PhilHealth, or the Philippine Health Insurance Corporation, is a government-owned and controlled corporation responsible for administering the National Health Insurance Program in the Philippines. Its mission is to provide affordable and accessible healthcare services to all Filipino citizens, including those residing in Cebu.

Also read: How to Create PhilHealth Account Online

PhilHealth Cebu members have access to quality healthcare facilities and services across the province. It covers a wide range of medical services, such as inpatient care, outpatient care, maternity care, and other specialized packages. Members can avail themselves of these benefits at accredited hospitals and healthcare providers in Cebu.

Membership Categories

PhilHealth offers different membership categories to cater to the various sectors of the Philippine population.

The main membership categories are:

1. Employed Members

This category includes individuals who are employed in the government or private sector. Employers and employees share the responsibility for contributions, with employers remitting the payments to PhilHealth.

2. Self-employed Members

This category includes professionals, informal sector workers, and self-employed individuals who are not covered by formal employment. Self-employed members pay their contributions voluntarily, either monthly or quarterly.

3. Overseas Filipino Workers (OFWs)

This category covers Filipinos working abroad, including land-based and sea-based workers. OFWs can register and pay their contributions through accredited collecting agents, local PhilHealth offices, or online payment channels.

4. Indigent Members

This category includes low-income individuals and families identified by the Department of Social Welfare and Development (DSWD) as eligible for subsidized health insurance coverage. These members are enrolled in PhilHealth through the sponsorship of the national or local government.

5. Senior Citizens

Filipino citizens aged 60 years old and above, who are not part of any other membership category, are automatically enrolled as senior citizen members. They can avail of PhilHealth benefits without paying additional contributions, as their coverage is funded by the government through the Sin Tax Law.

6. Lifetime Members

Retired employees, both from the government and private sector, who have reached the age of retirement and have made at least 120 monthly contributions are eligible for lifetime membership. Lifetime members do not need to pay further contributions and can continue to enjoy PhilHealth benefits.

7. Sponsored Members

This category includes individuals and families sponsored by private corporations, non-government organizations, or government agencies that pay for their PhilHealth contributions. Sponsored members receive the same benefits as regularly paying members.

Each membership category has specific requirements and procedures for registration, contribution payments, and benefit availment. You can find more information on the PhilHealth website at https://www.philhealth.gov.ph/ or contact their Action Center Hotline at (02) 8441-7442.

