Retirement is a crucial phase of life where one needs a stable and secure financial support system. The Social Security System (SSS) in the Philippines provides various beneficiary schemes for its members to make their retirement days easier! One such assistance is the SSS Pension Loan. It is a great opportunity for retired SSS members to cater to their emergency finances and ease their lives after retirement.

Also read: How to Calculate SSS Retirement Pension Benefits Online

The SSS Loan program is beneficial as it caters to the immediate needs of retired members that are easily repayable. We ensure a smooth and professional lending experience at SSS, ensuring timely disbursement and unhindered support to our members. We take pride in enabling our beneficiaries to lead a happy and financially stable retirement life through our pension loan programs.

What is SSS Pension Loan?

SSS pension loan is a form of loan offered by the Philippine Social Security System (SSS) to its members who are currently receiving their monthly pension. This loan, which is available in two options: regular and emergency, allows retired SSS members to borrow up to one-half of their total accumulated pension credits.

What are the Benefits of SSS Pension Loan?

The Social Security System (SSS) Pension Loan Program offers several benefits for qualified retirement pensioners:

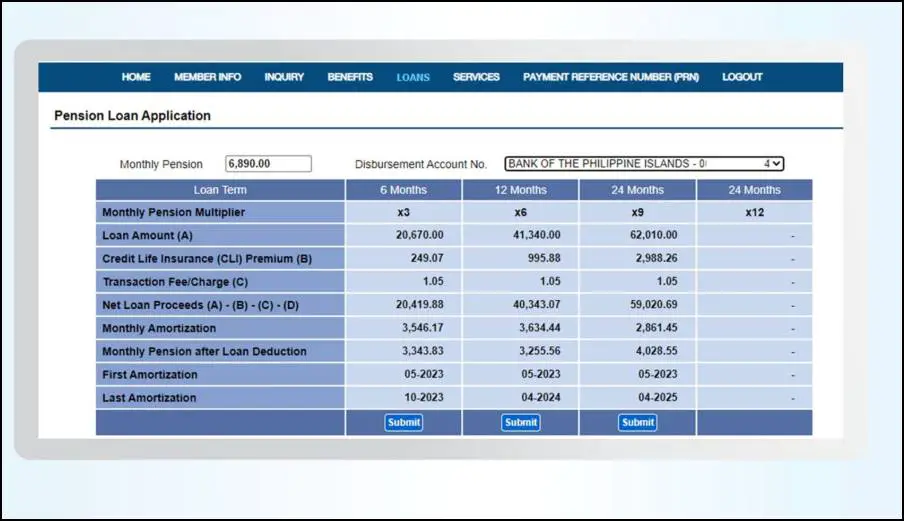

- Loan amount options: Qualified retirement pensioners can apply for a loan equivalent to three, six, nine, or twelve times their basic monthly pension plus the PHP 1,000 additional benefit.

- Flexible age requirement: All SSS retirement pensioners who are 80 years of age or below at the end of the month of the loan term can apply for a pension loan.

- No outstanding balance required: To qualify, pensioners must have no deductions, such as outstanding loan balance, benefit overpayment payable to SSS, etc. from his/her monthly pension.

- Easy application process: The loan application process is designed to be fast and convenient. It can even be done online, simplifying the process for pensioners.

- Low-interest rates: The SSS launched the Pension Loan Program to assist retiree-pensioners in their immediate financial needs by offering a loan program with a low-interest rate of 10% per annum.

- Uninterrupted benefits: The remaining balance on the pension loan will not be deducted from the Funeral and Death Benefits that the relatives of the deceased pensioner-borrower can receive.

- High maximum loanable amount: A retired SSS member can also avail of loans worth triple, six times, and nine times worth his monthly pension plus the ₱1,000 benefit, but not exceeding the maximum amount of PHP 200,000.00.

- Quick disbursement: Once approved, the loan proceeds are deposited into the pensioner’s account within five working days.

