The Philippine Health Insurance Corporation, more commonly known as PhilHealth, is a government-owned corporation that provides affordable and accessible healthcare services for Filipinos. It’s an integral part of the country’s healthcare system, offering financial assistance to members in times of medical need.

Also read: How to Create PhilHealth Account Online

One of the key benefits it offers is coverage for hospital bills, which can significantly reduce the financial burden on patients and their families. This coverage includes a wide range of services, from inpatient care and surgeries to maternity care and treatments for specific illnesses.

PhilHealth provides benefits for individuals who require hospitalization. Members can use their inpatient benefits at any PhilHealth-accredited healthcare institution. The corresponding case rate will be deducted from the member’s total bill before discharge.

Eligibility for PhilHealth Benefits

To be eligible for PhilHealth benefits, members must meet certain criteria related to their contribution history and current membership status.

Here’s a basic rundown of the eligibility requirements:

- Regularity of Payment: To be eligible for PhilHealth benefits, a member needs to have paid their monthly premiums for at least three (3) months within the six (6) months prior to their hospitalization.

- Membership Status: All types of members (employed, self-employed, lifetime, senior citizen, etc.) are eligible for benefits as long as they meet the regularity of payment requirement.

- Foreign Nationals: Foreign nationals residing or working in the Philippines are also eligible for coverage under the Lifetime Member Program of PhilHealth once they have reached the age of 60 and have made 120 monthly contributions.

- Dependents: Dependents of a PhilHealth member, such as legal spouse, children below 21 years old, and parents 60 years old and above, can also avail of PhilHealth benefits, given that the member meets the required contributions.

Please note that specific conditions or treatments may have additional eligibility requirements or limitations. It’s always best to check with PhilHealth or your healthcare provider to ensure you meet all the necessary criteria before availing of the benefits.

Inpatient and Outpatient PhilHealth Benefits

PhilHealth provides a wide array of benefits to its members to ensure that their healthcare needs are adequately covered.

1. Inpatient Benefits

- These cover a portion of the costs associated with hospitalization. The coverage includes room and board, medicines, laboratory exams, operating room use, and professional fees for physicians. The specific amount covered will depend on the illness or condition being treated.

2. Outpatient Benefits

- These include coverage for day surgeries, radiotherapy, hemodialysis, outpatient blood transfusion, and other similar procedures that do not require an overnight stay in a healthcare institution.

It’s important to note that the actual amount of coverage may vary depending on a variety of factors including the member’s contribution history, type of illness or condition, and the specific healthcare institution where treatment is received. Always check with PhilHealth or your healthcare provider to understand the specific benefits you are entitled to.

How to Use PhilHealth Benefits in Claiming Hospital Bills

Step 1: Check Eligibility Conditions

Before you can claim your PhilHealth benefits, you need to satisfy the following conditions:

- You must have paid at least three months’ worth of premiums within the immediate six months before confinement. For specific cases such as pregnancies, newborn care packages, dialysis, chemotherapy, radiotherapy, and selected surgical procedures, nine months’ worth of contributions in the last twelve months is required.

- Your confinement in an accredited hospital must be for a minimum of 24 hours due to an illness or disease that necessitates hospitalization. The attending physician(s) must also be PhilHealth accredited.

- Your claim must fall within the 45 days allowance for room and board.

Step 2: Prepare Required Documents

To get automatic deductions from your hospital bill, you’ll need to present the following documents before discharge:

- A clear, updated copy of your Member Data Record (MDR). If you’re a dependent, ensure your name is listed on the MDR.

- An original copy of PhilHealth Claim Form 1, obtainable from PhilHealth, the hospital, or your employer. Submit the original copy with your employer’s signature.

- Receipts of premium payments or, for employees, a Certificate of Premium Payments with OR numbers.

- Your PhilHealth ID and another valid identification.

If you’re unable to submit the claim form personally, prepare an authorization letter and a valid ID for your representative.

Step 3: Claiming and Post-Claim Process

Direct filing is no longer required. By submitting the necessary documents to the hospital prior to discharge, your benefits will be automatically deducted from your total bill.

