The Bureau of Internal Revenue (BIR) is the primary government agency responsible for tax collection, assessment, and enforcement in the Philippines. In Cebu, one of the country’s most vibrant economic hubs, BIR plays a crucial role in ensuring that individuals and businesses comply with tax regulations, contribute to the nation’s revenue, and support the government’s programs and services.

Also read: How to Get Your BIR TIN Card In Cebu

BIR Cebu consists of four main Revenue District Offices (RDOs). These offices cater to the tax-related concerns of taxpayers residing or operating within their respective jurisdictions. They facilitate tax registration, filing, payment, and enforcement, as well as provide taxpayer assistance, education, and information dissemination to promote voluntary compliance with tax laws and regulations.

Cebu BIR District Offices

Here is the list of Bureau of Internal Revenue Cebu Offices and their area of jurisdiction:

Revenue District Office No. 80 – Mandaue City, Cebu

- Office Address: 2nd Floor Insular Square, Tabok, Mandaue City

- Email: rdo_80css@bir.gov.ph

- Revenue District Officer: TRINIDAD A. VILLAMIL

- Assistant Revenue District Officer: DANIEL A. MENDIZABEL

- Area of Jurisdiction: Bogo City, Danao City, Lapu-Lapu City, Mandaue City, and other nearby municipalities

Revenue District Office No. 81 – Cebu City North

- Office Address: BIR Regional Office Building, Arch. Reyes Ave., Cebu City

- Email: rdo_81css@bir.gov.ph

- Revenue District Officer: RODOLFO A. CAÑIDO

- Assistant Revenue District Officer: NICANOR DG. SAN JUAN (OIC)

- Area of Jurisdiction: Several barangays in the northern part of Cebu City

Revenue District Office No. 82 – Cebu City South

- Office Address: Philwood Building, N. Bacalso Avenue, Cebu City

- Email: rdo_82css@bir.gov.ph

- Revenue District Officer: ESTRELLA T. BERNALDEZ (OIC)

- Assistant Revenue District Officer: RAMON M. CABARRON (OIC)

- Area of Jurisdiction: Barangays in the southern part of Cebu City

Revenue District Office No. 83 – Talisay City, Cebu

- Office Address: KC Square Lawaan I, Talisay, Cebu City

- Email: rdo_83css@bir.gov.ph

- Revenue District Officer: YOLANDA C. ZAFRA

- Assistant Revenue District Officer: JERRY BOY F. JAGONOS (OIC)

- Area of Jurisdiction: Carcar City, Naga City, Talisay City, Toledo City, and nearby municipalities

Please note that office locations, contact information, and jurisdictions may change over time, so it’s always best to confirm the information before visiting a BIR office. You can also visit the BIR’s official website or contact the respective district offices directly for the most up-to-date information.

Services Offered

Indeed, the Bureau of Internal Revenue (BIR) is mandated by law to perform various functions related to the assessment and collection of national internal revenue taxes, fees, and charges.

Some of these key responsibilities include:

Assessment of Taxes: The BIR is responsible for assessing taxes on individuals and businesses based on their income, sales, and other taxable transactions.

Collection of Taxes: The BIR collects taxes through a variety of means, including voluntary tax payments, withholding taxes, and tax remittance from Authorized Agent Banks (AABs) or through the Electronic Filing and Payment System (eFPS).

Enforcement of Penalties and Fines: The BIR enforces penalties, fines, and forfeitures associated with non-compliance or violation of tax laws and regulations. This may involve issuing notices, conducting audits or investigations, and implementing necessary legal actions.

Execution of Judgments: The BIR is responsible for executing judgments rendered in its favor by the courts, which may involve the collection of unpaid taxes, penalties, and fines from taxpayers.

Monitoring and Surveillance: The BIR monitors taxpayer compliance with tax laws and regulations through various compliance monitoring activities, such as audits, investigations, and surveillance.

Taxpayer Services: In addition to its enforcement and collection duties, the BIR also provides taxpayer services, such as registration, assistance, education, and issuance of tax clearances, to help taxpayers fulfil their obligations and understand their rights.

