If you are a member of the Social Security System (SSS) in the Philippines, you might already be familiar with the SSS UMID (Unified Multi-Purpose ID) card. This government-issued card serves multiple purposes – it’s an identification card and an SSS ID. However, there’s an opportunity to further optimize this card by upgrading to the SSS UMID ATM Pay Card.

Also read: How to Register an SSS Account Online

The UMID Pay Card is linked to a regular savings account with UnionBank. It serves as a valid government-issued ID and disbursement account for SSS benefits, loans, and refunds. This means that instead of going through the traditional method of receiving benefits or loan proceeds through checks or direct deposit, members can now receive them directly through their UMID ATM Pay Card.

In addition to its primary function as an ID and ATM card, the UMID Pay Card also allows for cashless payments at retail and online outlets. Moreover, it provides 24/7 access to funds either through ATM withdrawal or online bank transfer. This upgrade aims to streamline the process of receiving and managing SSS benefits, thus making the system more efficient and user-friendly for members.

Benefits of the New SSS UMID Pay Card

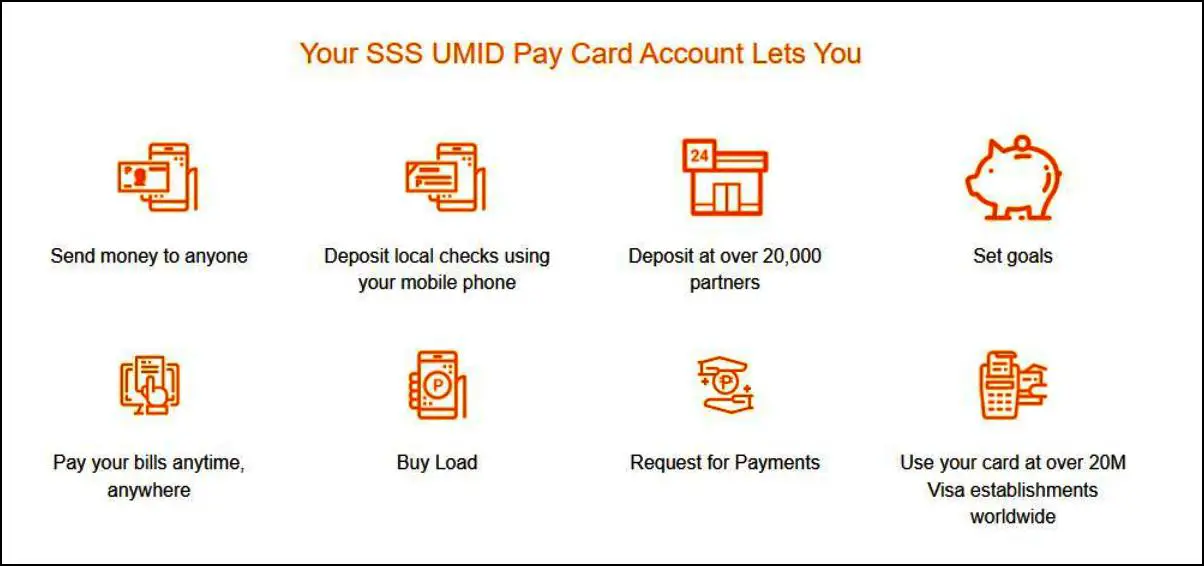

The new SSS UMID Pay Card Account offers several benefits to its holders:

- Convenience: The card serves both as an identification card and an ATM debit card, eliminating the need to carry multiple cards.

- Direct Disbursement: Benefits, loans, and refunds from SSS are directly deposited into your UMID Pay Card Account, ensuring a secure and efficient disbursement process.

- Cashless Transactions: The card can be used for cashless payments at various retail and online outlets, making transactions quick and hassle-free.

- 24/7 Access: You can access your funds anytime, anywhere through ATMs or online bank transfers. This provides flexibility and control over your finances.

- Government ID: The card is recognized as a valid government ID, which can be useful in various transactions requiring identification.

