unpredictable and can occur at any time, making it crucial to have the right protection in place. The GSIS My Shield personal accident insurance is the perfect solution for individuals looking for comprehensive coverage. Available 24/7, this insurance plan ensures complete protection wherever you may be. With flexible coverage options ranging from PHP 50,000 to PHP 5 million, applicants have the freedom to personalize their insurance plan according to their specific needs and budget.

Also read: Protect Your Property with GSIS Home Shield Fire Insurance: Avail Now!

Whether you’re at home, work, or on-the-go, the GSIS My Shield provides peace of mind. Knowing that you are covered in case of accidents allows you to focus on what’s important without worrying about the financial burdens that may arise. With the GSIS Personal Accident Insurance, you can confidently navigate through life, knowing that you are protected by a reliable and trusted insurance provider.

Personal Accident Insurance Features

The GSIS My Shield personal accident insurance offers several features to provide coverage and protection. Here are the features I found:

- Accidental Death Coverage: The insurance provides coverage for death caused by any form of accident, including accidents resulting from animal bites.

- Medical Reimbursement: In case of an accident, the insurance includes a medical reimbursement feature. The reimbursement amount is equivalent to either 10% of the Sum Insured or Php 50,000, whichever is lower. This feature helps cover the expenses incurred for medical treatment due to an accident.

- Travel Insurance: The GSIS My Shield personal accident insurance also serves as travel insurance. This means that it provides coverage for accidents that occur during travel, offering an additional layer of security and peace of mind.

It gives you the peace of mind knowing that you and your family are covered for various accident-related situations, both in terms of financial support in the event of accidental death and medical expenses reimbursement.

Who is Qualified to Apply for the Personal Accident Insurance?

The My Shield personal accident insurance is available for individuals who fall under the following categories:

1. Class A: Active GSIS Members: This includes individuals who are currently active members of the GSIS.

2. Class B: GSIS Retirees/Pensioners, Spouse, Children, Siblings and Parents of active GSIS members.

Who is Eligible for Coverage?

The GSIS My Shield personal accident insurance provides coverage for individuals between the ages of 3 to 80 years old. This means that individuals within this age range are eligible to be covered under this insurance plan.

Children who are under the guardianship of active GSIS members, retirees, and pensioners may also be covered under the GSIS My Shield (Submission of proof of guardianship is required for these cases)

Range of GSIS Personal Accident Insurance

The GSIS My Shield personal accident insurance provides coverage for various aspects related to accidents.

Here is an overview of the scope of cover offered by the insurance plan:

- Death Indemnity: In the event of the insured’s death as a result of an accident, the insurance policy provides 100% of the principal sum as the death benefit.

- Unprovoked Murder and Assault: If the insured is a victim of unprovoked murder or assault, the insurance policy provides 50% of the principal sum as compensation, not exceeding PHP 50,000.

- Accidental Death within 180 Days: The insurance policy covers the payment of the death indemnity if the insured dies within 180 days after the date of the accident.

- Dismemberment, Loss of Sight, Hearing, Speech Indemnity: The insurance policy provides compensation for permanent dismemberment or loss of sight, hearing, or speech resulting from an accident.

- Permanent Total Disability: In the case of permanent total disability caused by an accident, the insurance policy provides a monthly payment of 1% of the principal sum for 100 months, less any other amount paid or payable under the same policy for the same accident.

- Medical Expense Reimbursement: The insurance policy offers reimbursement for actual medical expenses incurred within 52 weeks from the date of the accident. This includes expenses for treatment by a physician/surgeon, hospital confinement, or the employment of a nurse.

- 24-hour Accident Rider: The insurance policy includes coverage for accidents that occur while the insured is a passenger on commercial flights. This coverage applies to bodily injuries caused by accidents during passenger travel, excluding flight operators or crew members.

What are the Requirements Needed?

To for the GSIS My Shield personal accident insurance, whether as a new applicant or for renewal, you will need to prepare the following requirements:

