The SSS Condonation Loan Program is a social welfare program implemented by the Social Security System (SSS) in the Philippines to help its members cope with financial challenges in times of need. The program is open to all SSS members who have an existing loan with the SSS, including those who are delinquent in their payments.

Also Read: How to Get a Loan from SSS

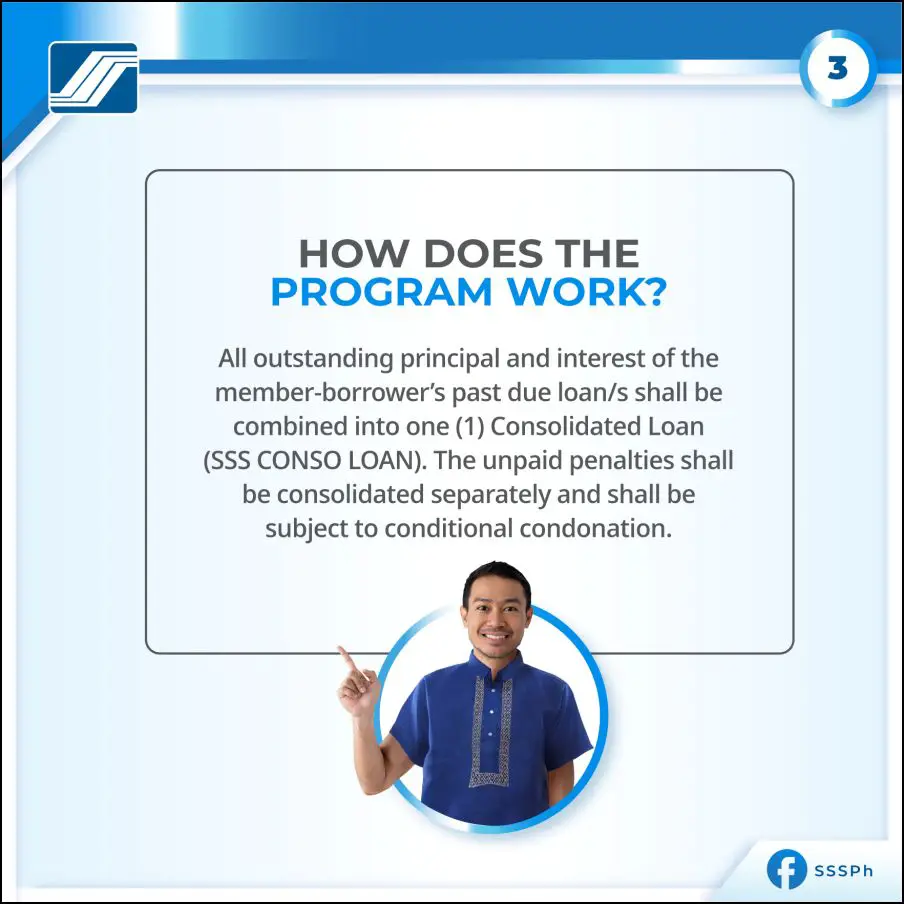

The Condonation Loan Program allows these members to pay off their existing loans and start fresh with new loan terms. This way, they can continue to avail of loans from the SSS without having to worry about their past delinquent payments.

The Condonation Loan Program is an excellent way for SSS members to get back on track with their loan payments and continue to avail of SSS loans. It can help them manage their finances and make sure they are in good standing with the SSS. The program also helps promote financial literacy among its members, which can help them make better decisions about their finances and lead to a more secure future.

Benefits of the Condonation Loan Program

The benefits of the Condonation loan program include the waiver of late payment penalties, reduced interest rates, and shorter loan terms. This makes it easier for SSS members to make their payments on time and keep up with their loan obligations. Additionally, this program can help reduce the overall financial burden that comes with continuing to take out loans from the SSS.

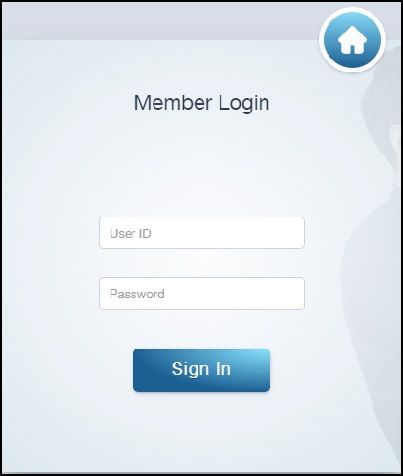

Applying for the Condonation Loan Program is easy. All SSS members who have existing loans with the SSS can apply by going to any branch of the SSS or their nearest accredited SSS partner. or apply online by signing in to the SSS website. Once approved, they will be given a new loan agreement that outlines the terms and conditions of the program.

