The Modified Pag-IBIG II (MP2) Savings is a unique savings scheme offered by the Pag-IBIG Fund. Specifically designed with a maturity period of five years, this program caters to Pag-IBIG Fund members who are eager to save additional funds and enjoy greater dividends. This is over and above the benefits, they already receive from their regular Pag-IBIG savings.

Also read: How to Make Pag-IBIG Payments Online

What sets the MP2 Savings apart is its inclusivity. Not only does it serve active members, but it also extends its advantages to pensioners and retirees, as long as they were once Pag-IBIG Fund members. Essentially, the MP2 Savings program provides an effective savings platform for a broad spectrum of individuals, helping them optimize their savings and secure their financial future.

Benefits of Pag-IBIG MP2 Savings

The Modified Pag-IBIG II (MP2) Savings program offers numerous benefits to members, making it an attractive savings option. Here are some of the key advantages:

- Easy and Affordable Savings: With a minimum requirement of only P500 per remittance, the MP2 Savings program makes it easy for members to start saving. This low entry point makes it accessible to a wide range of income earners.

- Higher Dividend Rates: MP2 Savings earn higher dividends compared to the regular Pag-IBIG savings. This allows members to grow their savings more quickly and efficiently.

- Tax-Free Dividends: One of the significant advantages of the MP2 Savings program is that dividends are tax-free. This means members get to enjoy the full benefit of their savings without any deductions.

- Option for Annual Withdrawal or Lump Sum Collection: Members have the flexibility to withdraw their dividends annually or wait until the end of the 5-year maturity period. This gives members control over their savings and how they wish to use them.

- Government-Guaranteed: The safety of your investment is assured as all MP2 Savings are fully guaranteed by the Philippine government. This provides members with peace of mind knowing their savings are secure.

The MP2 Savings program offers a simple, high-yield, and secure way for Pag-IBIG Fund members to save for their future.

Who Can Save in Pag-IBIG MP2?

The Modified Pag-IBIG II (MP2) Savings program is designed to be accessible to a wide range of individuals. Here’s who can save in the MP2 Savings:

a. Active Pag-IBIG Fund Members

- Any active member with at least one monthly savings (contribution) within the last six months is eligible to participate in the MP2 Savings program.

b. Former Pag-IBIG Fund Members

- Even if you’re no longer an active member, as a pensioner or retiree, you can still save with the MP2 Savings program. This is applicable as long as you have other sources of monthly income, regardless of age, and have made at least 24 monthly savings prior to retirement.

c. Natural-Born Filipinos

- If you are a natural-born Filipino who has reacquired your Filipino citizenship under RA 9225 or the Citizenship Retention and Reacquisition Act of 2003, you’re also eligible. However, you must have made at least 24 monthly savings prior to permanently migrating to another country.

In essence, the MP2 Savings program provides an opportunity for both active and former members, as well as natural-born Filipinos living abroad, to grow their savings and secure their financial future.

How to Open an MP2 Savings Account

There are two ways to enroll in the Pag-IBIG MP2 Savings Program – online and branch enrollment:

a. Online Enrollment

1. Visit the Virtual Pag-IBIG MP2 enrollment website.

2. Input your Pag-IBIG Membership ID (MID) number and personal details.

3. Enter the provided “CAPTCHA code” and select “Submit.”

4. Specify your preferred monthly contribution amount.

5. Select your preferences for:

- Dividend payout

- Mode of payment

- Source of funds

6. Click on “Submit.”

7. An enrollment form with your 12-digit MP2 savings account number will be displayed. It’s recommended to save this as a PDF or print it out for future reference.

b. Branch Enrollment

- Visit a Pag-IBIG branch in your vicinity.

- Obtain an MP2 Enrollment Form from the Pag-IBIG officer or download it from the official Pag-IBIG website.

- Fill out the MP2 Enrollment Form with your personal details, including your Pag-IBIG MID number.

- Specify your desired monthly contribution amount.

- Indicate your choices for the dividend payout and mode of payment.