These benefits make the SSS Pension Loan Program an attractive option for retirees in need of financial assistance.

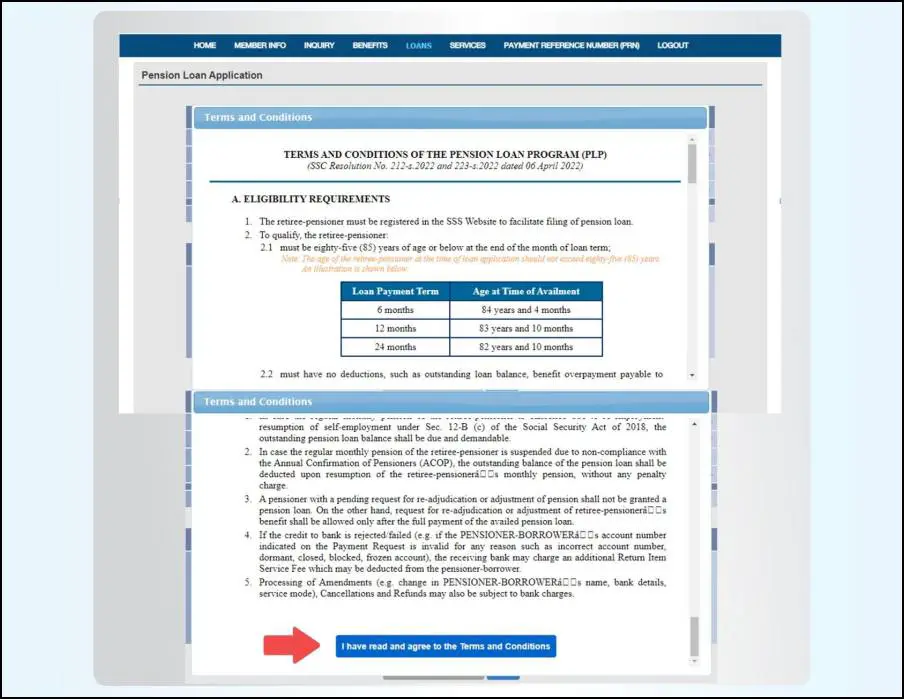

Who is Eligible to Apply for SSS Pension Loan?

- A retiree-pensioner who has a My.SSS account on the SSS website.

- 85 years old or younger at the end of the loan term.

- No deductions from the monthly pension or existing advance pension under the SSS calamity Loan Assistance Package.

- Regularly receiving a monthly pension and the pension status is “ACTIVE“.

- With valid disbursement account enrolled in the Disbursement Account Enrollment Module (DAEM).

Note: You can apply for a Pension Loan up to a maximum of PHP 200,000 which can be repaid over 6, 12, or 24 months, with an annual interest rate of 10 percent, even from the comfort of your own home.

How to Apply SSS Pension Loan Online

Step 1: Log in to your My.SSS account.

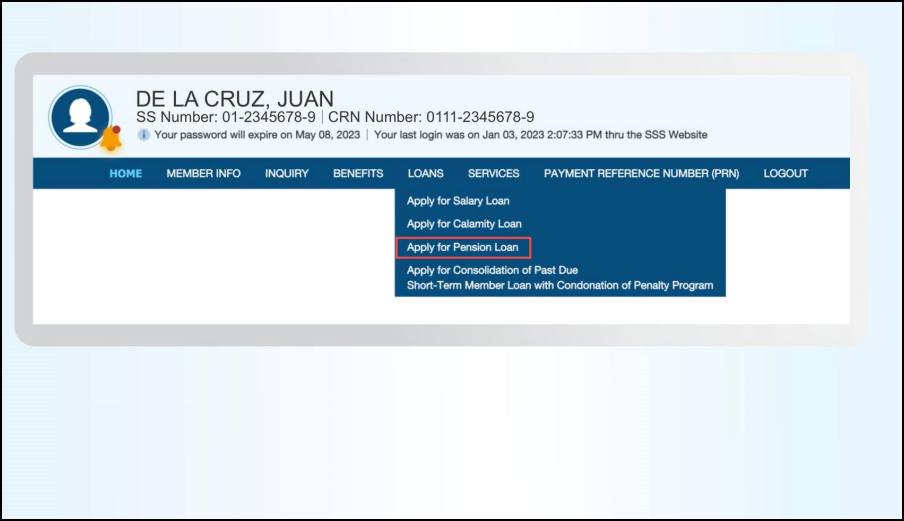

Step 2: Click on the “E-services Tab” and select Apply for Pension Loan.