Policy Development: The BIR plays a crucial role in the development and implementation of tax policies and regulations, working closely with other government agencies and stakeholders to ensure that tax laws are fair, efficient, and effective.

These responsibilities highlight the critical role of the BIR in ensuring the proper assessment and collection of national internal revenue taxes, fees, and charges, as well as the enforcement of penalties, fines, and forfeitures associated with them.

Application for Taxpayer Identification Number (TIN)

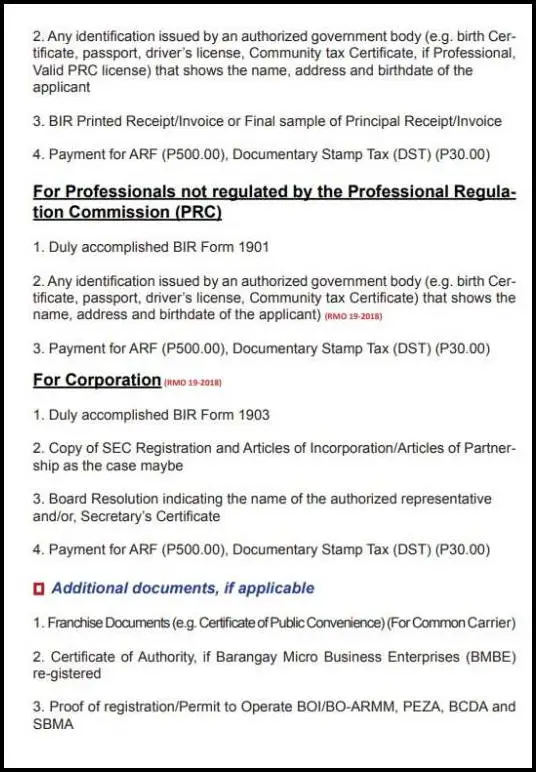

For Self-Employed and Mixed Income Individuals

Tax Form

BIR Form 1901 – Application for Registration for Self-Employed and Mixed Income Individuals, Non-Resident Alien Engaged in Trade/Business, Estates/Trusts.

Documentary Requirements

- BIR Form No. 1901 version 2018

- Any identification issued by an authorized government body (e.g., Birth Certificate, passport, driver’s license, Community Tax Certificate) that shows the name, address, and birthdate of the applicant

- Payment of ₱500.00 for Registration Fee and ₱30.00 for loose Documentary Stamp Tax (DST) or Proof of Payment of Annual Registration Fee (ARF) (if with existing TIN or applicable after TIN issuance)

- BIR Printed Receipts/Invoices or Final & clear sample of Principal Receipts/Invoices

Procedures

- Accomplish BIR Form 1901 version 2018 and submit it together with the documentary requirements with the New Business Registrant Counter of the RDO having jurisdiction over the place where the head office and branch, respectively.

- Pay the Annual Registration Fee (₱500.00), loose DST (₱30.00) and/or payment for the BIR Printed Receipt/Invoice (if the taxpayer opted to buy for use) at the New Business Registrant Counter in the BIR Office.

- The RDO shall then issue the Certificate of Registration (Form 2303) together with the “Notice to Issue Receipt/Invoice”, Authority to Print, BIR Printed Receipts/Invoices (if applicable), and eReceipt as proof of payment.

Note: Taxpayer may attend the scheduled initial briefing for new business registrants to be conducted by the concerned RDO in order to apprise them of their rights and duties/responsibilities.

Individual business taxpayers may also submit applications via electronic mail through the BIR New Business Registration (NewBizReg) Portal.

Deadline

All individuals engaged in trade or business shall accomplish and file the application on or before the commencement of business. It shall be reckoned from the day when the first sale transaction occurred or within thirty (30) calendar days from the issuance of the Mayor’s Permit/Professional Tax Receipt (PTR) by the LGU, whichever comes earlier.