- Hand over the filled-out form along with the necessary documents such as:

- A photocopy of a valid government-issued ID (like passport, SSS ID or UMID, etc.)

- Proof of income (like payslip, employment certificate, etc.)

7. Make the initial contribution as directed by the Pag-IBIG officer.

8. Keep a copy of your MP2 Enrollment Form and the receipt as evidence of enrollment.

Please note that specific Pag-IBIG MP2 requirements and processes may differ from branch to branch, so it is advisable to verify them with your nearest branch.

What is the Process for Saving Money in an MP2 Savings Account

Saving in the MP2 Savings program is easy and convenient, thanks to several available options.

a. Salary Deduction

If you’re employed, your employer can deduct your monthly MP2 savings from your salary and remit it to the Pag-IBIG Fund.

b. Online Remittance

You can make contributions online through:

- Virtual Pag-IBIG: Visit www.pagibigfundservices.com/virtualpagibig and make payments using PayMaya eWallet, GCash eWallet, or any debit or credit card powered by Visa, Mastercard, or JCB.

- Authorized Online Payment Channels: These include GCash, Moneygment App via Cashpinas, Coins.ph via Bayad, and PayMaya.

c. Over-the-counter (OTC) Remittance

You can also pay at:

- Any Pag-IBIG Fund branch.

- Authorized collecting partners’ outlets or branches in the Philippines, including Asia United Bank, Robinsons Bank, United Coconut Planters’ Bank, SM Business Centers, Bayad, M. Lhuillier, and ECPay accredited merchants.

- Authorized collecting partners’ outlets or branches overseas, such as Philippine National Bank, Asia United Bank, IRemit powered merchants, Ventaja powered merchants, and Cashpinas powered merchants.

These multiple payment options provide flexibility and convenience, making it easier for members to save regularly in the MP2 Savings program.

MP2 Savings Dividends Distribution

The MP2 Savings program offers flexible options for receiving your dividends.

Here’s when and how you can expect your dividends:

- Upon Full Withdrawal: After the 5-year maturity period of your MP2 Savings, you can withdraw your savings along with the compounded annual dividends. This allows your money to grow significantly over the five years.

- Annual Pay-out: If you prefer to receive your dividends yearly, they can be credited to your savings or checking account enrolled in any of Pag-IBIG Fund’s accredited banks. This way, you can enjoy your earnings annually while the principal amount continues to earn dividends.

- Check Release for Overseas Members: For members who choose an annual dividend payout but do not have a Philippine bank account, such as overseas members, their MP2 Savings Dividends will be released via check.

These options provide flexibility to members to choose the dividend distribution method that best suits their financial needs and circumstances.

MP2 Savings Limit

The Modified Pag-IBIG II (MP2) Savings Program does not have a maximum limit on the amount you can save. You are free to save as much as you want.

However, there are certain requirements for large savings:

- For One-Time Savings Exceeding PHP 500,000: If you decide to make a one-time savings that exceeds PHP 500,000, you will be required to remit this amount via personal or Manager’s Check.

- For MP2 Savings Over PHP 100,000: If your MP2 Savings exceed PHP 100,000, you will be required to submit proof of income or source/s of funds. The checklist for the required documents can be found in the MP2 Savings Enrollment Form, which you can download HERE.

These measures are in place to ensure the integrity and security of transactions involving significant amounts.