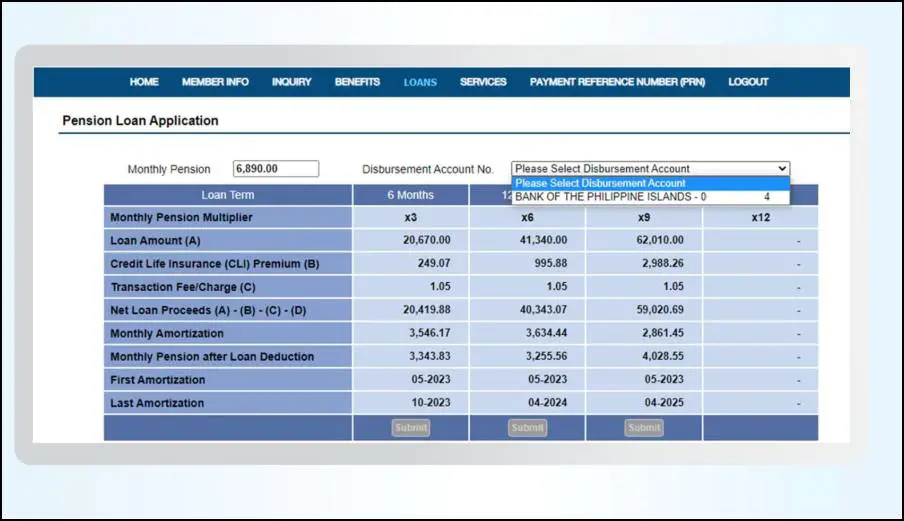

Step 3: Choose the desired Pension Loan amount from the displayed computations by clicking the “Submit” button under the chosen computation.