Steps on How to Apply for the Condonation Loan Program Online

1. Log in to SSS.Gov.Ph and input your username and ID.

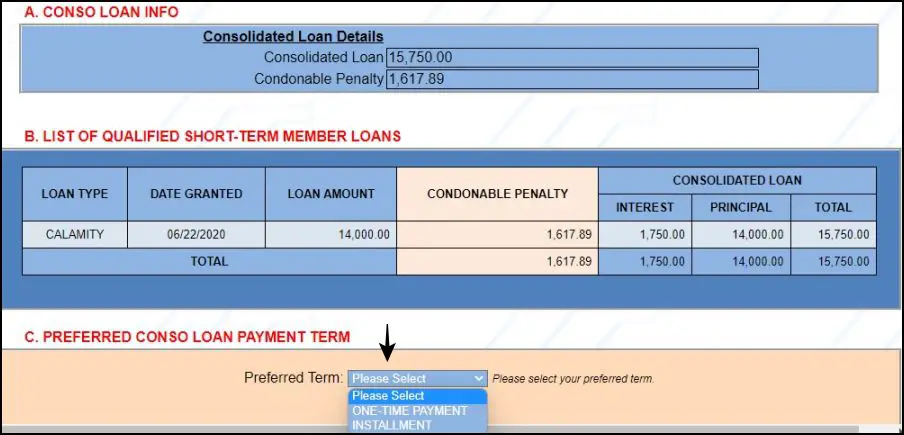

2. Once logged in, go to the “Loans” module and click “Apply for Consolidation of Past Due Short-Term Member Loan with Condonation of Penalty Program.” on the drop-down list and You will see the information on the Consolidated Loan Details.