Individuals Earning Purely Compensation Income

Tax Form

BIR Form 1902 – Application for Registration For Individuals Earning Purely Compensation Income (Local and Alien Employee)

Documentary Requirements

- Any identification issued by an authorized government body (e.g., Birth Certificate, passport, driver’s license, Community Tax Certificate) that shows the name, address, and birthdate of the applicant;

- Marriage Contract, if applicable;

- For Alien Employee – Passport; and

- Working Permit; or Photocopy of duly received Application for Alien Employment Permit (AEP) by the Department of Labor and Employment (DOLE)

For employers using eREG System, the above requirements shall be required from their employees.

Procedures

- Accomplish BIR Form 1902 and submit the same together with the documentary requirements to the employer.

- The employer shall accomplish the applicable sections of the application form.

- Submit BIR Form 1902 to the Revenue District Office (RDO) having jurisdiction over the place of office of the employer where such employee is expected to report for work.

Deadline

New employees shall accomplish and file the application within ten (10) days from the date of employment.

BIR EServices

The Bureau of Internal Revenue (BIR) offers various eServices to make tax-related transactions more accessible, efficient, and convenient for taxpayers.

Here are some of the BIR’s eServices:

- eReg: The eRegistration System is a web application that provides various taxpayer registration services, including TIN Issuance, Payment of Registration Fee, and Generation of Certificate of Registration.

- eFPS: The Electronic Filing and Payment System allows taxpayers to process and transmit tax return information, including attachments and taxes due, over the internet through the BIR website.

- eBIRForms: The Electronic Bureau of Internal Revenue Forms (eBIRForms) offers an alternative mode of preparing and filing tax returns that is more convenient and user-friendly.

- eAFS: The Electronic Audited Financial Statements (eAFS) is a web-based application that enables taxpayers to submit their filed Income Tax Returns (ITR), Audited Financial Statements (AFS), and other required attachments online in PDF file format.

- EPAY: This service provides links to ePayment Channels of Authorized Agent Banks (AABs) for the electronic payment of tax dues and liabilities using online, credit/debit/prepaid cards, and mobile payments.

- eONETT: The eONETT System is a web-based application that enables taxpayers to transact their One-Time Transaction (ONETT) related to the taxable sale of real properties classified as capital or ordinary (CGT-BIR Form 1706, CWT-BIR Form 1606, and DST-BIR Form 2000OT).

- eTSPCert: The Electronic Tax Software Provider Certification (eTSPCert) System is a web-based application that facilitates the certification of tax solutions for electronic tax return filing and/or payment, ensuring compliance with BIR data structure requirements.

- eTCBP-TCVC: The Electronic Tax Clearance for Bidding Purposes and Tax Compliance Verification Certificate (eTCBP-TCVC) is an online system where taxpayers can submit applications for Tax Clearance for Bidding Purposes/Tax Compliance Verification Certificate via email.

- ORUS: The Online Registration and Update System (ORUS) is a web-based application that provides an end-to-end process for registering taxpayers and updating their registration information.

These eServices make it easier for taxpayers to comply with tax requirements, streamlining the process and reducing the need for in-person transactions at BIR offices.

