Ensuring the safety and security of our homes is paramount, particularly in the face of natural calamities. The GSIS Home Shield Fire Insurance Program recognizes this need and provides a comprehensive fire insurance for properties. This program is specifically designed to safeguard them against any potential fire damage, offering homeowners peace of mind.

Also read: Cebu’s Best Insurance Providers: 6 of the Top Picks

What sets this insurance program apart is the option to extend coverage beyond fire damage. You have the flexibility to avail of additional protection against other potential disasters such as earthquakes, typhoons, or floods. This means you can rest assured that your home is comprehensively protected against a range of unexpected occurrences that could potentially cause extensive property damage.

What are the Benefits of GSIS Home Shield Fire Insurance?

- Fire Damage Coverage: The primary benefit of the GSIS Home Shield Fire Insurance Program is its coverage for fire damage. It can help mitigate the financial impact of a fire by covering the repair or replacement costs of damaged property.

- Additional Disaster Protection: Aside from fire, this insurance program offers optional coverage against other natural disasters like earthquakes, typhoons, and floods. This gives homeowners an added layer of protection against unforeseen events.

- Smoke and Water Damage Coverage: Not only does it cover fire damage, but also the damage caused by smoke and water used to put out the fire. This comprehensive approach ensures that all aspects of fire-related damage are covered.

- Damage from Firefighting Efforts: Any damage caused by firefighters during their efforts to extinguish the fire is also covered under this policy.

- Affordable Premiums: The GSIS Home Shield Fire Insurance Program offers comprehensive coverage at affordable rates, making it accessible to a larger number of homeowners.

- Peace of Mind: Knowing that your home is protected against fire and other potential disasters offers peace of mind. This can significantly reduce stress and anxiety related to the safety of your home.

- Financial Security: In the event of a disaster, the financial burden of repairing or replacing damaged property can be overwhelming. With this insurance program, homeowners have the security of knowing they won’t have to bear these costs alone.

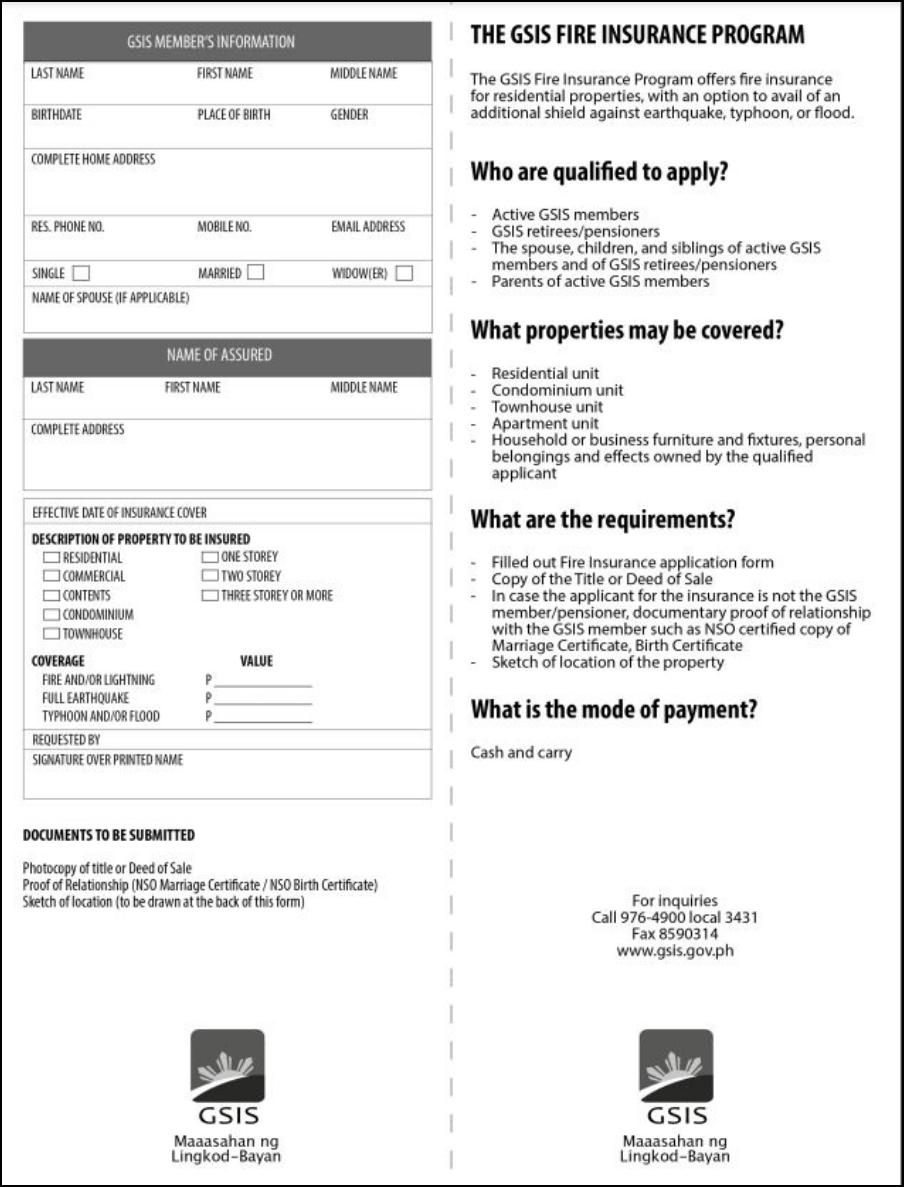

Who are Qualified to Avail the GSIS Home Shield Fire Insurance?