After the deduction, PhilHealth will send a Benefit Payment Notice to the address listed in your MDR. This notice outlines the actual payments made by PhilHealth pertaining to your claim or confinement.

Make sure your PhilHealth contributions are up-to-date is crucial as it provides invaluable financial assistance should you or any of your dependents require hospitalization.

Also read: How to Add Dependents in PhilHealth

How PhilHealth Deduction is Calculated in a Hospital Bills

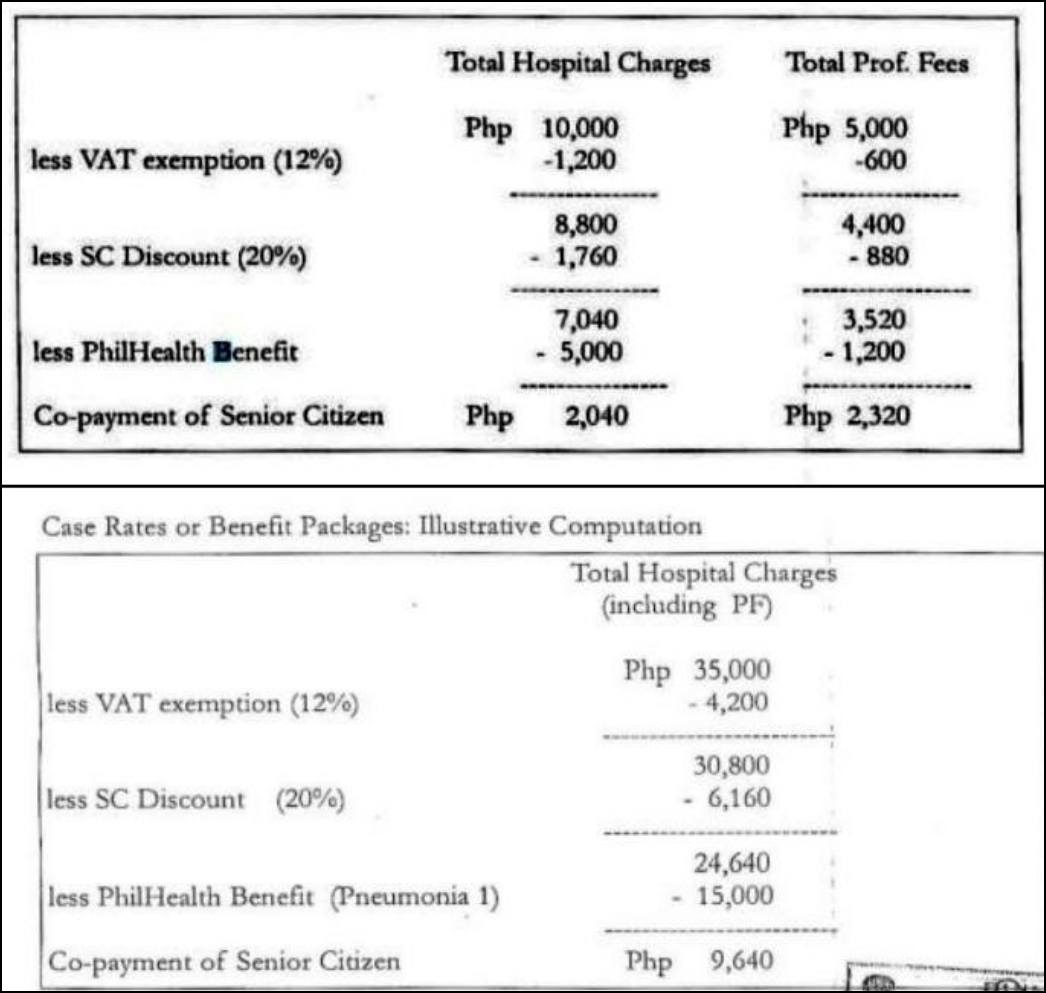

Calculating the PhilHealth deduction in your hospital bill involves a few steps, taking into account various factors such as VAT exemption and Senior Citizen Discount (SCD), if applicable.