- Free Upgrade: For members who applied for a generic UMID Card and have pending applications, the upgrade to a UMID ATM Pay Card is free.

Remember to always keep your card safe and secure to protect your personal information and funds.

How to Get SSS UMID Card or SSS ID Online

Applying for a UMID Card or SSS ID online involves several steps.

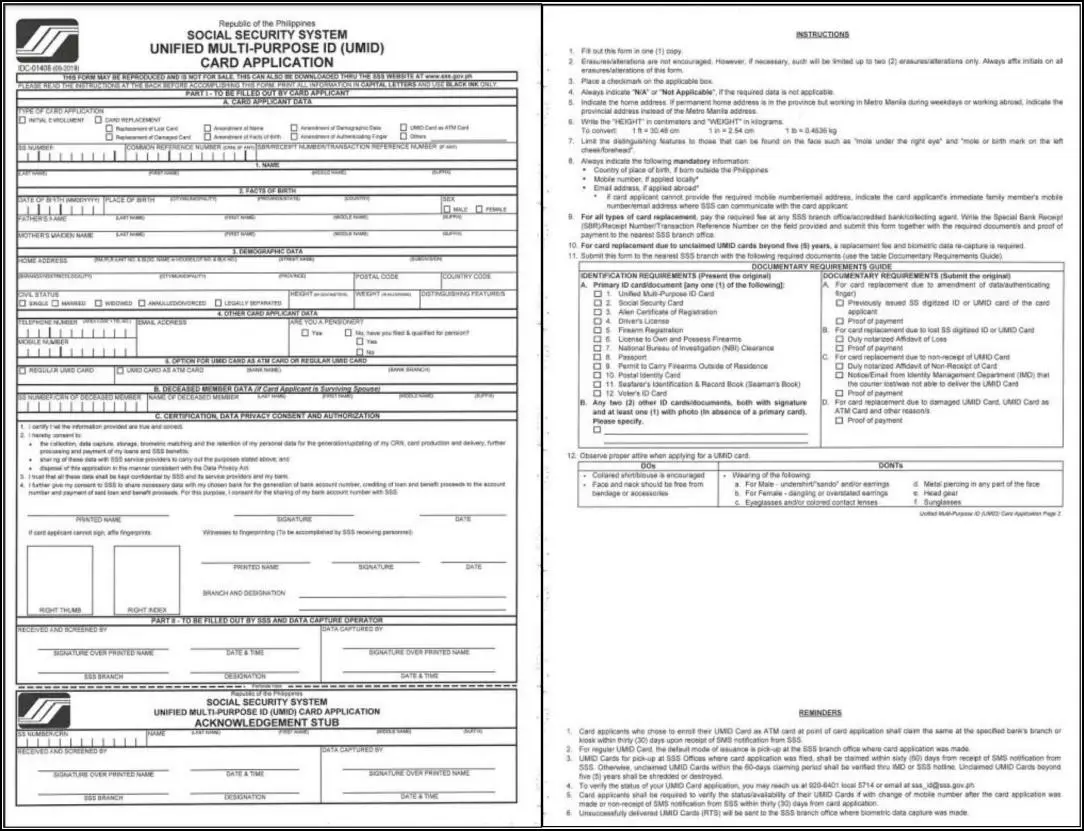

Step 1: Download and Print the UMID Application Form

- The first step is to download the UMID application form from the official SSS website. Once downloaded, print out the form.

Here’s the sample form:

Step 2: Fill Out the UMID Application Form

- After printing the form, fill it out with the necessary details. Make sure that all the information provided is accurate to avoid any issues later on.

Step 3: Schedule an Online Appointment with the SSS

- Before heading to the SSS branch, schedule an appointment online through the SSS portal. This will help you save time and ensure a smooth process when you visit the branch.

Step 4: Visit the SSS Branch for the Appointment

- On the day of your appointment, go to the designated SSS branch. Remember to bring along the filled-out UMID application form and other necessary identification documents.