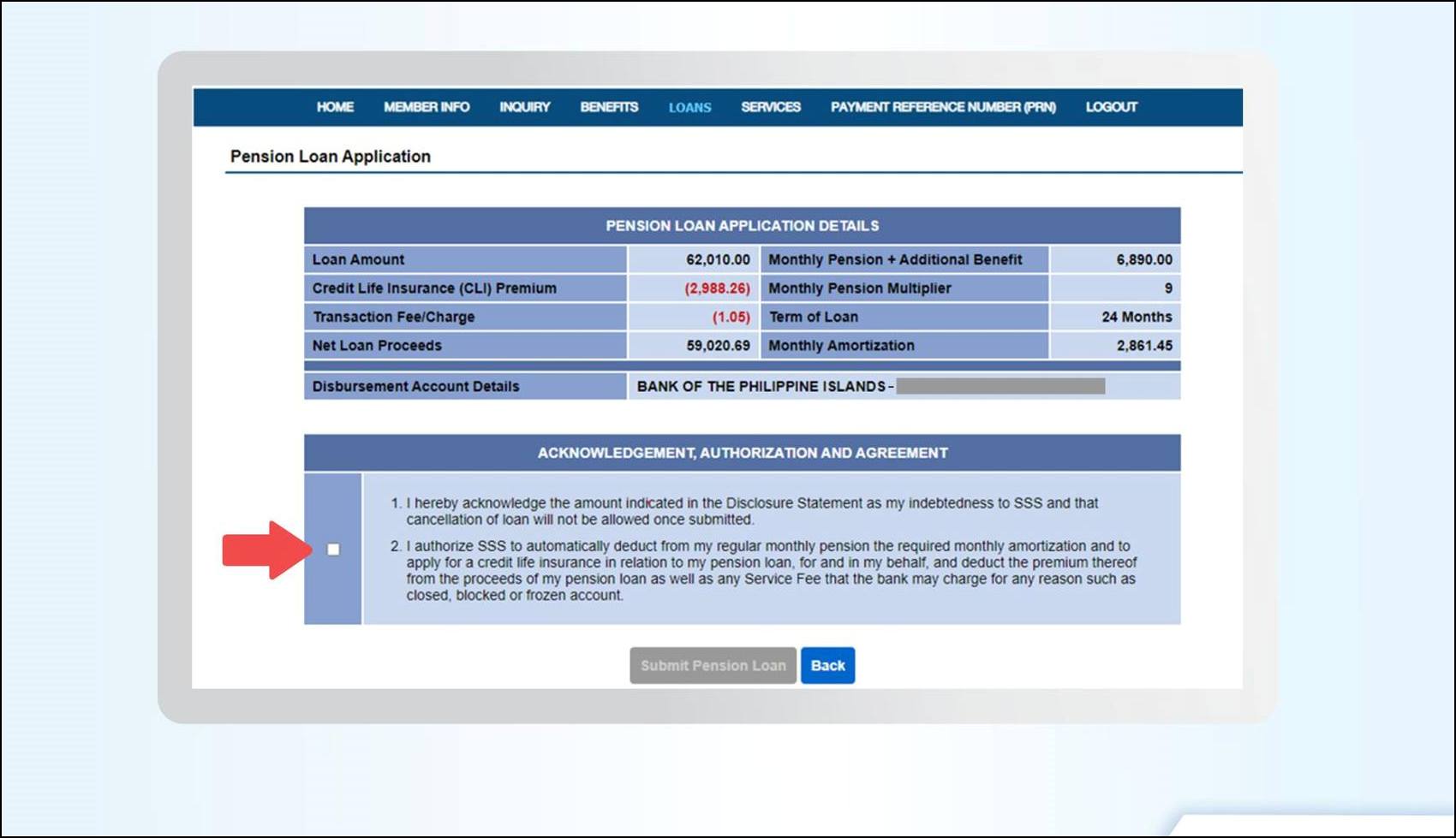

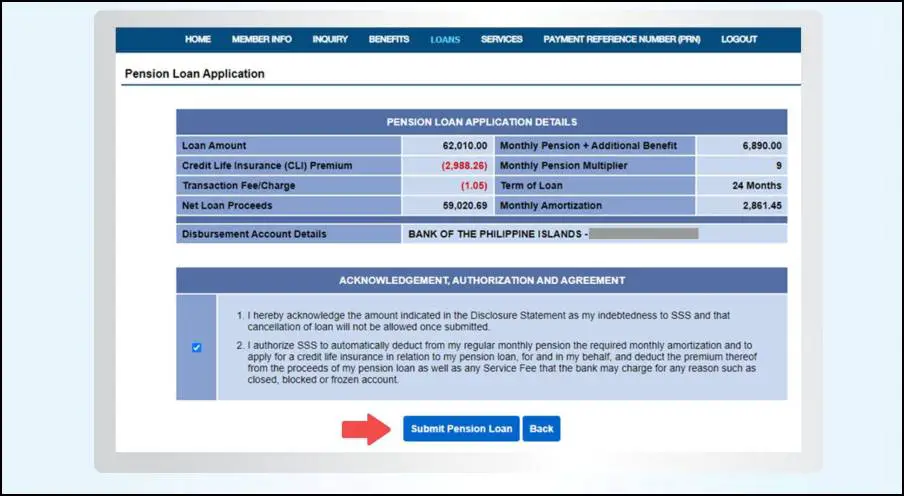

Step 4: Check all the details of the application, then click the small box at the lower left part of the Acknowledgement, Authorization and Agreement box screen. This means you agree with the Pension Loan amount stated in the Disclosure Statement, the deduction of monthly amortization from your pension, and the Terms and Conditions of the Pension Loan Program.

