If you’re a member of the Government Service Insurance System (GSIS), it’s essential to know that your welfare is a top priority for the organization. GSIS is committed to caring for those who selflessly serve the nation. In line with this commitment, GSIS has introduced the Ginhawa for All (GFAL) program, which offers an array of benefits to government employees.

Also read: How to Apply Multi-Purpose Loan from Pag-IBIG

One of the key benefits of the GFAL program is the Multi-Purpose Loan (MPL) Plus. This feature provides active members with an additional credit line to settle their outstanding GSIS loan balances. The MPL Plus is designed to help government employees consolidate their loans, thereby allowing them to manage their finances more effectively. As a GSIS member, it’s crucial to explore and utilize the benefits offered by the GFAL program for your financial well-being.

What is GSIS Ginhawa for ALL Program?

GSIS-administered program called GINHAWA FOR ALL (GFAL) provides support and assistance to government employees for their wellbeing and needs. It is part of GSIS’ commitment to take care of those who serve the nation.

What are the Benefits can a Member Get from Applying for MPL Plus?

Applying for the MPL Plus program offers several advantages:

- Additional Credit Line: It provides an extra source of funds that can be used to consolidate and settle outstanding GSIS loan balances.

- Flexible Usage: The loan can be used for various purposes such as medical expenses, home improvements, capital for small businesses, tuition fees, and more.

- Extended Repayment Period: With MPL Plus, borrowers have a longer time frame, up to 10 years, to repay their loans, which can make the repayment process more manageable.

- Higher Loan Amounts: Under the MPL Plus program, qualified borrowers may apply for a loan amount up to 14 times their basic monthly salary, with a cap of 3 million pesos.

- Simplified Application Process: The MPL Plus program has an easy application process, with multiple ways to apply, including online applications, email, through the GSIS mobile app, or at a GSIS kiosk.

- Uniform Interest Rate: All borrowers are subject to a standard interest rate of 7%, computed in advance. This makes it easier to understand the cost of borrowing.

Remember to check with GSIS for the most accurate and current information regarding the MPL Plus program.

Who Can Avail the GSIS Multi-Purpose Loan Plus ?

The Multi-Purpose Loan (MPL) Plus program is open to qualified borrowers including regular members (both permanent and non-permanent) and special members.

To be eligible for the MPL Plus program, applicants must meet the following criteria:

- They must have paid at least three months of premiums.

- They should not be on leave of absence without pay.

- They must not have any pending administrative or criminal cases.

- They must belong to an agency whose status is not suspended.

- Their resulting net take-home pay must not be lower than the amount required under the General Appropriations Act after all monthly obligations have been deducted.

- They must belong to an agency that has a memorandum of agreement (MOA) on MPL or GFAL with GSIS.

The MPL Plus program offers numerous benefits. It provides an additional credit line to help government employees settle their outstanding GSIS loan balances. This is designed to aid government employees in consolidating their loans, thus enabling them to manage their finances more effectively. It’s a valuable resource for those seeking financial management assistance or loan consolidation options.

Also read: How to Upgrade UMID ID to SSS UMID ATM Pay Card

What are the Requirements Needed to Avail for GSIS Multi-Purpose Loan Plus?

To apply for the Multi-Purpose Loan (MPL) Plus program, applicants must meet certain requirements and submit specific documents.