Please note that while the initial steps can be done online, the actual submission of the form and capturing of biometric data (photo, fingerprints, and electronic signature) will need to be done in person at an SSS branch.

Also read: How to Check SSS Outstanding Loan Balance Online

How to Upgrade SSS UMID Card to the New SSS UMID Pay Card Account?

Upgrading your SSS UMID card to the new SSS UMID Pay Card Account is a straightforward process. Here are the steps:

Step 1: My.SSS Account

- Begin by logging into your My.SSS Member account. If you don’t have an account yet, you can create one at sss.gov.ph. It’s crucial that all your information recorded with SSS is accurate and updated.

Step 2: Consent for Data Sharing

- Once logged into your My.SSS account, navigate to the “E-Services” menu. Here, you’ll need to give consent for sharing your UMID Application Data with UnionBank.

Step 3: UnionBank Mobile App

- Download the UnionBank mobile app from the AppStore or PlayStore. Use this app to open a UMID ATM Pay Card account.

Step 4: Opening the Account

- During the account opening process, you’ll be asked to enter a Transaction ID and other required information. Ensure all the details you provide match those in your My.SSS account.

Step 5: Card Delivery

- After successfully opening the account, your new SSS UMID ATM Pay Card Account will be delivered to your address. The delivery time is approximately fifteen (15) banking days for Metro Manila addresses and twenty (20) banking days for provincial addresses.

Step 6: Card Activation

- Upon receiving the card, activate it and set up a Personal Identification Number (PIN) using the UnionBank Mobile App.

By following these steps, you can seamlessly upgrade your SSS UMID card to the new SSS UMID Pay Card Account.