Contribution Rates

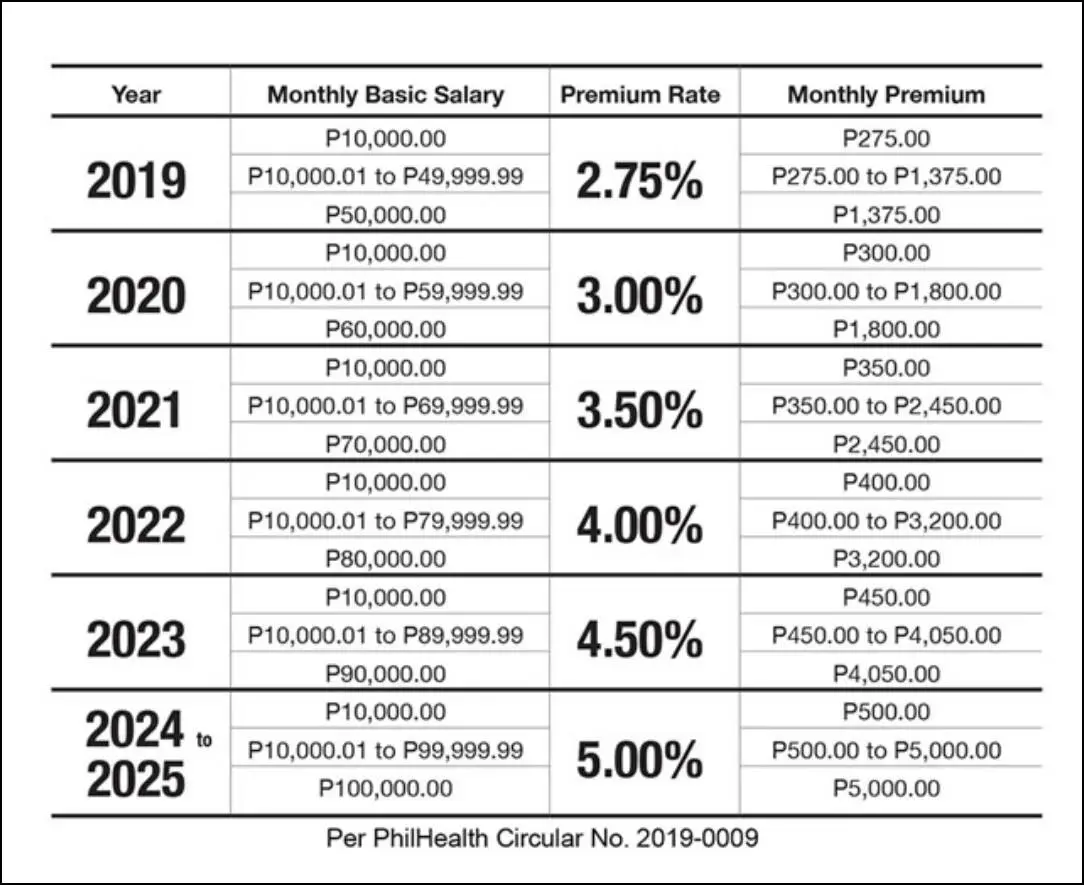

Here’s a summary of the contribution rates and payment schedules for different PhilHealth membership categories based on the Universal Health Care Law of 2019 and PhilHealth Circular No. 2019-0009:

1. Employed Members

The premium rate starts at 2.75% of monthly basic salary in 2019 and increases to 3% in 2020.

- The rate will gradually increase by 0.5% annually until it reaches 5% in 2025.

- Contributions are shared equally between the employee and employer.

- The income floor is fixed at PHP 10,000, and the salary ceiling increases by PHP 10,000 each year until it reaches PHP 100,000 in 2025.

- Payment schedule: Monthly, remitted by the employer

2. Self-employed Members & Practicing Professionals

- Same premium rate and schedule as employed members (2.75% in 2019, increasing to 5% by 2025)

- Premiums are computed based on their monthly earnings and must be paid in full by the member.

- Payment schedule: Quarterly or annually

3. Kasambahays

- Same premium rate and schedule as employed members

- Employers pay the full premiums, except when the monthly salary exceeds PHP 5,000, in which case the Kasambahay contributes an equal share.

- Payment schedule: Monthly, remitted by the employer

4. Overseas Filipino Workers (OFWs)

- Same premium rate and schedule as employed members

- Premiums are computed based on their monthly earnings and must be paid in full by the member.

- Payment schedule: Annually

5. Indigent Members

- No contributions are required, as coverage is subsidized by the national or local government.

6. Senior Citizens

- No contributions are required, as coverage is funded by the government through the Sin Tax Law.

7. Lifetime Members

- No contributions are required, as long as they have made at least 120 monthly contributions and reached the age of retirement.

8. Employed Persons with Disability (PWDs)

- Same premium rate and schedule as employed members

- Contributions are equally divided between their employers and the National Government.

- Payment schedule: Monthly, remitted by the employer

Please note that contribution rates and schedules may change over time. For the most up-to-date information on PhilHealth contribution rates and payment schedules.’

Also read: How to Check PhilHealth Contributions Online

Benefits and Coverage

PhilHealth provides a wide range of benefits to its members, including inpatient care, outpatient care, maternity care, and other specialized packages.

Here’s an overview of the benefits and coverage provided by PhilHealth:

1. Inpatient Care

PhilHealth covers hospitalization expenses, such as room and board, drugs and medicines, laboratory exams, and operating room fees. The coverage amount depends on the type of illness or medical condition and the chosen hospital or health care facility. In general, PhilHealth uses the case rate system, which means that a fixed amount is allocated for each specific illness or medical condition.

2. Outpatient Care

- Primary Care Benefit (PCB): This package covers consultation services, diagnostic examinations, and essential drugs for common medical conditions like upper respiratory tract infection, asthma, and hypertension.

- Outpatient Benefit (OPB): This package covers preventive services like annual check-ups, vaccinations, and family planning services.