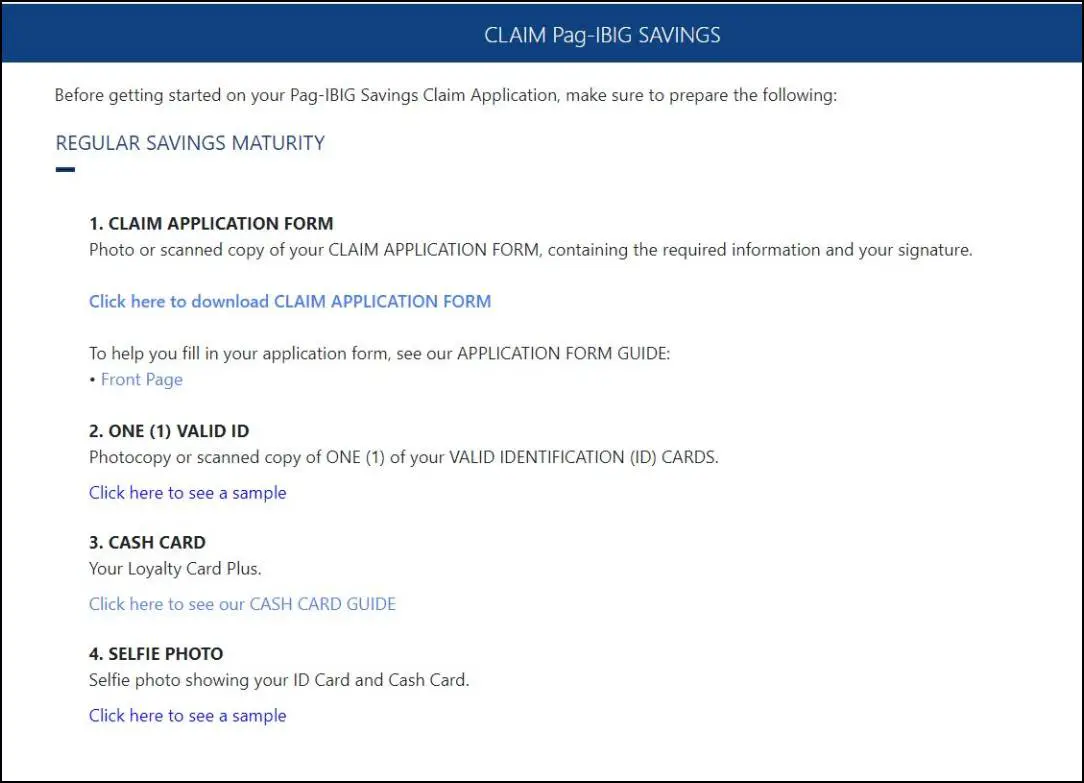

How to Claim MP2 Savings

Claiming your MP2 Savings after its 5-year maturity period is a simple process that can be done either online or over-the-counter. Here’s how:

a. Online Claims

- Visit the Virtual Pag-IBIG website by clicking on this link: Virtual Pag-IBIG

- Follow the instructions provided on the page to claim your MP2 Savings.

b. Over-the-Counter Claims

- Download and fill out the Application for Provident Benefits (APB) form from this link: Application for Provident Benefits Form.

- Submit the completed form to the nearest Pag-IBIG Fund branch.

Both methods are designed to provide convenience and ease in claiming your MP2 Savings. Remember, you can only claim your savings after the 5-year maturity period.

