As a member of the Government Service Insurance System (GSIS) and a vehicle owner, it is crucial to ensure that you have sufficient insurance coverage to protect yourself from unexpected events. The GSIS Auto Shield Motor Vehicle Insurance program offers comprehensive coverage specifically designed for eligible members, retirees, and their qualified dependents. This coverage goes beyond just accidents and theft; it also includes protection against Acts of Nature like typhoons, floods, earthquakes, and other natural disasters. By enrolling in this program, you can have the peace of mind knowing that your vehicle is fully protected.

Also read: Protect Your Property with GSIS Home Shield Fire Insurance: Avail Now!

This comprehensive insurance ensures that you are prepared for any unexpected circumstances that may arise while on the road. By choosing the GSIS Auto Shield Motor Vehicle Insurance program, you can drive with confidence, knowing that you have the necessary coverage to safeguard your vehicle and your financial well-being.

What are the Benefits of GSIS Motor Vehicle Insurance?

The GSIS Auto Shield Motor Vehicle Insurance program offers several key benefits for GSIS members and their qualified dependents.

- Comprehensive Coverage: The program provides full comprehensive coverage for vehicles owned by GSIS members, retirees, and their dependents. This coverage includes protection against damages resulting from accidents, theft, and Acts of Nature such as typhoons, floods, earthquakes, and other natural disasters.

- Peace of Mind: By enrolling in the Auto Shield Motor Vehicle Insurance program, policyholders can have peace of mind knowing that their vehicles are fully protected. Whether it’s damage caused by an accident or loss due to theft or natural disasters, the insurance coverage offers financial security and ensures that policyholders can recover from such unexpected events.

- Affordability: The GSIS offers competitive rates for its insurance plans, including the Auto Shield Motor Vehicle Insurance program. This allows members to obtain reliable coverage at affordable premiums, making it accessible for a wide range of individuals.

- Convenience: The GSIS provides a straightforward application process for the Auto Shield Motor Vehicle Insurance program. By completing the necessary application form and submitting the required documents, members can easily avail themselves of the insurance coverage and enjoy the benefits it offers.

It is important to review the specific terms and conditions of the GSIS Auto Shield Motor Vehicle Insurance program, as well as consult with GSIS directly, for detailed information on coverage limits, claim procedures, and any additional benefits provided.

Who is Qualified to Apply for GSIS Motor Vehicle Insurance?

Qualified individuals who can apply for the GSIS Auto Shield Motor Vehicle Insurance are:

a. Active GSIS members

This includes individuals who are currently employed and contributing to the GSIS as active members. They can avail themselves of the Ginhawa Active bundle, which provides access to the Auto Shield Motor Vehicle Insurance program.

b. GSIS retirees/pensioners

Retired GSIS members who are receiving pension benefits are eligible for the Ginhawa Grand bundle. This bundle allows them to apply for the Auto Shield Motor Vehicle Insurance program.

c. Spouse, children, and siblings of active GSIS members and retirees/pensioners

The Ginhawa Plus bundle is available for the spouse, children, and siblings of both active GSIS members and retirees/pensioners. These qualified dependents can also apply for the Auto Shield Motor Vehicle Insurance program.

d. Parents of active GSIS members

Parents of active GSIS members are eligible for the Ginhawa Plus bundle, which includes access to the Auto Shield Motor Vehicle Insurance program.

It’s important to note that specific eligibility requirements and documentation may apply for each bundle and insurance program. It is advisable to consult with the GSIS directly or visit their official website for more information on the application process and required documents.

Types of Covered Vehicles

The GSIS Auto Shield Motor Vehicle Insurance program covers various types of vehicles for private use, including:

- Motorcycles

- Tricycles

- Other Motor Vehicles

Types of Vehicles NOT Covered

The following types of vehicles are generally not covered under the GSIS Auto Shield Motor Vehicle Insurance program:

- Public utility vehicles: This includes vehicles that are used for public transportation purposes, such as buses, jeepneys (with PUJ plates), taxis, and FXs with yellow plates. These vehicles typically require specialized insurance coverage specific to their use as public transportation.

- Commercial vehicles: Commercial vehicles used for business purposes, including light or heavy delivery trucks and dump trucks, are not typically covered under the Auto Shield Motor Vehicle Insurance program. These vehicles may require commercial insurance policies that cater to their specific usage and associated risks.