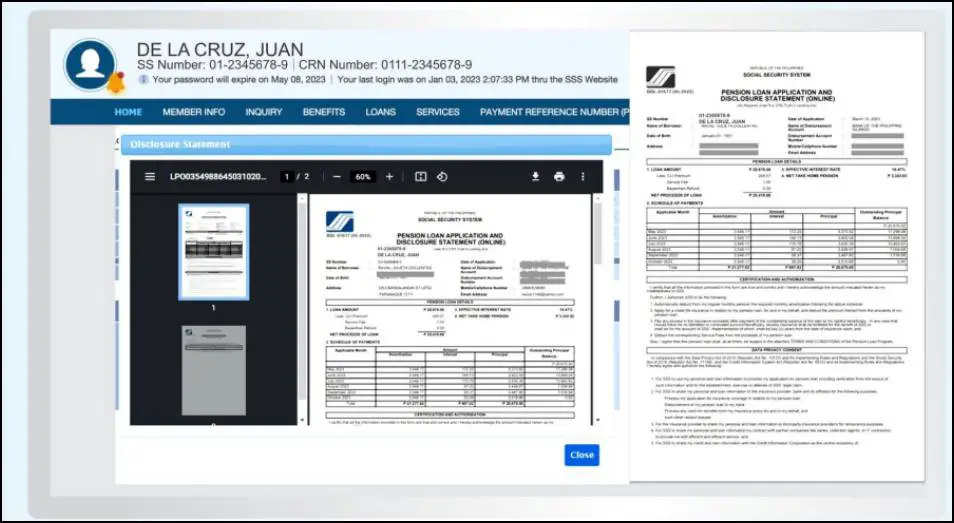

Step 5: Click on the “Disclosure Statement” and download or print a copy of it.

Step 6: Close the Disclosure Statement page to activate the Submit Pension Loan button. Click on “Submit Pension Loan”.

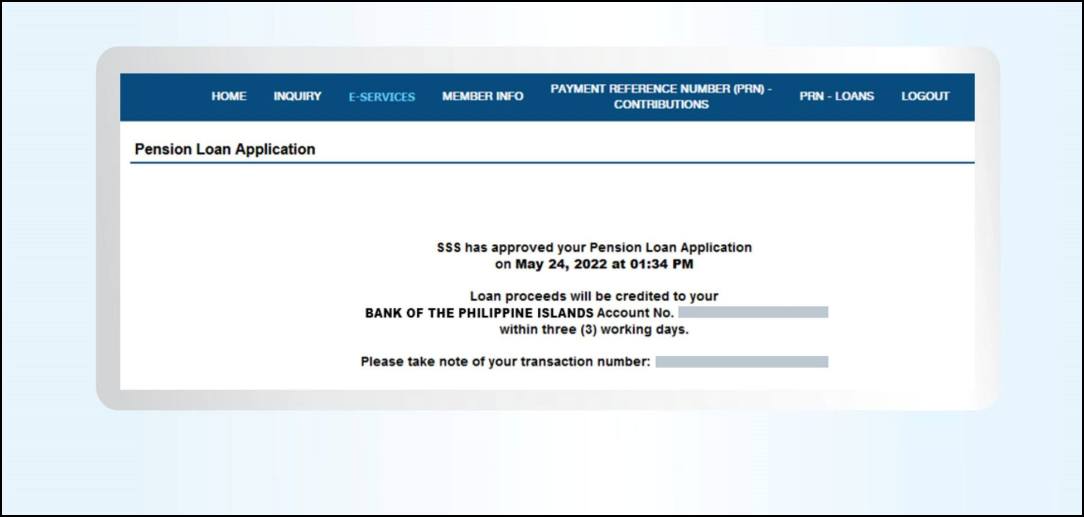

Step 7: After submitting the application, you will receive a notification that your application has been successfully submitted.