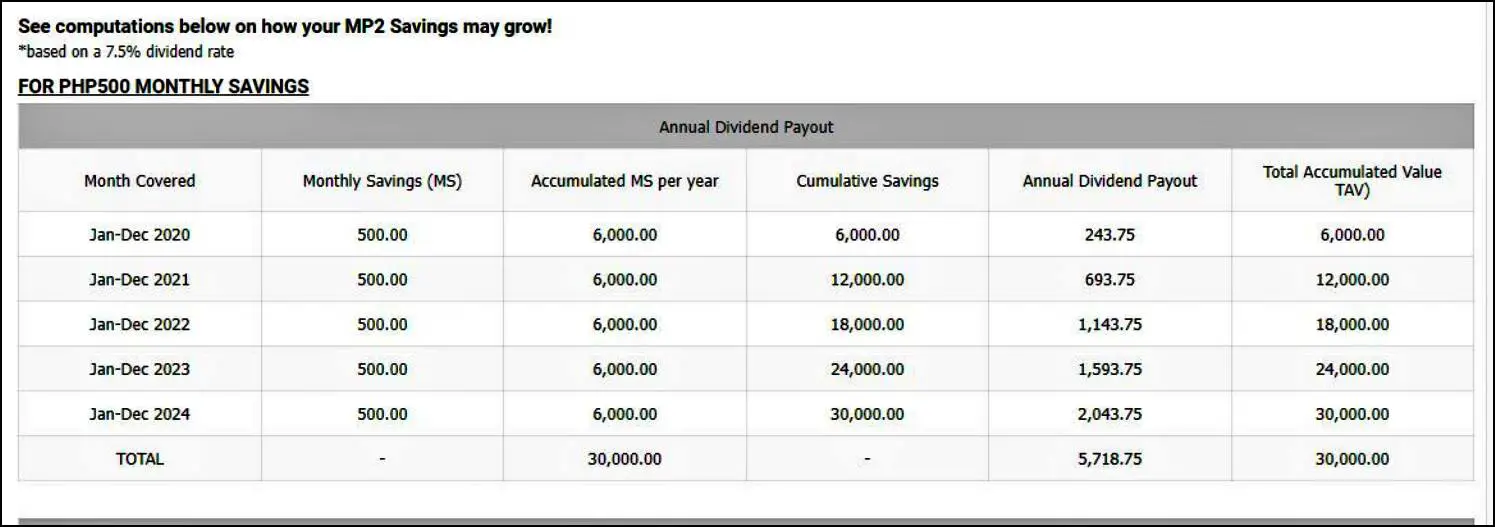

Expected Dividends on MP2 Savings

The dividends you earn on your MP2 Savings are derived from at least 70% of the Pag-IBIG Fund’s annual net income. The exact amount you can expect to earn depends on the dividend rate for that year.

For example, in 2022, the dividend rate was at 7.03%. This means if you had saved PHP 100,000 in your MP2 account, you would have earned PHP 7,030 in dividends for that year.

Please note that the dividend rate can fluctuate each year based on the fund’s performance. It’s also important to remember that the higher your savings, the more dividends you can potentially earn.

Early Withdrawal of MP2 Savings: What is the Process?

You can pre-terminate and withdraw your MP2 Savings before its 5-year maturity but only under certain conditions:

a. For Active Pag-IBIG Members

You can withdraw if you experience:

- Total disability or insanity

- Termination from employment due to health reasons

- Retirement

- Permanent migration to another country

- Unemployment due to layoff or company closure

- OFW repatriation from the host country

- Death (In this case, the MP2 Savings will be received by the member’s beneficiaries)

- Critical illness of the MP2 account holder or an immediate family member, as certified by a licensed physician and approved by Pag-IBIG Fund

- Other meritorious grounds as approved by the Pag-IBIG Fund Board of Trustees

b. For Retirees and/or Pensioners

The conditions are similar to those for active members, including total disability, death, critical illness, or other reasons approved by the Pag-IBIG Fund Board of Trustees.

c. For Members with Compounded Dividend Payout on their MP2 Savings

You can withdraw your principal MP2 Savings and 50% of the total dividends earned from prior years. Additionally, 50% of the dividends for the current year can be released after they have been declared and credited.

d. For MP2 Savings with Annual Dividend Payouts

You can withdraw your principal MP2 Savings, but 50% of the total dividends received from prior years will be deducted from the proceeds. Moreover, 50% of the dividends for the current year can be released after they have been declared and credited.

Also read: How to Apply for a Housing Loan from Pag-IBIG?

Tips to Maximize Your Savings Through MP2

- Start Early: The sooner you start saving, the more time your money has to grow. The power of compound interest can significantly increase your savings over time.

- Regular Contributions: Consistency is key in any savings plan. Make it a habit to regularly contribute to your MP2 Savings. Even small, regular contributions can add up over time.

- Maximize Your Contributions: While the minimum contribution is PHP 500 per remittance, consider contributing more if your budget allows. There’s no maximum limit to how much you can save in the MP2 program, and higher contributions mean higher dividends.

- Lump Sum Investment: If you have a large amount of money that you don’t immediately need, consider making a lump sum investment in your MP2 account. This money will then earn dividends for the next five years.

- Reinvest Your Dividends: If you choose the compounded savings scheme, your annual dividends will be reinvested and will also earn dividends, maximizing your earnings.

- Open Multiple MP2 Accounts: You can open multiple MP2 accounts and set different goals for each. For example, one could be for retirement, another for a future home down payment, etc.