- Day Surgeries and Radiotherapy: PhilHealth covers day surgeries and radiotherapy sessions performed in accredited ambulatory surgical clinics and hospitals.

3. Maternity Care

- Normal Spontaneous Delivery (NSD): PhilHealth covers up to PHP 5,000 for deliveries in hospitals and PHP 6,500 for deliveries in non-hospital facilities, such as birthing homes and maternity clinics.

- Caesarean Section (CS): PhilHealth covers up to PHP 19,000 for CS deliveries.

- Prenatal Care: Reimbursement of up to PHP 1,500 for prenatal care expenses.

- Newborn Care Package: Coverage of PHP 1,750 for newborn care services, including essential newborn screenings and vaccinations.

If you want to know the list of hospital that offers maternity package, please click HERE.

4. Specialized Packages

- Z Benefit Package: Covers treatment for catastrophic illnesses, such as cancer, kidney transplant, and coronary artery bypass graft surgery. The coverage amount depends on the specific illness and treatment required.

- Dialysis Package: Covers hemodialysis and peritoneal dialysis sessions for patients with end-stage renal disease.

- TB-DOTS Package: Covers diagnostic services and treatment for tuberculosis under the Directly Observed Treatment, Short-course (DOTS) program.

- HIV/AIDS Package: Covers antiretroviral therapy, laboratory tests, and other support services for members diagnosed with HIV/AIDS.

Please note that benefit amounts and coverage may change over time.

Also read: List of Hospitals in Cebu City

Claiming Benefits

To avail of PhilHealth benefits, follow these steps:

1. Prepare the necessary documents: Before hospitalization or availing of medical services, make sure to prepare the following documents:

- PhilHealth Claim Form 1 (CF1) – filled out and signed by the member or their representative

- Member Data Record (MDR) – proof of membership and contribution history

- Proof of identity (e.g., valid ID, company ID, etc.)

- For dependents, provide proof of relationship (e.g., birth certificate, marriage certificate)

2. Submit documents at the hospital/healthcare facility: Upon admission or during confinement, submit the required documents to the hospital’s billing or PhilHealth section. Inform the hospital staff that you are a PhilHealth member and want to avail of the benefits.

3. Hospital/healthcare facility processes the claim: The hospital or healthcare facility will process your claim and deduct the PhilHealth benefit amount from your total bill before discharge. In some cases, you may need to file a reimbursement claim directly with PhilHealth if the hospital or facility is not able to process it.

4. Reimbursement claims: If you have already paid your hospital bill in full and need to claim reimbursement from PhilHealth, submit the following documents to the nearest PhilHealth office within 60 calendar days after discharge:

- PhilHealth Claim Form 1 (CF1)

- Member Data Record (MDR)

- Official Receipts of payment to the hospital and doctors

- Medical records and operative records, if applicable

- Proof of identity and relationship for dependents

- After submitting the required documents, PhilHealth will evaluate your claim and release the reimbursement amount accordingly.

How to Get a PhilHealth ID

A PhilHealth ID card serves as proof of membership and can be used to avail of benefits and coverage.

To obtain a PhilHealth ID card, follow these steps:

- Visit the nearest PhilHealth office or Local Health Insurance Office (LHIO) in your area.

- Fill out the PhilHealth Member Registration Form (PMRF).

- Submit the form along with a photocopy of your valid ID and other required documents (e.g., birth certificate, marriage certificate) to the PhilHealth officer.

- After your membership is confirmed, you will receive your PhilHealth ID card.

Always keep your PhilHealth ID card with you as it serves as proof of your membership and can facilitate the claim process when availing benefits.

Updating Membership Information

To update your personal information with PhilHealth, such as change of address or marital status, follow these steps:

- Download and fill out the PhilHealth Member Registration Form (PMRF) from the PhilHealth website or obtain a copy from the nearest PhilHealth office.

- Indicate the changes you want to make in the appropriate fields on the PMRF.

- Prepare the necessary supporting documents for the changes you want to make, such as marriage certificate for change of marital status or a utility bill for change of address.

- Submit the completed PMRF along with the supporting documents to the nearest PhilHealth office or Local Health Insurance Office (LHIO).

- The PhilHealth officer will process your request and update your membership information accordingly.

