One of the benefits of being an SSS member is that you get to apply for loans. Whether you are self-employed, voluntary, or an employed member, you can definitely avail of the said privileges. In this article, we summarized the basic steps on how you can get a loan from SSS.

Also Read: How to File for SSS Unemployment Benefit

This is so you can maximize the uses of your SSS contributions and give solutions to your financial needs. We hope that this blog will serve as your simple guide in getting your loan from the SSS.

Step by Step Loan Application Process in SSS Cebu

Now that you have a gist of why an SSS salary loan is a good alternative and the qualifications of a borrower, let’s get to the main loan application process.

Step 1: Prepare the documents needed.

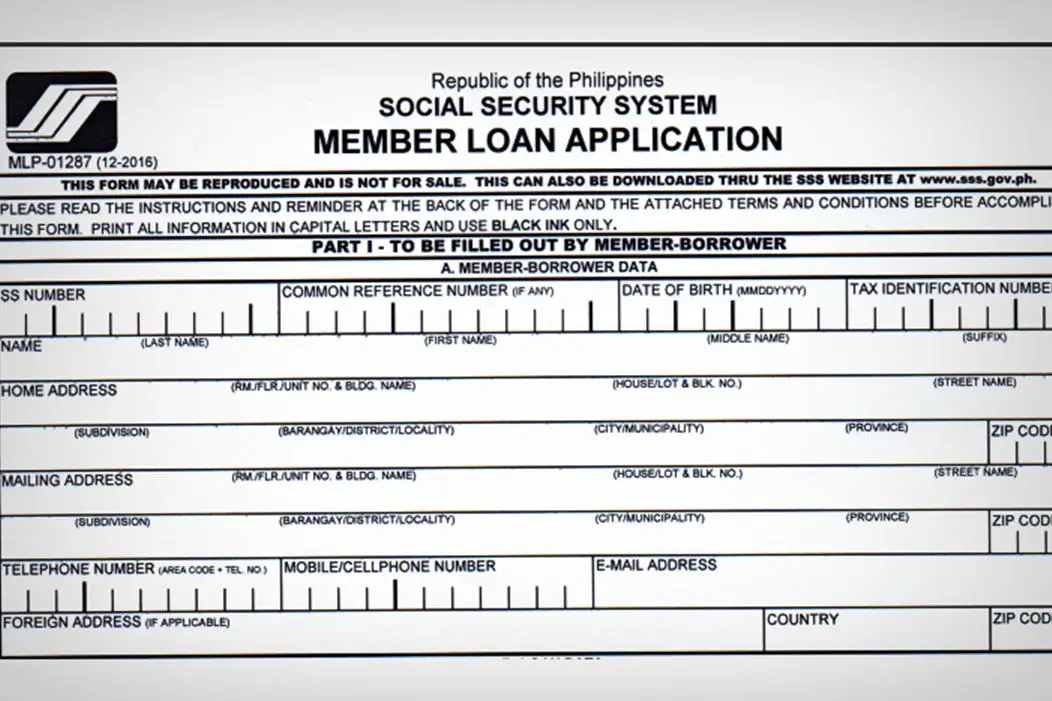

When you apply for an SSS loan, you will need an application form and two valid IDs. These are what you need to submit to the branch. You may download the documents from the website of SSS or ask for the form when you get to the branch.

Step 2: Talk to your HR or go to the nearest SSS branch.

If you are employed, you don’t have to go to the nearest SSS branch. You just need to talk to your HR to tell them that you are applying for a loan from SSS. From there, your employer will process the application. You need to give your accomplished application form to your employer so they can do push through with the process.

Your employer needs to have his/her authorized company representative (ACR) card issued by SSS and a letter of authority.

Step 3: Wait for your loan to get approved.

Once you’ve submitted your application, wait for it to get approved. It takes 7-14 days before a loan application is approved or rejected. You can create your SSS online account via member.sss.gov.ph so you can check the status of your loan.

Step 4: Wait for your check.

After your loan gets approved, you will receive a check from SSS through your employer. It normally takes 2-3 weeks before the check arrives. However, in some circumstances, it could take at least a month, especially if you apply for it during December where there are many holidays.

SSS salary loan comes in a check, which you will need to encash before you can use it.

Step 5: Encash your check.

SSS loan checks are encashed in Landbank. After receiving your check, you need to go to a Landbank branch to convert your check into cash. Just tell the bank cashier that you are going to encash the check and he/she will give you the instruction. Normally, it doesn’t take an hour to process the encashment, unless you need to line up and wait until your turn in the counter.

Why loan from SSS?

Here are some of the reasons of applying for a loan at SSS:

1. Easy application

One of the ultimate reasons why loaning from SSS is a nice option is because it’s easier to apply in this agency than in banks and other financial institutions. If you need money for emergency purposes, you can get it easily from SSS by simply providing requirements that are easy to complete.

2. Low interest

Another reason why it’s good to loan from SSS is that the interest is lower compared to other financial institutions that charge more than 10% interest in a year. SSS only charges 10% per annum. So if you are trying to budget your income, you will only set aside 10% of the amount you loan so you can pay your salary loan within a year without being burdened by the interest.

3. No complex requirements

Third, the requirements are easy to comply with. Employees find it easy to get a salary loan from SSS because they just need to talk to their HR so that the company can work on the application. There’s no complex requirement when loaning from SSS. You can easily provide them, which makes the whole process a lot easier.

4. SSS allows you to loan from time to time

SSS is generous to borrowers as it allows them to borrow money from time to time. Once you’ve paid half of your loan, you can get a new loan from the agency already. So, for example, if you have P18,000 loan and you’ve paid P9,000 already, you can get another P18,000 to borrow from the SSS.

5. Your loan depends on the amount of your salary

When you loan from the SSS, the agency computes the amount you can borrow from your salary. This is a good reason to loan from this agency because you only get to borrow the amount you can pay. If you are not good at budget management, you will sometimes try to borrow a loan that is beyond your capability to pay. One good thing about SSS is that they only let you borrow what you can afford.

Who can loan from SSS?

All current members of this agency can loan, whether you are employed, self-employed, or voluntary. You need to have contributions when you borrow money from SSS. One instance is when you borrow a month salary loan. This type of loan requires you to have at least 36 posted monthly contributions and 6 of which should be within the last 12 months prior to submitting your loan application.

Meanwhile, when you apply for a 2-month salary loan, you should have at least 72 posted monthly contributions and 6 of which should be within the last 12 months prior to submitting your loan application. If you are currently employed, your employer needs to be updated in contributing to your account.

Another qualification, so you can apply for a salary loan, is when your final benefit has not been granted. These final benefits include retirement, death, and total permanent disability.

You should also be under 65 years old when you apply for the loan. Those who have not been disqualified due to fraud against SSS have high chances of getting approved.

Getting your loan from SSS is simple and easy as long as you meet the requirements. Follow the instructions above to make it more convenient for you.