Here’s a step-by-step breakdown of how it’s calculated:

- 12% VAT Exemption: The first step is to deduct the 12% VAT exemption from the total hospital charges. This applies if the patient is a senior citizen or a person with disability.

- 20% Senior Citizen Discount (SCD): If the patient is a senior citizen, a further 20% discount is deducted from the remaining amount after the VAT exemption.

- PhilHealth Benefit Deduction: Lastly, the PhilHealth benefit for the specific illness or condition (based on the case rate) is deducted from the remaining amount after the VAT exemption and SCD (if applicable).

Let’s illustrate this with an example:

Suppose the total hospital bill is PHP 100,000 and the patient is a senior citizen. The PhilHealth benefit for the patient’s specific condition is PHP 30,000.

- First, calculate the 12% VAT exemption: PHP 100,000 – 12% = PHP 88,000.

- Next, calculate the 20% SCD: PHP 88,000 – 20% = PHP 70,400.

- Finally, deduct the PhilHealth benefit: PHP 70,400 – PHP 30,000 = PHP 40,400.

So, the patient would be responsible for paying PHP 40,400 out of the original PHP 100,000 hospital bill.

Remember, this is a simplified example and actual calculations may vary based on individual circumstances. Always consult with your healthcare provider or PhilHealth for accurate information.

Also read: List of PhilHealth Offices and Branches in Cebu

Video: PhilHealth Inpatient Benefits: Alamin mo ang iyong benepisyo kapag na admit ka sa hospital.

Frequently Asked Questions

1. Can my dependents avail of my PhilHealth benefits?

A: Yes, legal dependents such as your legitimate spouse, children below 21 years old, parents above 60 years old, and siblings with disabilities can avail of your PhilHealth benefits.

2. How often can I use my PhilHealth benefits?

A: You can use your benefits as long as your hospitalization falls within the 45 days allowance for room and board per year.

3. Are there illnesses that are not covered by PhilHealth?

A: Most common illnesses are covered by PhilHealth. However, conditions considered as “non-compensable” or “exclusions” might not be covered. Always check with PhilHealth or your healthcare provider to understand the specific benefits you are entitled to.

4. What happens if the hospital does not deduct my PhilHealth benefits from my total bill?

A: If you’ve submitted all necessary documents and are eligible for benefits, but the hospital doesn’t deduct them from your bill, you can file a complaint with PhilHealth.

5. Can I avail of PhilHealth benefits if I am confined in a non-accredited hospital?

A: Only accredited healthcare institutions and professionals can provide PhilHealth benefits. It’s recommended to check the accreditation status of the hospital or healthcare professional prior to confinement.

6. What is the Benefit Payment Notice from PhilHealth?

A: The Benefit Payment Notice is a document sent by PhilHealth to members after their hospital stay, detailing the actual payments made by PhilHealth for their claim or confinement.

7. Can I use my PhilHealth benefits for outpatient procedures?

A: Yes, PhilHealth covers certain outpatient procedures such as day surgeries, radiotherapy, hemodialysis, and outpatient blood transfusion. Check with your healthcare provider or PhilHealth for specifics.

Summary

PhilHealth benefits can be a lifesaver when it comes to paying for inpatient hospital bills and other expenses related to hospitalization. The process of claiming these benefits can be quite overwhelming, but it’s important to know which benefits you’re entitled to receive and how to make the most out of them.

Inpatient hospitalization is one of the most common types of benefits covered by PhilHealth, and you can use these benefits to help cover the cost of treatment, hospital room, and other expenses. By taking the time to understand the ins and outs of PhilHealth benefits, you can ensure that you have the financial support you need to focus on getting better.

Contact Information

Website: philhealth.gov.ph

Facebook Page: https://www.facebook.com/PhilHealthOfficial/

Callback Channel: 0917-898-7442 (PHIC)

Email: actioncenter@philhealth.gov.ph