Also read: How to Pay Real Estate Tax in Cebu City Treasurer’s Office Building

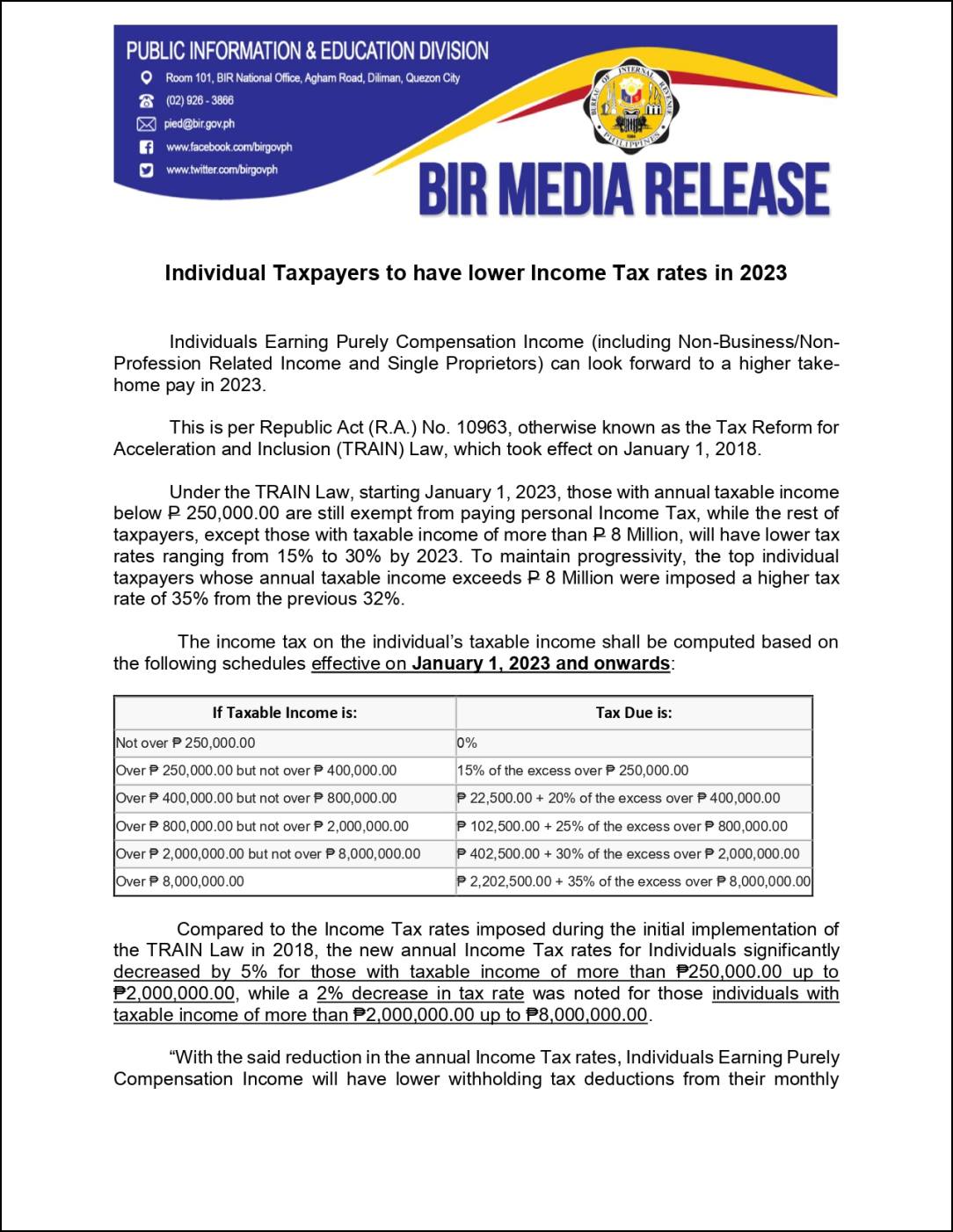

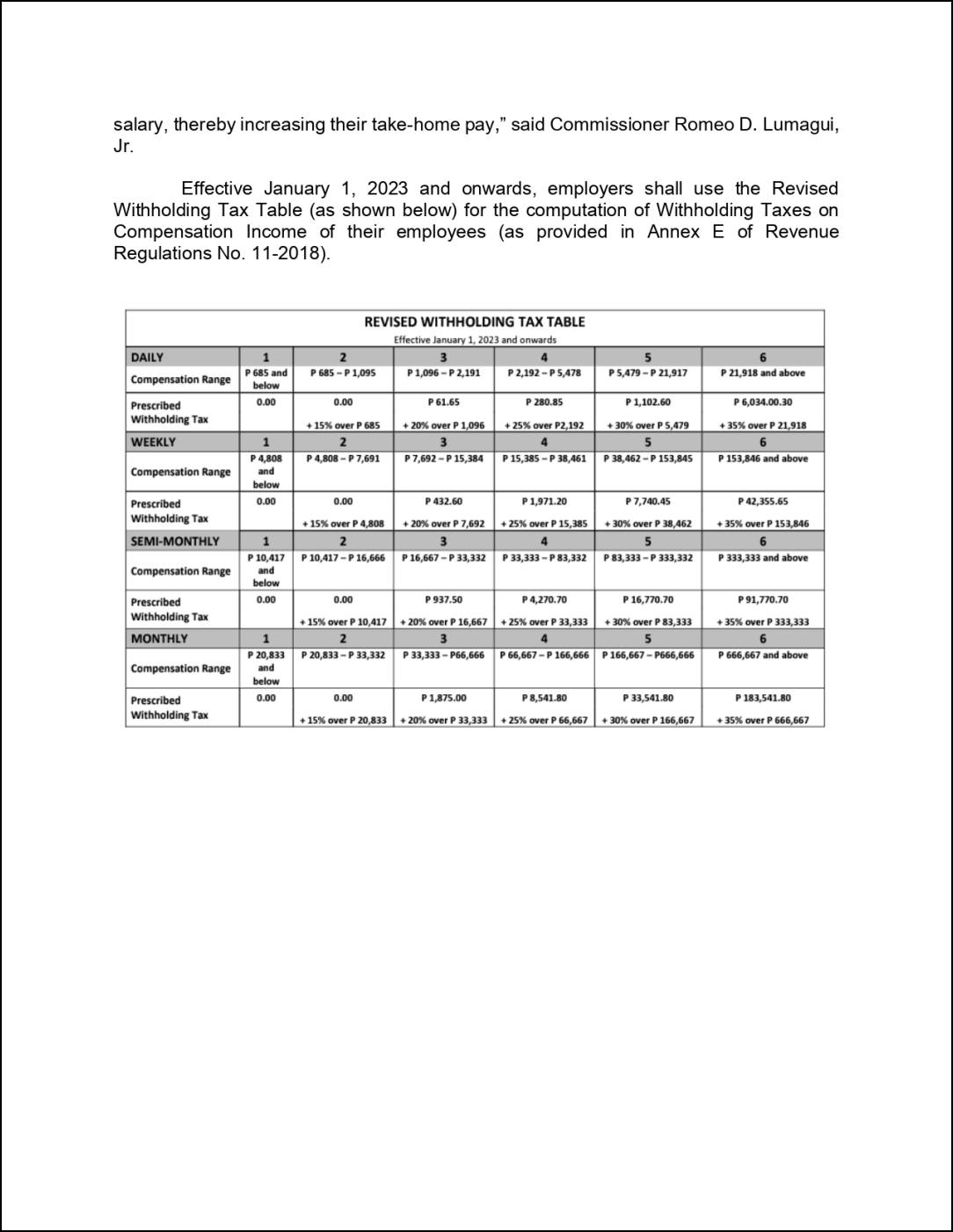

Income Tax Rates

In the Philippines, income tax rates for individuals and corporations vary depending on the type of taxpayer and the amount of income.

Who is Required to File Income Tax Returns?

Individuals who are required to file Income Tax Returns (ITRs) include:

- Resident citizens receiving income from sources within or outside the Philippines.

- Employees deriving purely compensation income from two or more employers, concurrently or successively at any time during the taxable year.

- Employees deriving purely compensation income regardless of the amount, whether from a single or several employers during the calendar year, the income tax of which has not been withheld correctly (i.e., tax due is not equal to the tax withheld), resulting in a collectible or refundable return.

- Self-employed individuals receiving income from the conduct of trade or business and/or practice of profession.

- Individuals deriving mixed income, i.e., compensation income and income from the conduct of trade or business and/or practice of profession.

- Individuals deriving other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax.

- Individuals receiving purely compensation income from a single employer, although the income of which has been correctly withheld, but whose spouse is not entitled to substituted filing.

- Non-resident citizens receiving income from sources within the Philippines.

- Aliens, whether resident or not, receiving income from sources within the Philippines.

Non-individuals who are required to file ITRs include:

- Corporations, including partnerships, no matter how created or organized.

- Domestic corporations receiving income from sources within and outside the Philippines.

- Foreign corporations receiving income from sources within the Philippines.

- Estates and trusts engaged in trade or business.

It is important to be aware of your tax filing obligations and ensure that you file your ITRs on time to avoid penalties and interest charges.