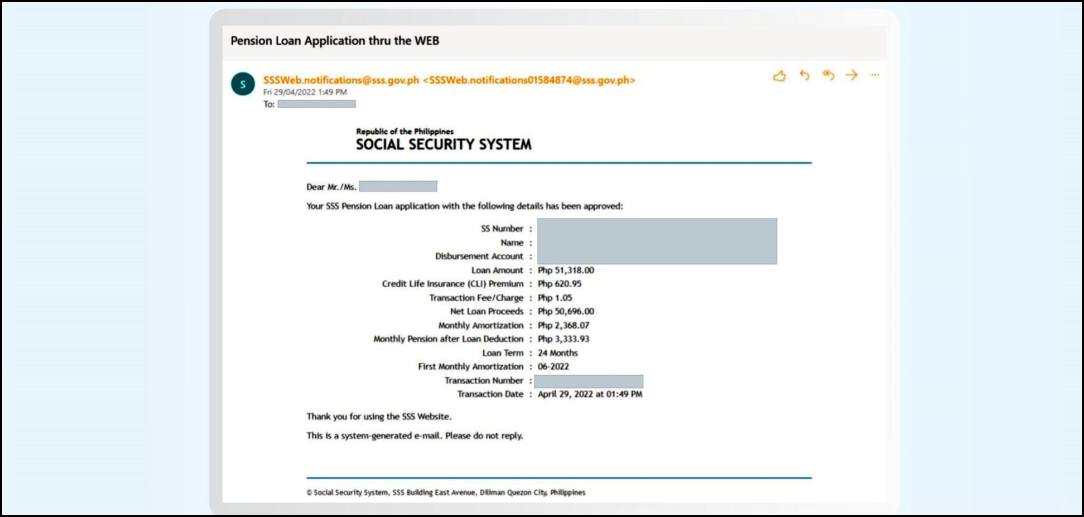

Step 8: An email notification containing the details of your Pension Loan application will be sent to your registered email address.

Also read: How to Register an SSS Account Online

How to Apply SSS Pension Loan Manually

Here are the steps to apply for an SSS Pension Loan:

Step 1: The pensioner-borrower must personally visit any SSS branch or service office and present the original, along with a photocopy of any of the following valid IDs:

- Social Security (SS) ID card

- Unified Multi-purpose Identification Card (UMID)

- Alien certificate of registration from Bureau of Immigration

- LTO Driver’s License

- NBI Clearance

- Passport

- PNP Permit to Carry Firearms Outside of Residence

- PNP Firearm Registration

- Phil Postal Corp. ID Card

- MARINA Seafarer’s Identification and Record Book (Seaman’s Book)

- Two valid ID cards/documents, both with signature and at least one with photo.

Step 2: The pensioner will then need to wait for the results of the eligibility check performed by SSS counter personnel to determine if they are eligible for the Pension Loan.

Step 3: The pensioner can then select the loan amount and repayment term they wish to apply for.

Step 4: The pensioner should review their personal information and loan details as shown by the SSS counter personnel.

Step 5: The pensioner will receive either a Cash Card or Quick Card from their chosen bank, or they can enroll their UMID card as an ATM card at a Union Bank of the Philippines kiosk (if available in branch).

Step 6: The pensioner needs to sign the following:

- Pension Loan Application and Disclosure Statement (3pcs)

- Photocopy of the valid IDs (3 signatures)

Step 7: The pensioner must fill out and sign the Supplemental Information Sheet and Terms and Conditions of their chosen bank.

Step 8: Finally, the pensioner should wait for five (5) working days from the date of approval before withdrawing the loan proceeds from their Cash Card/UMID Card.

Note: Retirement pensioners who are based abroad and have their UMID Cards enrolled as ATM cards may apply for a Pension Loan by submitting the documentary requirements at the nearest SSS Foreign Representative Office.

Also read: List of SSS Branches and Offices in Cebu

How Can I receive My Loan?

