Are you considering retirement in the Philippines soon, but unsure of how to navigate the complexities of calculating your pension benefits? You’re certainly not alone. Knowing what to expect from your pension can be a daunting task, and there are certainly important matters to consider when it comes to financial planning for retirement.

However, while seemingly complicated at first glance, the process of accurately determining your benefit amounts is doable—all it takes is knowledge and foresight.

Also Read: How to Get a Loan from SSS

In this post, we’ll cover all that’s needed for you to feel confident about navigating your financial future in preparation for retirement. Read on for tips on calculating and receiving the maximum amount possible from your pension plan!

What is SSS Retirement Pension Benefits?

The Social Security System (SSS) Retirement Pension Benefits is a type of retirement program that provides financial assistance to Filipino citizens who are at least 60 years old and have been paying SSS contributions for at least 10 years.

It is designed to ensure that retirees can maintain their standard of living even after the end of their working life. The payment can be received as a lump sum or in monthly installments and is based on the retiree’s estimated earning capacity.

How to Calculate Your Retirement Pension Benefits Online

Calculating your SSS Retirement Pension Benefits is an important step before retirement. Fortunately, this can easily be done online via the SSS website. Here are the steps:

1. Log in to your SSS account.

2. Once logged in, hover over your mouse to Benefits and choose “Simulate My Retirement (Calculator)”.

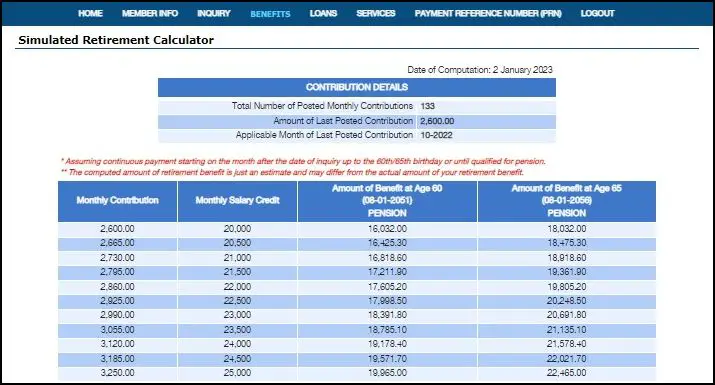

3. You will be redirected to the next page which will show the Contribution Details including the Total Number of Posted Monthly Contributions, the Amount of Last Posted Contribution, and the Applicable Month of the Last Posted Contribution.

4. On the same page, you will also see a Retirement Estimator which will allow you to calculate your estimated retirement pay.

NOTE: The details above are only estimated if continuous payment starting from the month after the date of inquiry up to the 60th/65th birthday or until qualified for a pension, the computed amount of retirement benefit is just an estimate and may differ from the actual amount of your retirement benefit.

What are the conditions for entitlement to a retirement pension

- The member has paid at least 120 monthly contributions prior to the semester of their retirement; and

- He/She has reached the age of 60 years and has already been separated from employment or has stopped being self-employed or has stopped paying voluntary contributions; or

- He/she has reached the age of 65 years, even if still employed or self-employed.

Tips for Maximizing Your Retirement Pension Benefits

There are several ways to maximize your pension benefits and ensure that you get the most out of them. Here are a few tips to keep in mind:

- Make sure to pay your SSS contributions regularly and on time.

- Choose the monthly installment option if you plan to use your pension as a regular source of income after retirement.

- Increase your estimated salary at retirement to get a higher benefit amount. This will require some careful financial planning and research to make sure that it is realistic and achievable.

- Consider investing your pension funds in high-yield investments that can generate additional income.

With these tips, you can be sure to make the most out of your SSS Retirement Pension Benefits and ensure a comfortable retirement life. It is important to remember that accurately calculating and receiving the amount due to you is just as important as investing wisely with it.

Frequently Asked Questions

1. Who is eligible for SSS Retirement Pension Benefits?

A. Those who have paid at least 120 monthly contributions to the Social Security System and are at least 60 years old, regardless of gender. Self-employed individuals with sufficient total payments are also eligible.

2. How much can I receive in SSS Retirement Pension Benefits?

A. The amount of your SSS Retirement Pension Benefit depends on the total number of monthly contributions you have paid, as well as the current contribution rate.

3. How do I receive my SSS Retirement Pension Benefits?

A. Your SSS Retirement Pension Benefits will be electronically credited to preferred bank accounts that you set up with the SSS.

4. What if I am still working?

A. If you are still employed, you can still receive your SSS Retirement Pension Benefits as long as you meet the eligibility requirements. However, you should note that some employers may require you to terminate your employment before receiving benefits.

5. Can I opt out of receiving my SSS Retirement Pension Benefits?

A. No, once you have filed for your SSS Retirement Pension Benefits, you cannot opt out or change your decision. You are required to receive the pension benefits that you are entitled to, even if it is lower than what you originally expected.

Summary

Knowing your SSS retirement pension benefits ahead of time offers a degree of control and peace of mind that many people seek in their retirement years. By taking the effort to properly research and understand the different types of benefits available through Social Security, individuals can plan for their future more effectively and allocate their income accordingly. Having informed knowledge about potential sources of retirement income also helps people ensure they take full advantage of all their benefits, such as lifetime annuities and death benefits for spouses.

Knowing your SSS retirement pension ahead of time also opens up a variety of avenues for controlling life assets, such as implementing tax strategies or investing to boost savings. Having access to this knowledge prior to or early in your retirement period will allow you to make decisions with greater confidence and without any unwelcome surprises down the line.

Contact Information

Customer Service: 1-800-10-2255777

Email: member_relations@sss.gov.ph

Website: https://member.sss.gov.ph/members/