The GSIS Home Shield Fire Insurance Program is open to a wide range of individuals, making it accessible to many who are seeking protection for their homes. Eligibility for this program includes:

a. Active GSIS Members (Ginhawa Active)

- Current members of GSIS who are actively contributing to the system are eligible to apply for this insurance program.

b. GSIS Retirees/Pensioners (Ginhawa Grand)

- Individuals who have retired from government service and are currently receiving pensions from GSIS can also avail of this insurance program.

c. Family of GSIS Members and Pensioners (Ginhawa Plus)

- The spouse, children, and siblings of active GSIS members and GSIS retirees/pensioners are also eligible for this program. This extends the coverage to family members, ensuring their homes are protected as well.

d. Parents of Active GSIS Members (Ginhawa Plus)

- Parents of active GSIS members can also apply for this insurance, providing them with the peace of mind that their home is protected against potential fire damage.

It’s important to note that terms and conditions may apply, so it’s always best to check with GSIS for the most accurate and up-to-date information.

What Types of Properties are Covered in the House Shield Fire Insurance Coverage?

The GSIS Home Shield Fire Insurance (HSFI) program provides coverage for a variety of property types, ensuring that a wide range of homeowners and business owners can benefit from its protection. Here are the types of properties covered under this program:

a. Residential Units

- These include stand-alone houses or any other structure used for residential purposes.

b. Condominium Units

- Condominiums are also covered under this program, providing protection for individual unit owners within the building.

c. Townhouse Units

- Townhouses, which are typically multi-level residences that share one or two walls with adjacent properties, are eligible for coverage.

d. Apartment Units

- Owners of apartment units can also avail of this insurance program, safeguarding their property against potential fire damage.

e. Household or Business Furniture and Personal Effects

- The program covers not only the physical structure but also the contents of the property. This includes furniture, fixtures, and personal belongings owned by the qualified applicant.

f. Commercial or Business Units Owned by a Corporation

- If a qualified assured owns a majority share in a corporation, any commercial or business unit owned by that corporation is eligible for coverage under the HSFI program.

It’s important to note that terms and conditions may apply, so it’s always best to check with GSIS for the most accurate and up-to-date information.

What are the Requirements Needed for Application?

To apply for the GSIS Home Shield Fire Insurance Program, both new applicants and those seeking to renew their coverage must meet specific requirements:

a. For New Applicants

- Fire Insurance Application Form: Complete and sign the Fire Insurance Application Form. This should be the original copy. The form can be downloaded from the GSIS website.

- Title or Deed of Sale: Provide a photocopy of the Title or Deed of Sale of the property you want to insure.

- Transfer of Certificate of Title (TCT) and/or Tax Declaration: A photocopy of these documents is necessary. If the property is owned by a corporation, the applicant must own the majority of the corporation’s shares.

- Documentary Proof of Relationship: If the applicant is not the GSIS member or pensioner, they must provide documentary proof of their relationship with the GSIS member, such as a PSA certified copy of a marriage certificate or birth certificate.

- Sketch Location of the Property: Provide a sketch that shows the location of the property.

- Inspection Report of an Authorized GSIS Officer: You may proceed to the marketing department for Inspection.

Here is the sample form: Home Shield Fire Insurance Form

b. For Renewals

- Renewal Form: Fill out and sign the Renewal Form. This should be the original copy.

Please note that terms and conditions may apply, and it’s always best to check with GSIS for the most accurate and up-to-date information.

Application Process: Step-by-Step Guide

Applying for the GSIS Home Shield Fire Insurance Program, whether as a new applicant or for renewal, is a straightforward process. Here’s a step-by-step guide on how to apply:

a. For New Applicants

Step 1: Download the Application Form

- The first step is to download the application form from the GSIS website.

Step 2: Fill Out the Application Form

- Carefully fill out the form with all the necessary information. Make sure to also prepare the other requirements such as the Title or Deed of Sale, Transfer of Certificate of Title (TCT) and/or tax declaration, proof of relationship with the GSIS member if applicable, sketch location of the property, and Inspection Report of authorized GSIS Officer.

Step 3: Submit Your Application

- Once all your documents are ready, you can submit your application. There are two ways to do this:

- Via Email: You can send your completed application form and other necessary documents to marketing@gsis.gov.ph.

- Over-the-Counter (OTC): You can also submit your application in person at any GSIS Office nationwide.

b. For Renewals

Step 1: Download and Fill Out the Renewal Form

- Download the renewal form from the GSIS website and fill it out.

Step 2: Submit Your Renewal Form

- Submit your completed renewal form either via email to marketing@gsis.gov.ph or over-the-counter at any GSIS Office nationwide.

For any queries or issues, you can get in touch with GSIS through their contact details provided on their website. Stay updated with any related news about the insurance program by regularly checking the news section on the GSIS website.

Summary

Protect your biggest investment with GSIS Home Shield Fire Insurance. This amazing program offers homeowners the security they need to safeguard their property. Plus, you have the option to add coverage against earthquakes, typhoons, and floods. Don’t leave anything to chance when it comes to protecting your home. Choose GSIS Home Shield Fire Insurance and enjoy the peace of mind you deserve.

Contact Information

Address: Leon Kilat St., Brgy. Kalubihan, Cebu City, 6000

Email: mvpeenriquez@gsis.gov.ph, gsiscebu@gsis.gov.ph

Website: gsis.gov.ph

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers)

or 1-800-10-8474747 (for Smart subscribers)