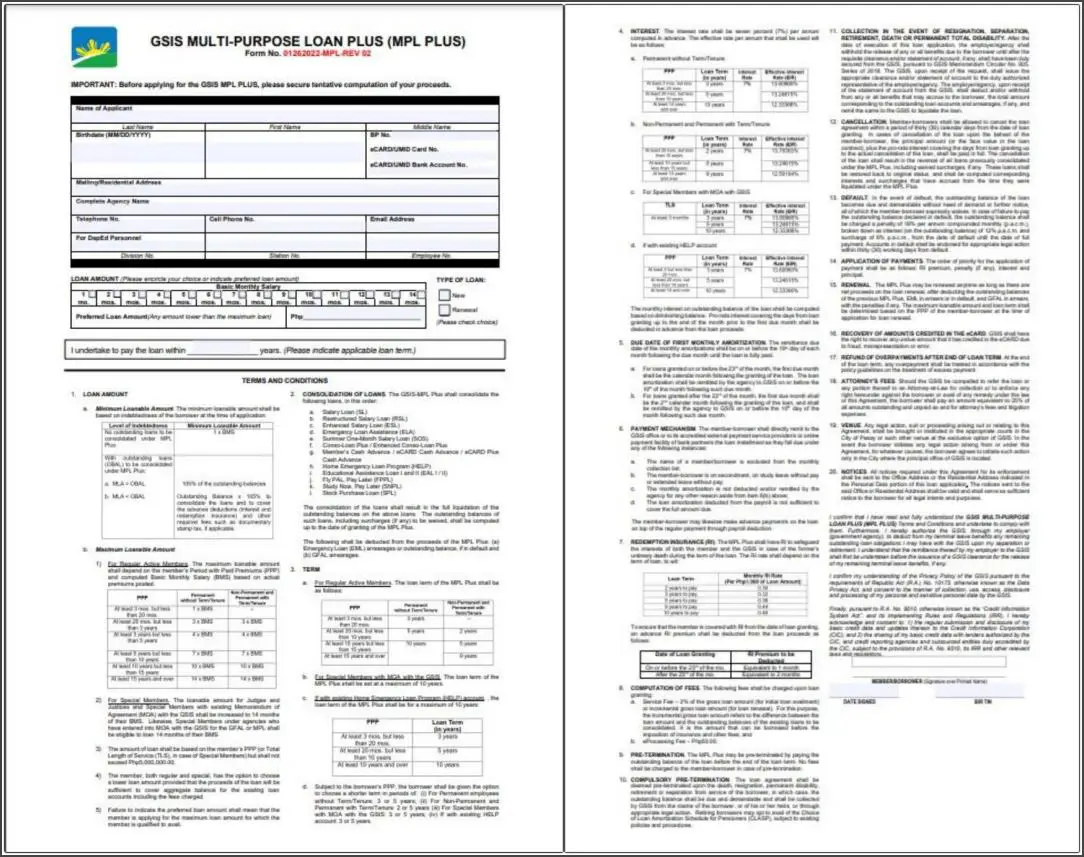

1. A duly accomplished MPL Plus Application Form: This form typically asks for personal information, employment details, loan information, and a declaration of understanding and agreement to the terms and conditions of the loan.

Here is the sample form:

2. Photocopy of Identification: Applicants should provide a photocopy of their Unified Multi-Purpose ID (UMID) card or Electronic Card (eCard). This serves as proof of identity and membership with the GSIS.

Before submitting these documents, ensure that all the information provided in the application form is accurate and that the photocopy of your ID is clear and legible. It’s always recommended to check with the respective agency for any additional requirements or changes in the application process.

Application Process: What are the Steps

Applying for the Multi-Purpose Loan (MPL) Plus program from GSIS can be done through several methods. Here’s a step-by-step guide for each:

a. Via the Electronic GSIS Member Online (eGSISMO)

Step 1: Log in to your eGSISMO account using your User ID/Business Partner (BP) number and Password.

Step 2: Click on ‘Loans Application’. Select ‘Multi-purpose Loan Plus’ from the dropdown menu for Loan Product and choose between ‘New‘ or ‘Renewal‘ for the Loan Type.

Step 3: Upload a picture of yourself holding your UMID card or temporary eCard (or any 2 valid government-issued IDs if UMID / temporary card is not available). The file should be in JPEG or PDF format and its size should not exceed 2MB. Click ‘Next’.

Step 4: Confirm the Loan Agreement and click ‘SAVE‘.

Step 5: Wait for email confirmation from GSIS with your tentative loan computation.

b. Via Email

Step 1: Prepare the following:

- A Duly accomplished MPL Plus Application Form

- A clear photo of yourself holding your GSIS UMID card or temporary eCard. If you do not have a UMID card or temporary eCard, have 2 valid IDs ready and take a clear photo of them.

- 2 valid IDs (front and back)

- Picture of yourself holding two valid ID cards

Step 2: Save the application form and photos of your IDs as JPEG or PDF files. The file size should not exceed 2MB.

Step 3: Email these documents to your GSIS handling branch. You can find the list of email addresses of GSIS offices on the GSIS website under ‘Contact Us’.

Step 4: Wait for email confirmation from GSIS with your tentative loan computation.

c. Via the GSIS Wireless Automated Processing System (GWAPS) Kiosk

Step 1: Visit a GWAPS kiosk near you.

Step 2: Place your UMID/eCard Plus in the GWAPS kiosk card reader and place your finger on the biometrics scanner. Once recognized, your personal data will be displayed.

Step 3: Choose the ‘Loan Windows’ icon and click on ‘Multi-Purpose Loan Plus’. You’ll see a tentative computation of your preferred loan. You can adjust the loan amount or payment term.

Step 4: To confirm your loan application, place your finger on the biometrics scanner again.

