Are you currently in a situation where you need additional funds but want to avoid the complexities associated with traditional loans? The GSIS Policy Loan could be an ideal solution for you. This loan facility offers you the opportunity to take a loan from your Life Endowment Policy (LEP) or Enhanced Life Policy (ELP) with the GSIS, providing a hassle-free way to access extra cash when you need it.

The loanable amount is dependent on the type of policy you hold. If you have an ELP, you can avail up to 90% of the termination value of your policy. For those with an LEP, you can receive a loan equivalent to 50% of your policy’s accumulated cash surrender value. This makes the GSIS Policy Loan a convenient and straightforward option to access funds, eliminating the usual headaches associated with typical loan processes.

What are the Advantages of GSIS Policy Loan?

The GSIS Policy Loan comes with several advantages that make it an attractive option for GSIS members:

- Ease of Access: The loan is easy to apply for, requiring fewer documents and less processing time compared to traditional loans.

- Competitive Interest Rate: The loan carries a relatively low interest rate of 8%, making it a more cost-effective borrowing option.

- Flexible Loan Amount: The loanable amount depends on the type of policy you have. With an Enhanced Life Policy (ELP), you can borrow up to 90% of the termination value of your policy. If you have a Life Endowment Policy (LEP), you can avail up to 50% of your policy’s accumulated cash surrender value.

- No Collateral Required: The loan uses your life insurance policy as collateral, so you don’t need to provide any additional assets or guarantees.

- Financial Relief: It provides immediate financial relief in times of need, helping you cover unexpected expenses or financial emergencies.

- Contributes to Savings: Since it’s a policy loan, it does not deplete your savings. Instead, it allows you to leverage your life insurance policy to meet immediate financial needs.

- No Tax Implications: Unlike some other forms of loans, policy loans are typically not taxable as long as they are equal to or less than the amount of life insurance premiums you have paid.

Remember, while a policy loan offers many benefits, it’s important to understand the terms and conditions before availing of one. Always consider your ability to repay the loan within the stipulated period to avoid future financial difficulties.

Who are the Qualified Borrowers of GSIS Policy Loan?

To be eligible for a GSIS Policy Loan, you need to meet the following criteria:

- Insured Duration: You should have been insured for at least one year. This means you must have held an insurance policy for a minimum of one year prior to applying for the loan.

- Active Service with Active Insurance Policy: You need to be in active service and have an active insurance policy. This indicates that you are currently employed and maintaining an insurance policy.

- GSIS eCARD: You must be a holder of an activated GSIS eCard. The eCard serves as your official identification card and provides access to GSIS’s electronic services.

- No Pending Cases: You should not have any pending administrative or criminal cases. This ensures that you are in good standing and not subject to any legal actions that could affect your ability to repay the loan.

Meeting these criteria does not guarantee loan approval. GSIS will still review your application and make a decision based on their assessment. Always ensure that all the information you provide during the application process is accurate and up-to-date.

Requirements Needed for GSIS Policy Loan

To apply for a GSIS Policy Loan, you need to complete and submit the Application Form for Policy Loan. This form is available in two types: Regular and Optional.