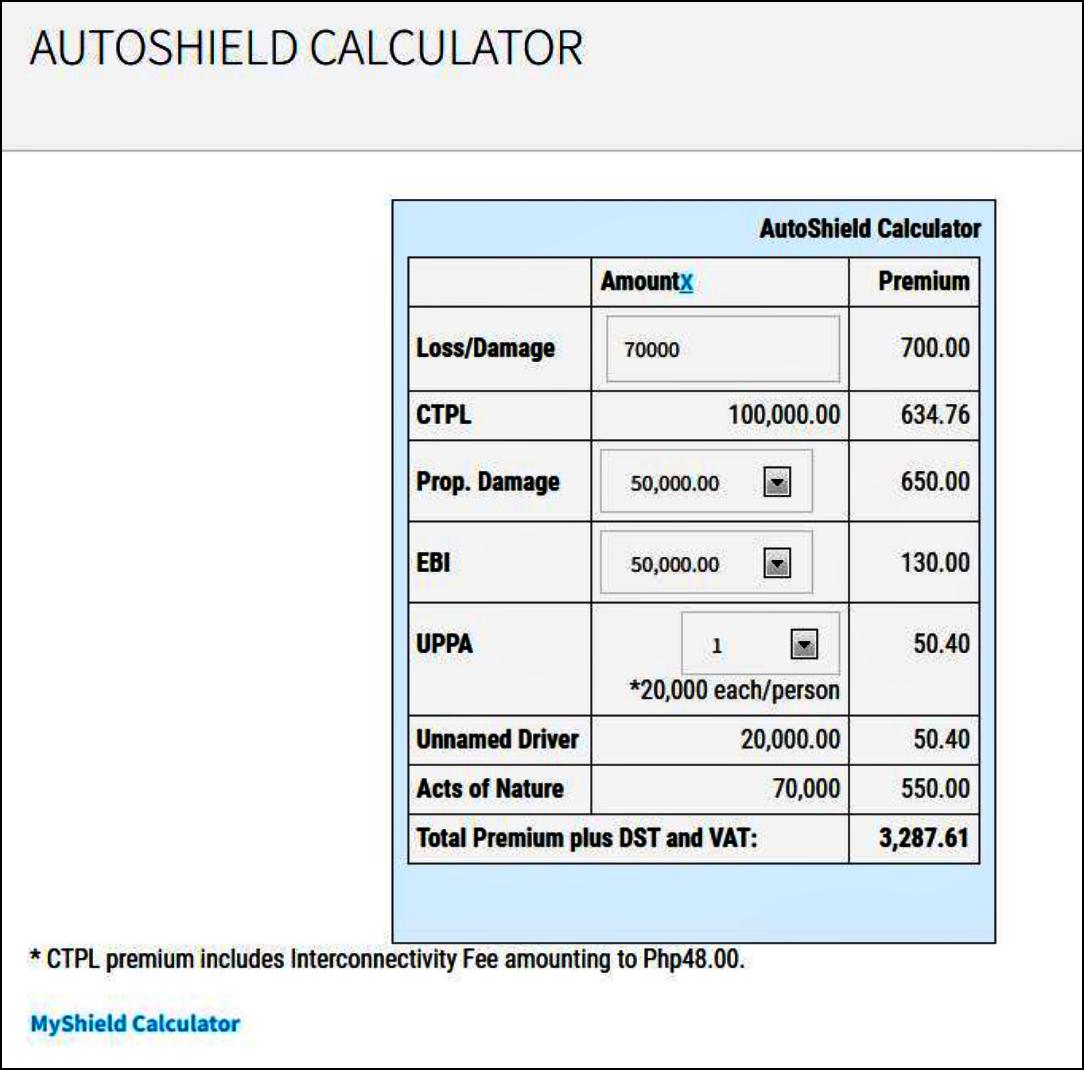

Sample Computation and Auto Shield Calculator

Also read: Cebu’s Best Insurance Providers: 6 of the Top Picks

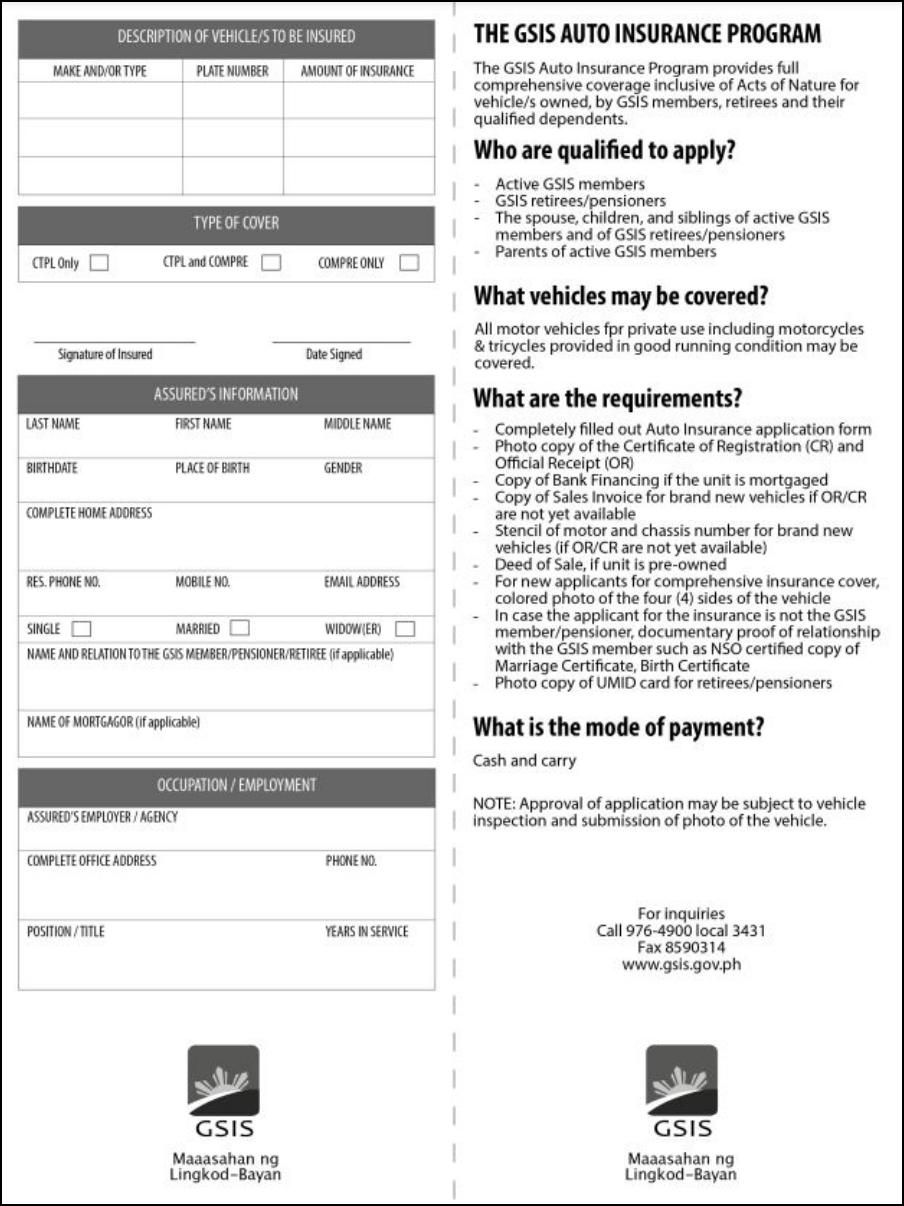

What are the Requirements for Application?

The requirements for application for new applicants and renewal of the GSIS Auto Shield Motor Vehicle Insurance program are as follows:

a. New Applicants

- Completely filled out auto insurance Application Form.

- Photocopy of the Certificate of Registration (CR) and Official receipt (OR) of the vehicle.

- Copy of Sales Invoice with signature and date for brand new vehicles if the OR/CR are not yet available.

- Copy of Notarized Deed of Sale, if the unit is pre-owned, along with a complete history of ownership.

- Colored photo of the four (4) sides of the vehicle.

- In case the applicant for the insurance is not the GSIS member/pensioner, documentary proof of relationship with the GSIS member such as a PSA certified copy of the marriage certificate or birth certificate.

- Photocopy of the UMID card of the GSIS member/retiree.

- Copy of previous/existing comprehensive insurance, if applicable.

Here is the sample Form for New Applicants:

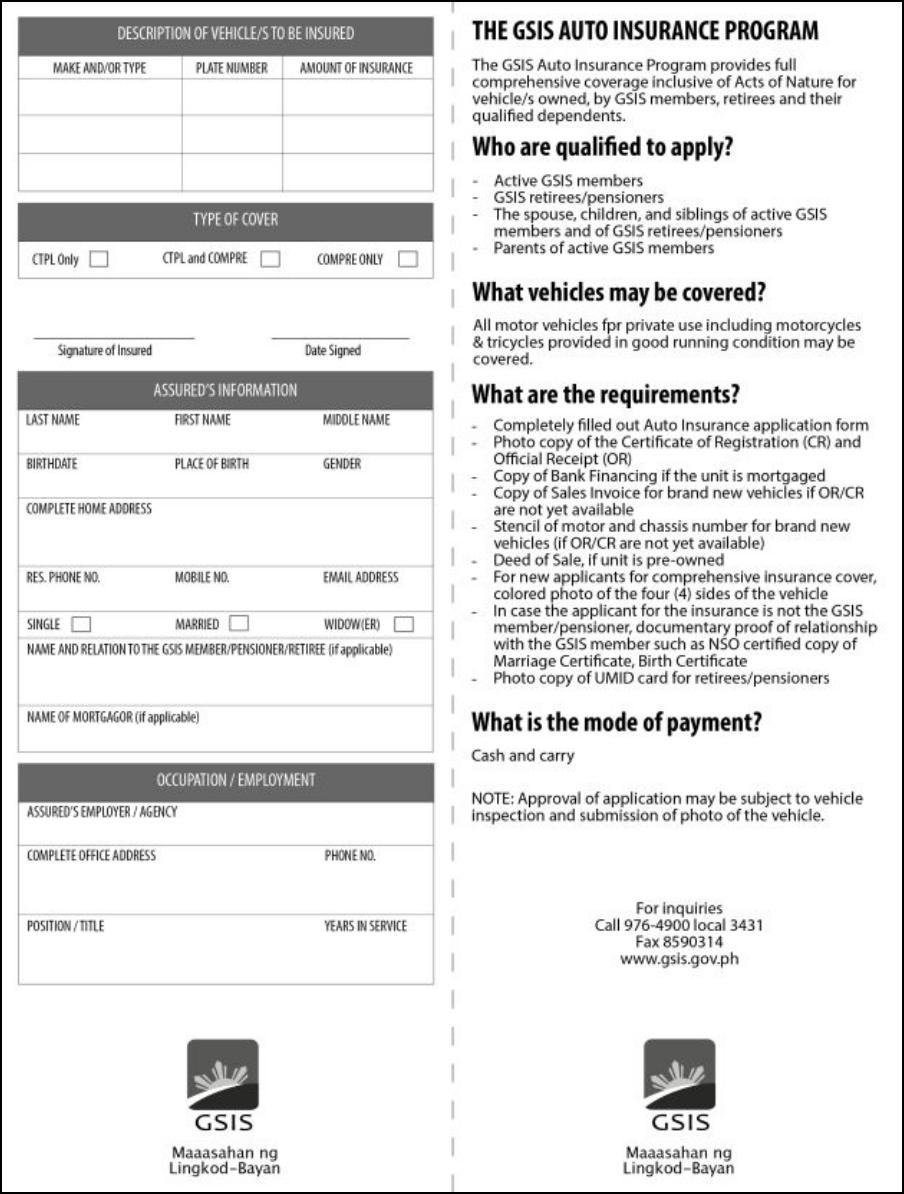

b. Renewal

- Completely filled out Renewal Form.

- Copy of the Certificate of Registration (CR) and latest Official receipt (OR) of the vehicle.

- Picture of the four sides of the vehicle, if the coverage has expired.

Here is the sample Renewal Form:

Application Process: Step-by-Step Guide

Here is a step-by-step procedure on how to apply for the GSIS Auto Shield Motor Vehicle Insurance, both for new applicants and for renewal:

Step 1: Download the Application Form from the GSIS website or obtain it from the nearest GSIS office.

Step 2: Fill out the application form completely with accurate information.

Step 3: Gather the necessary documents, including photocopies of the Certificate of Registration (CR) and Official Receipt (OR) of the vehicle, copy of Sales Invoice (if applicable), Notarized Deed of Sale (for pre-owned vehicles), colored photos of the four sides of the vehicle, proof of relationship with the GSIS member (if applicable), photocopy of the UMID card of the GSIS member/retiree, and copy of previous/existing comprehensive insurance (if applicable).

Step 4: Submit the completed application form and all required documents to the nearest GSIS office. You can also send the application form via email to marketing@gsis.gov.ph.

Video: Gastos O Investment Ba Ang Car Insurance? Practical Pa Ba Ito Sa Panahon Ngayon?

Watch this video to find out if having car insurance is a financial expense or an investment for the present time.

Car insurance is a form of protection. It is designed to protect an individual from financial losses that result from accidents, theft, and other damages related to vehicles. While having car insurance is required by law in many places, it offers far more benefits than simply meeting a legal requirement.

Summary

GSIS Motor Vehicle Insurance is a valuable way to ensure that your vehicle stays protected from accidents and unexpected damages. This insurance policy provides coverage for theft, collision, and other unforeseen incidents that may occur on the road. With its competitive pricing and comprehensive coverage, GSIS Motor Vehicle Insurance is the perfect solution for those who want to safeguard their car without breaking the bank. By investing in this type of insurance, you can have peace of mind knowing that your vehicle is well-protected and that any unforeseen expenses will be covered by your policy.

Contact Information

Address: Leon Kilat St., Brgy. Kalubihan, Cebu City, 6000

Email: mvpeenriquez@gsis.gov.ph, gsiscebu@gsis.gov.ph

Website: gsis.gov.ph

Insurance Applications: 7-976-4900 local 3431

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers)

or 1-800-10-8474747 (for Smart subscribers)