Step 5: Wait for an email or SMS from GSIS regarding the approval of your loan.

d. Via GSIS Touch

Step 1: Download the GSIS Touch mobile app from the Apple App Store or Google Play Store and install it on your smartphone.

Step 2: Register in eGSISMO using your BP number. Ensure that your mobile number is updated.

Step 3: Log in to your eGSISMO account using your Username and Password.

Step 4: Tap the ‘Loans‘ icon at the bottom of the eGSISMO screen and tap ‘Available Loans’. Select ‘Multipurpose Loan Plus’.

Step 5: Check the tentative computation details displayed on your mobile screen. Tap ‘Submit Loan Application’.

Step 6: Wait for an email or SMS from GSIS regarding the approval of your loan.

Interest Rate of MPL Plus

For the Multi-Purpose Loan (MPL) Plus program, all borrowers are subject to a standard interest rate of 7%. This interest is calculated upfront and applies uniformly to all applicants.

Also read: How to Apply for SSS Pension Loan: Online and Manual Processes

Types of Loans that Can Be Consolidated Under MPL Plus

The MPL Plus program allows for the consolidation of various types of loans. This means that if you have any of the following outstanding loans, they can be combined into a single MPL Plus loan:

- Salary Loan (SL)

- Restructured Salary Loan (RSL)

- Enhanced Salary Loan (ESL)

- Emergency Loan Assistance (ELA)

- Summer One-Month Salary Loan (SOS)

- Conso-Loan Plus / Enhanced Conso-Loan Plus

- Member’s Cash Advance / eCard Cash Advance / eCard Plus Cash Advance

- Home Emergency Loan Program (HELP)

- Educational Assistance Loan I and II (EAL I / II)

- Fly PAL, Pay Later (FPPL)

- Study Now, Pay Later (SNPL)

- Stock Purchase Loan (SPL)

The consolidation process of MPL Plus results in the complete settlement of the outstanding balances of the consolidated loans, including any surcharges. These balances, including waived surcharges, if any, will be calculated up to the date of the granting of the MPL Plus loan.

If an Emergency Loan (EML) account is in arrears (unpaid for 6 months or less) or in default (unpaid for more than 6 months), or if a GSIS Financial Assistance Loan (GFAL) is in arrears, these outstanding balances will also be deducted from the proceeds of the MPL Plus loan.

For members who have already taken out an MPL and wish to renew their loan under MPL Plus, the outstanding balance of their existing MPL will be deducted from the proceeds of the new loan. This is in addition to any outstanding EML and arrears balances as previously mentioned. This way, the MPL Plus loan simplifies debt management by consolidating various loans into one, making it easier for members to manage their repayments.

Video: GSIS Multi-purpose Loan – Plus

Please watch this video for more detailed information on availing the GSIS Multi-Purpose Loan Plus.

Frequently Asked Questions

1. What is MPL Plus?

A: MPL Plus is an enhanced loan program offered by GSIS that allows members to consolidate their existing GSIS loans into one.

2. What is the maximum loanable amount under MPL Plus?

A: The maximum loanable amount for regular members has been increased to Php5 million from the previous Php3 million.

3. What is the repayment period for MPL Plus?

A: Borrowers can choose a repayment period between 2 to 10 years depending on their Preferred Payment Period (PPP) and employment status.

4. How are the loan proceeds disbursed?

A: Loan proceeds will be credited to the borrower’s GSIS UMID card or eCard.

5. Can MPL Plus be renewed?

A: Yes, MPL Plus can be renewed as long as there are net proceeds and the member’s net take-home pay isn’t lower than Php5,000 after all deductions.

6. What happens to the loan if the borrower passes away?

A: If the borrower passes away and their loan is up to date, the outstanding loan balance will be considered fully paid through the Loan Redemption Insurance (LRI).

Summary

GSIS has made it easier for their members to manage their loans with the MPL Plus program. This program provides an extra credit line to active members that can be used to consolidate and pay off outstanding loan balances. The process for availing the MPL Plus loan is simple and straightforward, ensuring that members can access this benefit with ease. Whether it’s for paying off debts or funding other important expenses, the MPL Plus program is a valuable tool for GSIS members seeking financial flexibility and security.

Contact Information

Address: Leon Kilat St., Brgy. Kalubihan, Cebu City, 6000

Email Address: mvpeenriquez@gsis.gov.ph, gsiscebu@gsis.gov.ph

Website: gsis.gov.ph

GSIS CALL CENTER NUMBERS:

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers)

or 1-800-10-8474747 (for Smart subscribers)