Online Services

PhilHealth offers various online services to facilitate membership management, benefits inquiry, contributions, collections, and accreditation.

Here’s an overview of these online services:

1. Membership

- Member and Electronic Group Enrollment: Members and employers can register or update their membership information online through the Electronic Registration System.

2. Benefits

- Case Rate Search: This online tool allows members and healthcare institutions to search for case rates for specific medical conditions and procedures.

- Claims Eligibility Checking: The online Claims Eligibility Checking service enables healthcare providers to verify a member’s eligibility for PhilHealth benefits. Healthcare providers must log in to the PhilHealth portal to access this service.

3. Contribution

- Electronic Premium Remittance System (EPRS): Employers can manage their employees’ contributions and remittances through the EPRS. This system allows employers to upload remittance reports, view contribution history, and generate payment-related documents.

4. Collection

- Electronic Collection Reporting System (ECRS): The ECRS facilitates the electronic submission of collection reports by accredited collecting agents. To access ECRS, collecting agents must log in to the PhilHealth portal.

5. Accreditation

- Health Care Institutions: Healthcare providers can apply for accreditation or check the status of their existing accreditation through the PhilHealth portal. Providers must log in to the portal to access these services.

For more information about PhilHealth’s online services, visit their official website at https://www.philhealth.gov.ph/services/ or contact the PhilHealth Action Center Hotline at (02) 8441-7442.

List of PhilHealth Offices and PhilHealth Express in Cebu

PhilHealth – Regional Office

Address: 7th and 8th Floor, Skytower, N. Escario Street corner Acacia Street,

Cebu City 6000

Phone: (032) 233 3270

Local Health Insurance Offices

PhilHealth Cebu City

Address: G/F Golden Peak Hotel & Suites N. Escario Street, Cebu City 6000

Phone: (032) 233-3287

Email: cebu.pro7@gmail.com

PhilHealth Mandaue City, Cebu

Address: Wireless Plaza, Hernan Cortes corner Lopez Jaena Streets, Subangdaku, Mandaue City 6014 Cebu

Phone: (032) 505-3022 (telefax)

Email: philhealthmandaue01@gmail.com

PhilHealth Carcar City, Cebu

Address: Lower Ground, New Carcar City Hall, Poblacion 3, Carcar City 6019 Cebu

Email: lhiocarcar@gmail.com

PhilHealth Danao City, Cebu

Address: J. D. Almendras Building, National Road, Poblacion, Danao City 6004 Cebu

Phone: (032) 324-7963; 0917 147 5041

Email: danaolhio.philhealth@gmail.com

PhilHealth Express

PhilHealth SM City Cebu

Address: 2nd Level, Government Services Express, SM City Cebu, North Reclamation Area, Cebu City

Hours: Mondays-Fridays (10 am to 6 pm)

PhilHealth Robinsons Fuente

Address: 3rd Level, Lingkod Pinoy Center, Robinsons Fuente, Osmeña Boulevard, Cebu City

Hours: Mondays-Fridays (10 am to 6 pm)

PhilHealth Robinsons Galleria

Address: 3rd Level, Lingkod Pinoy Center, Robinsons Galleria, Gen. Maxilom Avenue Extension, Cebu City

Hours: Mondays-Fridays (10 am to 6 pm)

PhilHealth SM City Consolacion

Address: 2nd Level, SM City Consolacion, Cebu North Road, Lamac, Consolacion, Cebu

Hours: Mondays, Tuesdays, Wednesdays (10 am to 6 pm)

Summary

PhilHealth Cebu is a vital element of the healthcare system in the region, providing coverage and access to medical services for millions of people. Understanding the different aspects of the program is essential for anyone who wants to take advantage of their benefits. From eligibility requirements and membership options to the different types of healthcare services covered by PhilHealth, this essential guide provides all the information you need to know to maximize your health insurance coverage. So, whether you’re in need of a medical check-up, hospitalization, or other healthcare services, PhilHealth Cebu is there to help.

Contact Information

Website: philhealth.gov.ph

Facebook Page: https://www.facebook.com/PhilHealthOfficial/

Callback Channel: 0917-898-7442 (PHIC)

Email: actioncenter@philhealth.gov.ph