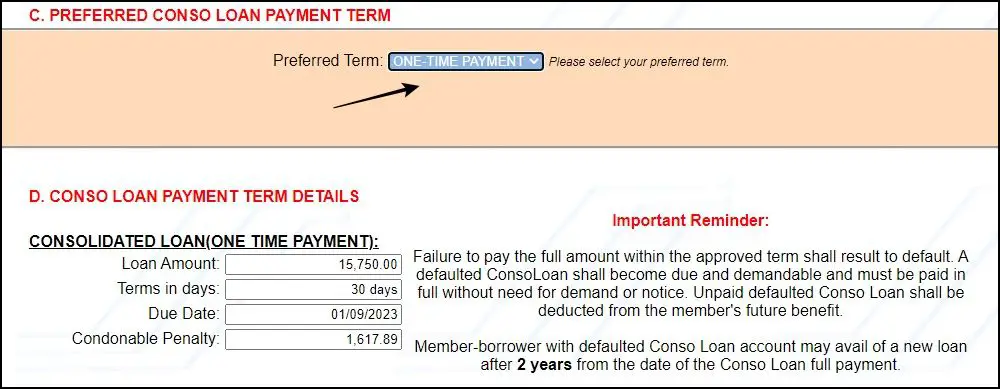

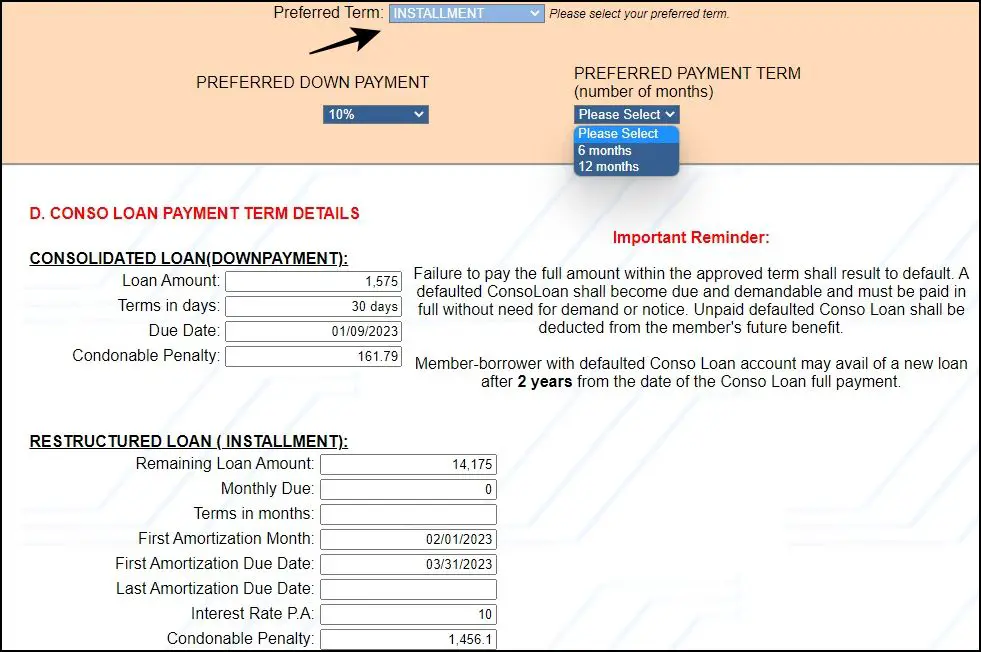

3. Next, select your Preferred Term. You can choose either a One-Time Payment or an Installment.

- For One-time payment – You will pay the whole past loan amount within 30 days or 1 month.

- For Installment – you can choose your preferred down payment from 10% up to 90% of your past loan then the remaining balance can be paid in your preferred number of months from 6 months up to 24 months.

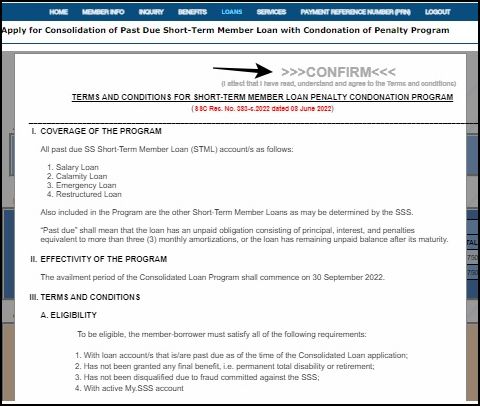

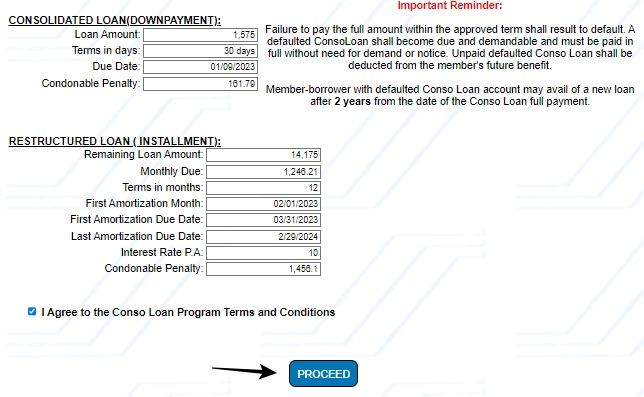

4. Once the details of the loan will show, check the “I Agree to the Conso Loan Program Terms and Conditions” and make sure to read carefully the SSS Terms and Conditions and click confirm to continue, and click PROCEED.

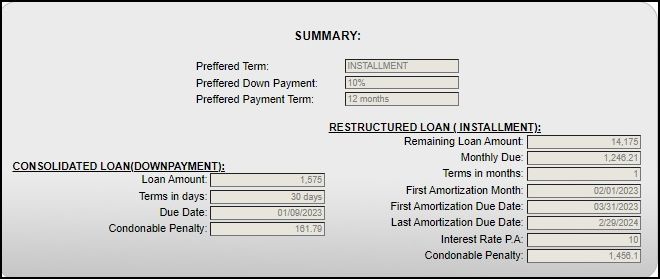

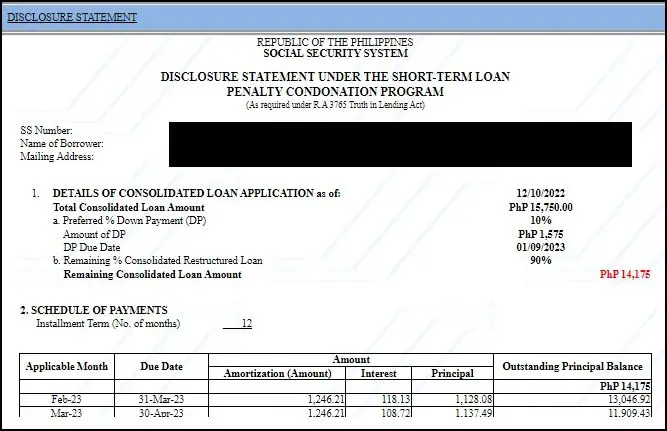

5. The summary of the consolidated loan application will show including the Remaining Consolidated Amount to be paid in installments, the number of months, interest, and monthly amortization.

