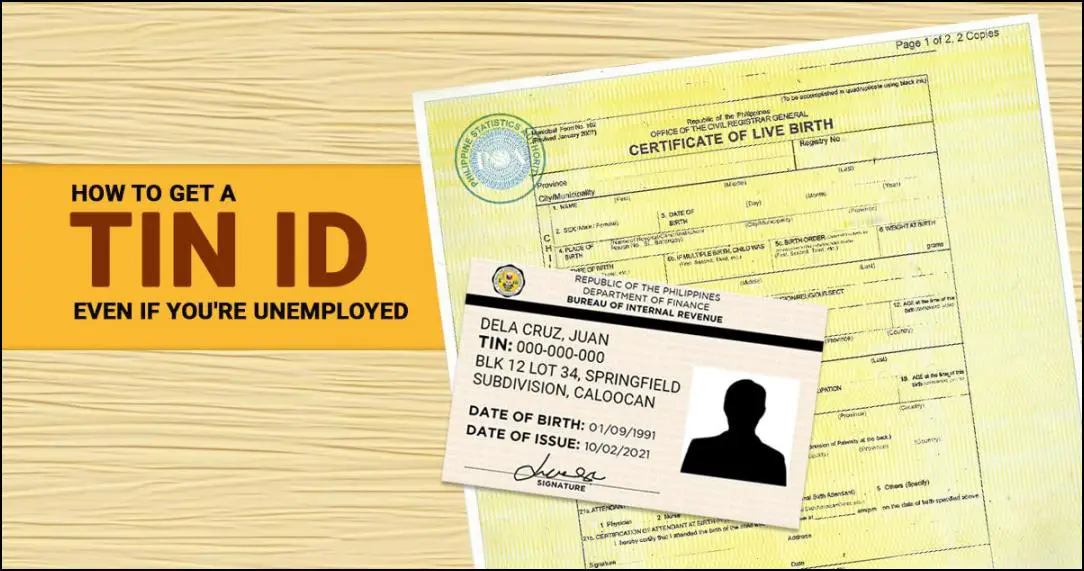

Getting a Tax Identification Number (TIN) ID may seem like a daunting task, but it is necessary. Whether you’re a young student with no job prospects yet or an individual in between employment, a TIN ID is an important requirement for government and private transactions.

Also read: How to File BIR Taxpayer Identification Number (TIN) for Self-Employed and Mixed-Income Individuals

In fact, you may need it to open a bank account, apply for licenses, permits, clearances, and even other government-issued IDs. That’s why it’s essential to secure one as soon as possible. The good news is, you don’t need a job to get a TIN ID; you can apply regardless of your current employment status. It’s straightforward and easy to obtain; all you need to do is follow the requirements, and you’ll have your TIN ID in no time.

What are the Benefits of Having a TIN ID?

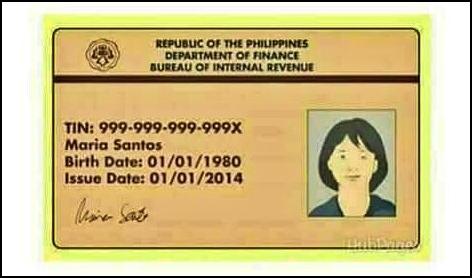

A Taxpayer Identification Number (TIN) is a unique identifier used by tax authorities to track taxpayers’ transactions. There are several benefits associated with having a TIN ID:

- Tax Compliance: A TIN is compulsory for filing tax returns or claiming treaty benefits. It enables the Internal Revenue Service or similar tax authorities to efficiently process taxes and monitor individual and business income.

- Financial Transactions: A TIN is often required for opening a business checking account or applying for credit. It makes financial transactions easier and more streamlined, especially for businesses.

- Employment: Certain types of work, particularly freelance or self-employed roles, may require a TIN for reporting income and paying taxes.

- Loans & Credit: Having a TIN and a good tax payment record can facilitate access to loans and other forms of credit, as it provides evidence of income.

- Government Services: In some cases, a TIN may be required to access certain government services or benefits.

Remember that while a TIN ID has many uses, it’s considered sensitive personal information and should be kept secure to prevent identity theft.

What are the Requirements Needed to Get a TIN ID Card?