Also read: List of NBI Branches and Satellite Offices in Cebu

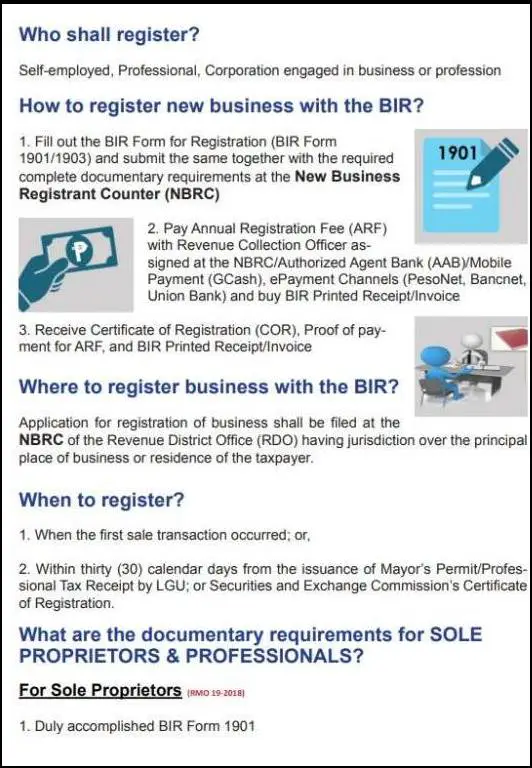

How to Register Your Business with the Bureau of Internal Revenue (BIR)

Registering a business with the Bureau of Internal Revenue (BIR) in the Philippines involves several steps. Here’s a guide to help you register your business:

Ensure that you comply with all BIR regulations and deadlines for filing and paying taxes to avoid penalties and interest charges. Regularly check for any updates on tax regulations, as they may change over time.

How to Pay Taxes

Paying taxes is an essential responsibility for individuals and businesses. There are several methods to pay taxes, both online and offline.

Here’s a guide on how to pay taxes in the Philippines:

1. Over-the-counter (OTC) payment at Authorized Agent Banks (AABs)

- Accomplish the required BIR tax return forms.

- Proceed to an Authorized Agent Bank (AAB) branch within your Revenue District Office’s jurisdiction.

- Submit the accomplished tax return form along with your payment to the bank teller.

- The bank teller will validate the tax return form and issue an acknowledgement receipt as proof of payment.

2. Electronic Filing and Payment System (eFPS)

- Enroll in the eFPS through the BIR website (https://www.bir.gov.ph).

- Log in to your eFPS account and file your tax return electronically.

- After submission, you will receive an email confirmation with a summary of your tax return.

- Choose your preferred mode of payment (debit from a bank account, credit card, or GCash) and follow the instructions provided.

- Keep a copy of the electronic payment confirmation for your records.

3. Mobile Banking Apps: Some banks offer their mobile banking app for tax payments. Check if your bank supports this service and follow these steps:

- Log in to your bank’s mobile banking app.

- Choose “Pay Bills” or a similar option.

- Select “BIR” as the biller and enter the required information from your accomplished tax return form.

- Complete the transaction and keep a copy of the payment confirmation for your records.

4. GCash

- Register for a GCash account if you don’t have one.

- Fund your GCash wallet through various cash-in options.

- Open the GCash app and select “Pay Bills.”

- Choose “Government” and then select “BIR.”

- Enter the required information from your accomplished tax return form.

- Confirm the transaction and keep a copy of the payment confirmation for your records.

Always remember to pay your taxes on or before the due date to avoid penalties and interest charges.

Also read: Lingkod Pinoy Center in Robinsons Galleria Cebu

Summary

For those living or operating a business in Cebu, understanding the ins and outs of the Bureau of Internal Revenue (BIR) is essential. BIR Cebu plays a crucial role in ensuring tax compliance and collecting revenues for the government. Whether you need to register for a tax identification number or file your annual tax returns, it’s important to understand the process and requirements for doing so. With this guide, you’ll have a better understanding of how BIR Cebu works and how to navigate its various services. Don’t let tax season catch you off guard – take the time to familiarize yourself with BIR Cebu today.

Contact Information

Phone: 285383200

Email: contact_us@bir.gov.ph

Website: bir.gov.ph

Facebook Page: https://web.facebook.com/birgovph