You will receive your loan proceeds within 5 working days through your Savings Account, according to the following order of priority:

- Valid SSS Umid Card enrolled as an ATM Card;

- Valid UPB QuickCard with a savings account registered with SSS;

- Valid Pension Savings Account in a PESOnet-participating bank enrolled with SSS.

Tips in Applying for SSS Pension Loan

Applying for an SSS Pension Loan can be a straightforward process, especially if you’re well-prepared.

Here are some tips to ensure a smooth application:

- Understand the Terms: Before applying for a loan, make sure you understand the terms and conditions, including the interest rate, repayment period, and penalties for late payment.

- Check Eligibility: Make sure that you meet the eligibility criteria before applying. You should be an SSS retirement pensioner who is 80 years old or younger at the end of the loan term, and you should have no outstanding loan balances or benefit overpayments payable to SSS.

- Prepare Your Documents: Have all the necessary documents ready before you apply. This includes a valid ID and your Pension Loan Application and Disclosure Statement.

- Choose the Right Loan Amount: Borrow only what you need and what you can comfortably repay. Remember, your loan repayments will be deducted from your monthly pension.

- Consider the Repayment Schedule: Keep in mind that the first loan repayment is due on the second month after the loan was granted. Plan your finances accordingly.

- Keep Track of Your Payments: It’s essential to keep track of your repayments to avoid any penalties for late payment.

Remember, a loan is a responsibility. Make sure you’re fully aware of all the terms and conditions before you apply.

Video: How to Apply Pension Loan in SSS | Tutorial updated 2023

Frequently Asked Questions

1. What is the interest rate of the SSS Pension Loan?

A: The annual interest rate for the SSS Pension Loan is 10%, or approximately 0.83% per month, calculated on a diminishing principal balance until the loan is fully paid.

2. How long does it take to process the SSS Pension Loan?

A: The SSS Pension Loan application is processed within the same day of submission. Once approved, the loan amount will be credited to the borrower’s Cash Card/UMID Card within five business days.

3. Is there a fee for the Quick Card/Cash Card?

A: Yes, there is a minimal fee associated with the Quick Card/Cash Card, which varies depending on the bank chosen by the pensioner-borrower. This fee is deducted from the loan proceeds by the bank.

4. If the pensioner-borrower passes away, will the remaining loan balance be deducted from the family’s funeral and death benefits?

A: No, the outstanding loan balance will not be deducted from the funeral and death benefits claimed by the beneficiaries. All pensioner-borrowers are covered by Credit Life Insurance (CLI), which ensures the loan balance is fully paid in the event of the borrower’s death. The usual 1% service fee charged by SSS is waived and used instead to subsidize the pensioner-borrower’s CLI premium.

5. Can someone else apply for the loan on behalf of the pensioner if they are unable to visit the SSS branch due to health concerns?

A: No, pensioner-borrowers must personally apply for the loan. They are required to sign the Pension Loan Application and Disclosure Statement to confirm that they understand and agree to the terms and conditions of the loan.

6. When can the pension loan be renewed?

A: The pension loan can only be renewed once the existing loan has been fully paid.

7. How is the monthly loan repayment handled?

A: The loan repayments are automatically deducted from the monthly pension. The first repayment is due on the second month after the loan was granted. For instance, if the loan was granted in May, the first repayment will be deducted from the July pension.

Summary

The SSS Pension Loan offers a quick and easy solution for pensioners in need of financial assistance. With both online and manual processing options available, applicants can choose the method that suits them best. This gives them greater flexibility and convenience when it comes to applying for a loan.

While the online process is quite straightforward, the manual process may require more time and effort on the applicant’s part. However, it still offers a viable option for those who prefer a more personal touch when dealing with financial matters. Whichever option you choose, the SSS Pension Loan is a valuable resource for pensioners in need.

Contact Information

Customer Service: 1-800-10-2255777

Email: member_relations@sss.gov.ph

Website: https://member.sss.gov.ph/members/