When applying for a Taxpayer Identification Number (TIN) ID, there are several documents you need to prepare:

a. BIR Registration Form

- Form No. 1901: For self-employed and mixed-income individuals, non-resident aliens engaged in trade or business, and estates and trusts.

- Form No. 1902: For individuals earning purely compensation income, including local and alien employees.

- Form No. 1904: For one-time taxpayers and persons registering under Executive Order 98.

b. Identification Documents

You’ll need to provide any of the following:

- Passport

- Social Security System (SSS) card

- Government Service Insurance System (GSIS) card

- Unified Multi-Purpose Identification (UMID) card

- Land Transportation Office (LTO) Driver’s License

- Professional Regulatory Commission (PRC) ID

- Overseas Workers’ Welfare Administration (OWWA) E-Card

- Philippine National Police (PNP) Permit to Carry Firearms Outside Residence

- Airman License (issued August 2016 onwards)

- Philippine Postal ID (issued November 2016 onwards)

- Seafarer’s Record Book

- PSA birth certificate

- Community Tax Certificate (cedula)

c. Additional Requirements

- A 1×1 picture

- If you’re a married woman, you’ll need to provide your marriage contract.

- If you’re a non-resident alien who is either a student or unemployed, you’ll need to provide your passport.

Remember to check with your local BIR branch if there are any additional requirements or specific procedures you need to follow.

Steps on How to Get a TIN ID Card

The process to obtain a Taxpayer Identification Number (TIN) ID card varies depending on whether you’re an unemployed, student, new employee or an existing taxpayer.

A. For Unemployed and Students

Step 1: Visit your nearest Bureau of Internal Revenue (BIR) branch and complete Form 1904.

Step 2: Submit the completed form along with any other required documents to the Revenue District Office (RDO) located in your city or municipality.

Step 3: The RDO staff will process your application. If you submit your application before the 1:00 PM deadline, they typically issue the TIN card on the same day.

Step 4: If the office has run out of ID paper or is experiencing technical issues, they may ask you to come back in one to three business days.

Step 5: Return to the same RDO on the specified date to collect your TIN ID card. Don’t forget to affix your 1×1 picture and sign your TIN card after receiving it.

B. For New Employees

If you have never been assigned a TIN, the first step is to acquire one from the Bureau of Internal Revenue (BIR).

Step 1: After you’ve obtained your TIN, visit the Revenue District Office (RDO) in your city or municipality and submit Form 1902 along with any other required documents. You can request a TIN card upon completion of the registration process at the same RDO where you got your TIN.

Step 2: If the RDO isn’t busy on the day you complete your transaction, they may issue your TIN card on the same day. If not, they’ll ask you to return in one to three business days.

Step 3: Return to the same RDO on the assigned date to claim your TIN ID card. Remember to attach a 1×1 picture and sign your TIN card after receiving it.

If your employer’s HR department handles your TIN ID application, you just need to submit the necessary documents to them.

C. For Existing Taxpayers

Step 1: Visit the RDO where you initially registered and submit the required documents.

Step 2: If the RDO isn’t busy when you go, they might issue your TIN card within minutes or an hour. If they run out of ID paper or experience technical difficulties, they’ll ask you to return in one to three business days.

Step 3: Return to the same RDO on the assigned date to collect your ID. Attach a 1×1 picture and sign your TIN card.

Important Reminder: Remember that these procedures may vary slightly depending on the specific rules of your local BIR branch.

Also read: How to Pay Real Estate Property Tax Online

Video: PAANO KUMUHA NG BIR TIN I.D HOW TO APPLY FOR A TIN ID (STUDENTS & UNEMPLOYED) 2022

Summary

Obtaining a TIN ID card is a straightforward process that even unemployed citizens, students, and new employees should prioritize. This identification card serves as proof of registration as a taxpayer and enables individuals to apply for various legal documents, such as licenses and permits.

What’s more, a TIN ID card does not expire, which makes it an advantageous tool for long-term use. Before applying for the ID, however, it is crucial to have an active Tax Identification Number (TIN). Overall, getting a TIN ID card is a simple act that can go a long way in establishing oneself as a responsible taxpayer.

Contact Information

Hotline: 8538-3200

Email: contact_us@bir.gov.ph.

Website: https://www.bir.gov.ph/