a. For New Applicants

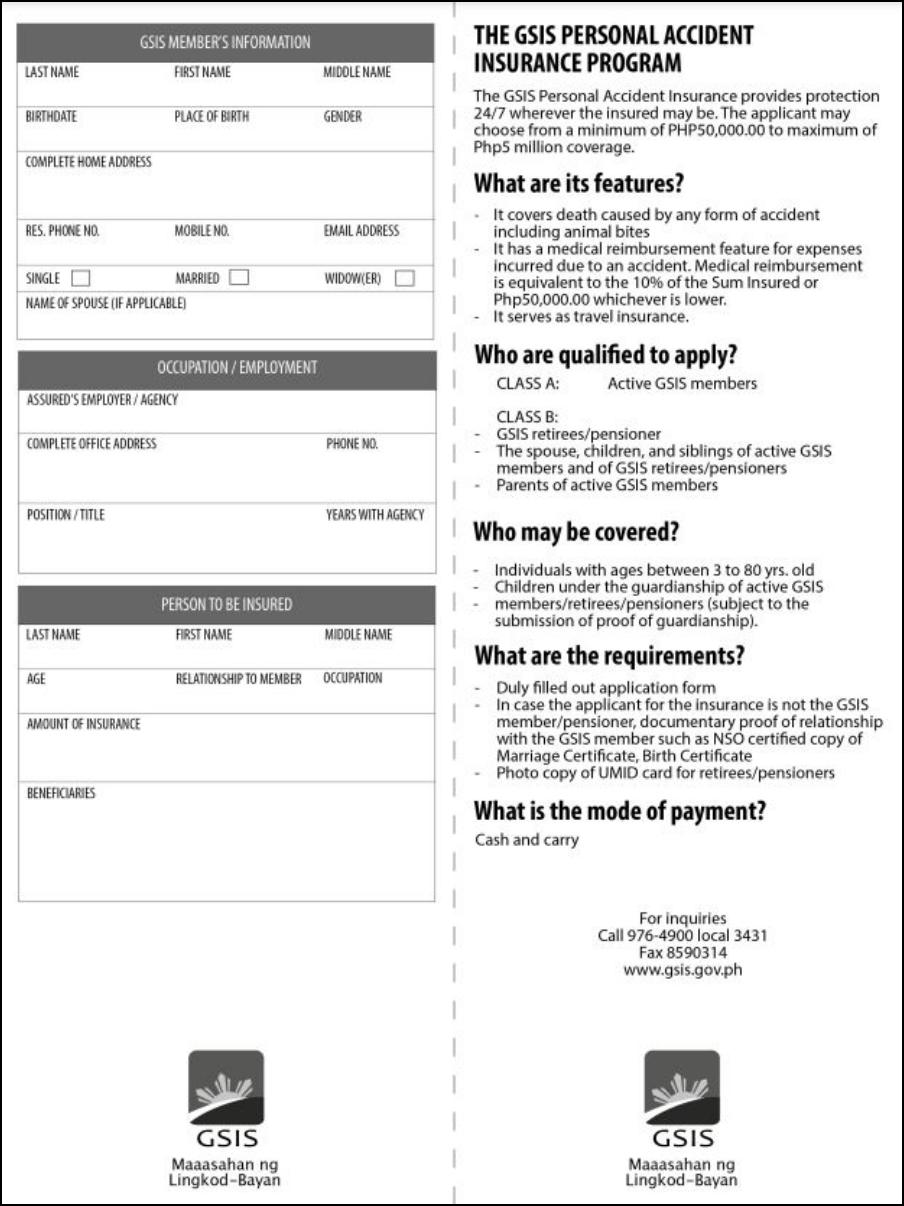

- Personal Accident Insurance Application Form: Fill out the application form completely and sign it. You can download the form from the GSIS website.

- Proof of Relationship (if applicable): If the applicant/assured is not a GSIS member or pensioner, provide documentary proof of the relationship with the GSIS member. This can be a photocopy of the Marriage Certificate or Birth Certificate.

- Unified Multipurpose Identification (UMID) Card (for retirees and pensioners): If the applicant/assured is a retiree or pensioner, include a photocopy of their UMID card.

b. For Renewal

- Renewal Form: Fill out the renewal form completely. The form can be downloaded from the GSIS website.

GSIS Personal Accident Insurance Program Form

Remember to verify the details directly with the GSIS or relevant authorities for the latest information.

Also read: How to Apply for Student Driver’s License in LTO: Initial and Renewal Processing

Application Process: Step-by-Step Guide

Here is a step-by-step guide to the application process for GSIS Personal Accident Insurance:

Step 1: Research and Gather Information

- Start by researching and gathering information about the GSIS Personal Accident Insurance policy. Visit the GSIS website or contact their customer service for comprehensive details about the coverage options, terms, and conditions.

Step 2: Determine Coverage Needs

- Assess your personal insurance needs and determine the coverage amount that would be suitable for you and your family. Consider factors such as your age, occupation, lifestyle, and financial circumstances.

Step 3: Prepare Required Documents

- Gather all the necessary documents required for the application process. This may include identification documents, proof of guardianship (if applicable), and any other supporting documents as specified by GSIS.

Step 4: Fill Out the Application Form

- Obtain the application form for GSIS Personal Accident Insurance. Fill out the form accurately and completely, providing all the required information.

Step 5: Submit the Application

- Once you have completed the application form, submit it along with the required documents to the designated GSIS office or through their online application portal, if available.

Step 6: Pay the Premium

- Pay the premium for the chosen coverage option. GSIS will provide you with the payment details and options. Ensure that you make the payment within the specified deadline to activate your insurance coverage.

Step 7: Confirmation and Policy Issuance

- After submitting the application and paying the premium, you will receive a confirmation of your application. GSIS will process your application and issue the policy document once it is approved.

Step 8: Review and Understand the Policy

- Upon receiving the policy document, carefully review and understand the terms, conditions, and coverage details provided. Familiarize yourself with the policy’s scope of coverage, exclusions, and claim procedures.

Also read: How to Apply DSWD Cash Aid Transportation Assistance

Summary

GSIS offers personal accident insurance that is designed to provide protection around the clock for both you and your loved ones. With their My Shield Personal Accident Insurance, you can rest easy knowing that you are covered no matter where you are or what you’re doing. You can select coverage options ranging from PHP50,000 up to PHP5 million, depending on your needs and preferences. Don’t take risks with your safety – invest in the protection you need and deserve with GSIS’s reliable and convenient personal accident insurance today.

Contact Information

Address: Leon Kilat St., Brgy. Kalubihan, Cebu City, 6000

Email: mvpeenriquez@gsis.gov.ph, gsiscebu@gsis.gov.ph

Website: gsis.gov.ph

Insurance Applications: 7-976-4900 local 3431

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers)

or 1-800-10-8474747 (for Smart subscribers)