6. Make sure to read every detail to avoid penalties. Click Submit and the system will generate the automated Payment Reference Number (PRN) for the initial down payment of your outstanding loan balance you can use the PRN upon payment.

Frequently Asked Questions

1. Who is eligible to apply for the Condonation Loan Program?

A: Any SSS member with existing loans may apply for the Condonation Loan Program, including those who are delinquent in their payments.

2. How can I apply for the Condonation Loan Program?

A: You can apply for the Condonation Loan Program by going to any branch of the SSS or their nearest accredited SSS partner. Alternatively, you can also apply online by signing in to the SSS website and following the steps provided. Once approved, you will be given a new loan agreement that outlines the terms and conditions of the program.

3. Is there an application fee for the Condonation Loan Program?

A: No, there is no application fee for applying to the Condonation Loan Program. However, you may need to pay other fees related to the loan, such as processing fees and late payment penalties.

4. Is there a deadline for applying to the Condonation Loan Program?

A: Yes. The program has a specific deadline for applications. You should check with your nearest SSS branch for more information about the deadlines or visit their social media accounts.

5. Can I apply for a loan under the Condonation Loan Program if I have an existing SSS loan?

A: Yes, you can apply for a loan under the Condonation Loan Program even if you have an existing SSS loan. However, this will depend on the terms and conditions of your existing loan as well as your financial capacity to take out a new loan. It is best to consult with an SSS representative for more information.

6. What happens if I fail to repay my loan under the Condonation Loan Program?

A: If you fail to repay your loan on time as per the terms and conditions of the loan agreement, you will be subject to late payment penalties and other sanctions. It is important to make timely payments and comply with all the terms of your loan agreement to avoid penalties or other sanctions.

7. Can I apply for a loan under the Condonation Loan Program if I am unemployed?

A: Yes, you may still be eligible to apply for the Condonation Loan Program even if you are currently unemployed. This will depend on your financial capacity and other requirements set by the SSS. It is best to consult an SSS representative for more information. This loan program is designed to provide additional support and assistance to SSS members in need, so take full advantage of it if you qualify.

8. Where can I pay my loan payments under the Condonation Loan Program?

A: You can make your loan payments at any branch of the SSS or their accredited partner banks. You may also pay online through Gcash or Paymaya and other digital payment platforms. It is important to note that all loan terms and conditions must still be followed even when making payments through digital payment platforms and bank networks. If you are ever unsure, reach out to an SSS representative for assistance.

9. What is the disadvantage of the Condonation Loan Program?

A: The main disadvantage of the Condonation Loan Program is that it imposes a fixed repayment structure. You will be expected to pay off your loan in fixed installments within an agreed period, so you must make sure that you are financially able and committed to complying with these terms and conditions before applying. if you fail to make your loan payments on time, you will be subject to late payment penalties or other sanctions.

10. Are OFW members eligible to apply for the Condonation Loan Program?

A: Yes, OFW members are also eligible to apply for the Condonation Loan Program. However, they must meet certain requirements such as having an active SSS membership and a valid passport before they can be considered for this program. It is best to consult an SSS representative for more information.

Summary

Do you have a past-due loan with the SSS? The Condonation Loan Program may be the perfect solution for you! With waived late payment penalties, reduced interest rates, and shorter loan terms, this program can help reduce the overall financial burden of taking out loans from the SSS. This program by SSS helps us a lot, especially the most vulnerable sectors in society.

Please take note that we should always be aware of its terms and conditions to make sure we get the most out of this program. Make sure to consult an SSS representative if you need more information or help. Take advantage of the Condonation Loan Program and start fresh with your loan payments today!

Also Read: List of SSS Branches and Offices in Cebu

Contact Information

SSS Website: https://member.sss.gov.ph/

SSS Hotline: 02-1455 or 8-1455

Email Address: member_relations@sss.gov.ph

Facebook Page: https://www.facebook.com/SSSPh/

Twitter Page: https://twitter.com/PHLSSS/

Instagram Page: https://www.instagram.com/mysssph/

Youtube Channel: @MYSSSPH

For any information or inquiries regarding the Condonation Loan Program, please contact the SSS directly.