- Leave Your Savings Until Maturity: To maximize your dividends, avoid prematurely withdrawing your savings unless absolutely necessary. Remember, the MP2 program is designed as a 5-year savings plan.

- Enroll in Automatic Savings: Consider setting up an automatic savings plan where contributions to your MP2 account are automatically deducted from your salary or bank account. This ensures that you never forget to save.

- Monitor Your Savings: Regularly check your MP2 account through Virtual Pag-IBIG to monitor your savings growth and ensure that your contributions are correctly credited.

- Secure Your Future: After the 5-year maturity period of your MP2 account, consider opening a new one. This way, you’re continuously building your savings for a secure financial future.

Remember, the key to maximizing your savings is discipline, consistency, and patience. Happy saving!

VIDEO: How to Invest in Pag-IBIG MP2 for Students, OFWs, and Beginners 2021 | Why Invest in MP2 | START NOW!

Watch this video to learn why you should start investing in Pag-IBIG MP2! Learn about the benefits of Pag-IBIG MP2, how to begin investing, and why it’s a great option for beginners, OFWs, and students.

Frequently Asked Questions

1. What is the Modified Pag-IBIG 2 or MP2 Savings?

A: The Modified Pag-IBIG II (MP2) Savings Program is a voluntary savings scheme with a 5-year maturity period. It is designed for active Pag-IBIG Fund members who want to save more and earn higher dividends beyond their Regular Pag-IBIG Savings.

2. Is there a minimum amount I should save in the MP2 Savings?

A: Yes, the minimum contribution to the MP2 Savings is PHP 500 per remittance.

3. Can I remit a one-time lump sum amount for the MP2 Savings 5-year period?

A: Yes, you have the option to make a one-time lump sum payment for the entire 5-year duration of your MP2 Savings.

4. Can I open more than one MP2 Savings Account?

A: Yes, you are allowed to open and maintain multiple MP2 Savings accounts.

5. Can I view my MP2 Savings records online?

A: Absolutely! You can access and view your MP2 Savings, including your annual dividends, online through Virtual Pag-IBIG.

6. Where does Pag-IBIG Fund invest my money?

A: The Pag-IBIG Fund invests at least 70% of its investible funds in housing finance as mandated by its Charter. The remaining funds are invested in government securities and corporate bonds.

7. Can I change my dividend payout mode before the maturity of my MP2 Savings?

A: No. The dividend payout mode you selected upon enrolling in the MP2 Savings program cannot be changed during the 5-year savings period. However, you can open another MP2 Savings account and select a different dividend payout mode for that account.

8. Are my MP2 Savings guaranteed?

A: Yes, your MP2 Savings are guaranteed by the government. However, the annual dividends depend on the financial performance of the Pag-IBIG Fund.

9. What will happen to my MP2 Savings if they are not claimed after maturity?

A: If your MP2 Savings remain unclaimed after the 5-year maturity period, they will stop earning dividends at the MP2 rate. Instead, they will earn dividends based on the Pag-IBIG Regular Savings rate for the next 2 years. After that, they will no longer earn dividends.

10. Can I re-apply for a new MP2 Savings account once it matures?

A: Yes, once your MP2 Savings mature after the 5-year period, you can re-apply for a new MP2 Savings account.

Summary

Pag-IBIG MP2 Savings is an excellent opportunity for members to invest wisely and earn bigger returns. It offers a 5-year maturity and is a special savings facility for those who wish to save more than just their regular savings. With this program, members can earn even higher dividends, making it an attractive investment option. Even retirees and pensioners who were former Pag-IBIG Fund members can benefit from the MP2 Savings program.

Investing in Pag-IBIG MP2 Savings is a smart financial move that can help you build a stronger financial future. Learn more about this exciting investment opportunity, and start investing for your future today!

Contact Information

Website: pagibigfund.gov.ph

Phone: 02 8724 4244

Email: contactus@pagibigfund.gov.ph

Facebook Page: https://www.facebook.com/PagIBIGFundOfficialPage