Features of Upgraded SSS UMID Pay Card Account

Also read: How to Apply SSS Maternity Benefit Online: A Step-by-Step Guide

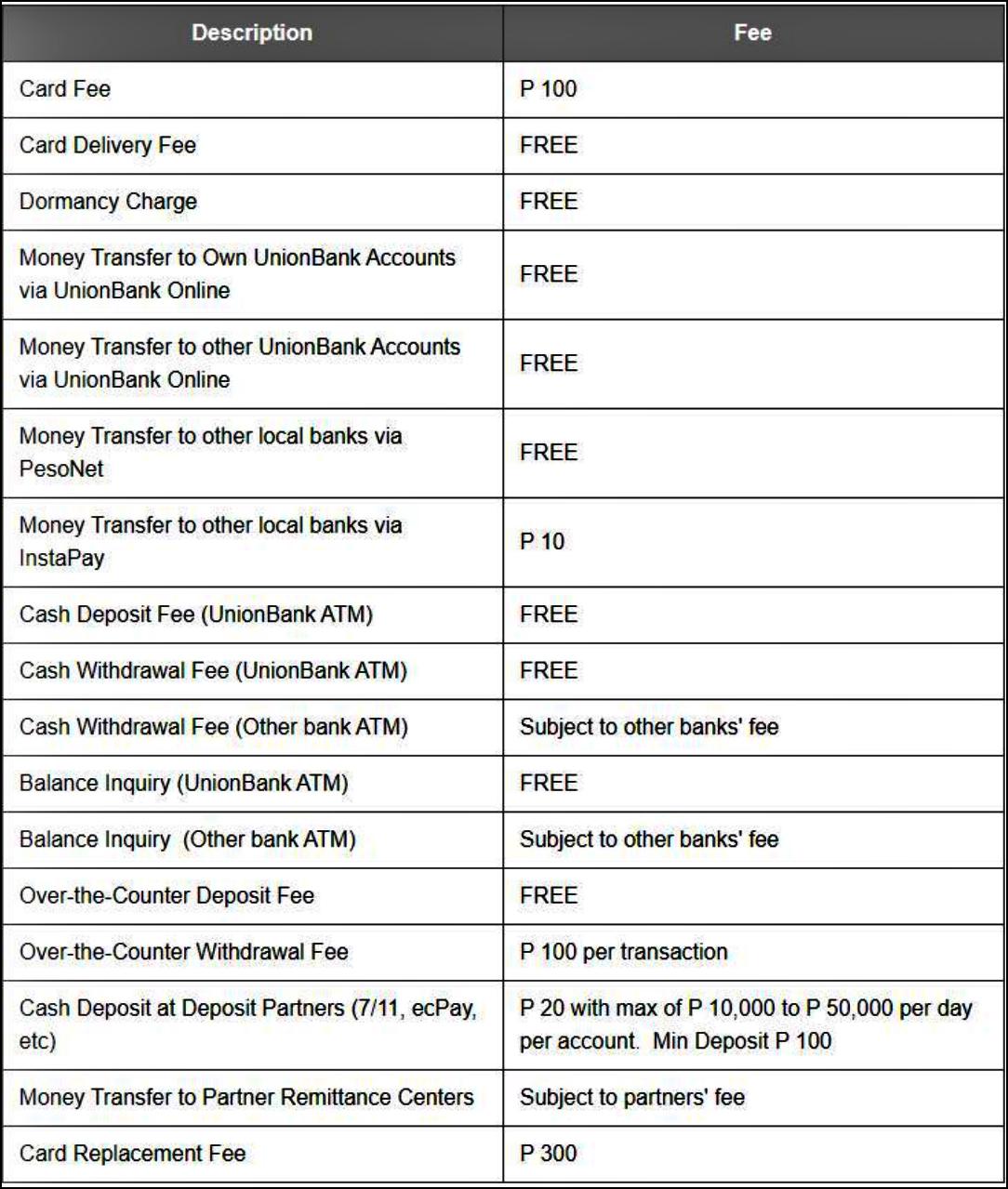

Fee’s and Charges

Video: How to upgrade SSS UMID ID to UMID ATM PAY CARD online | Upgrade UMID ATM Pay card for free

Frequently Asked Questions

1. What is the SSS UMID Pay Card Account?

A: The SSS UMID Pay Card Account is a fusion of an SSS UMID card and an ATM debit card. It serves both as a valid identification card and a means to access and manage your funds.

2. Can I utilize the UnionBank Online App while waiting for the card?

A: Yes, once your account has been set up and you’ve registered for UnionBank online, you can immediately take advantage of all the features the app offers, even before receiving your physical card.

3. What functions does the UMID ATM card serve?

A: The UMID ATM Pay Card acts as an identification card and a debit card. It allows direct receipt of SSS loans, claim proceeds, and refunds in a secure manner. Additionally, it provides cashless transaction capabilities at various retail and online outlets and 24/7 access to your funds via ATM or online bank transfer.

4. What is the cost for replacing an SSS UMID card?

A: If your SSS UMID Card is lost or damaged, you can get a replacement by submitting the necessary requirements and paying a fee of ₱200 at your nearest SSS branch.

5. What is the lifespan of a UMID ID?

A: The UMID ID does not expire and remains valid throughout your lifetime. According to SSS, the UMID card should be delivered within 30 days after application. If you need to replace or change your UMID, a replacement fee of Php 200 is required.

Summary

Switching to SSS UMID ATM Pay Card is a smart move for those who want to simplify their banking experience. With this card, you can enjoy the benefits of an SSS UMID Pay Card Account and an ATM debit card all in one. The process of upgrading is straightforward and effortless. Some of the benefits of having this card include the ability to check your SSS contributions, withdraw cash from ATMs nationwide, and transfer funds online or through mobile banking.

Additionally, you get to enjoy the convenience of not carrying multiple cards for your SSS transactions and daily expenses. Upgrading to an SSS UMID ATM Pay Card is a smart financial decision that can improve the way you manage your account.

Contact Information

Customer Service: 1-800-10-2255777

Email: member_relations@sss.gov.ph

Website: https://member.sss.gov.ph/members/