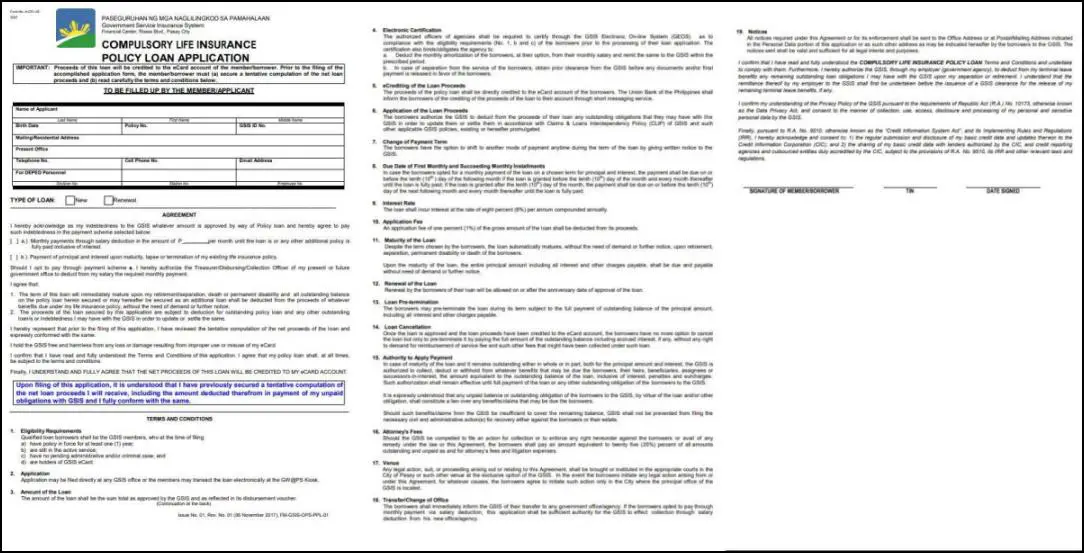

a. Regular – COMPULSORY LIFE INSURANCE POLICY LOAN APPLICATION

Here is the sample form:

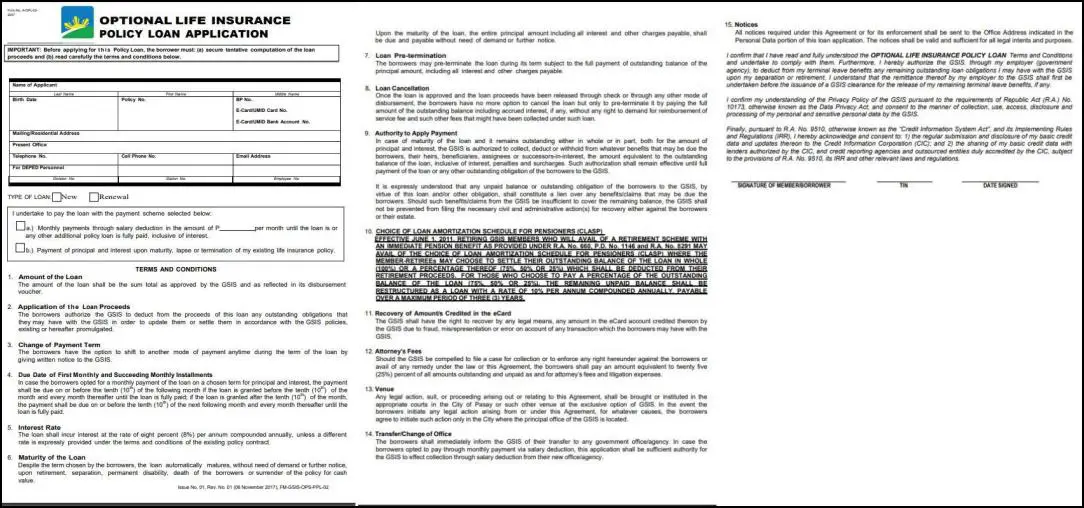

b. Optional – OPTIONAL LIFE INSURANCE POLICY LOAN APPLICATION

Here is the sample form:

Note: It’s important to read and understand the terms and conditions of the loan before submitting your application. If you have any questions or concerns, don’t hesitate to reach out to GSIS for clarification.

Also read: GSIS Member Can Now Apply for a Multi-Purpose Loan Plus: How to Avail

Application Process: Step-by-Step Procedures on How to Avail the GSIS Policy Loan

Here’s a step-by-step guide on how to apply for a GSIS Policy Loan:

a. Via GWAPS Kiosk

Step 1: Place your UMID-compliant eCard on the kiosk card reader.

Step 2: Confirm your identity by placing your finger on the biometric reader.

Step 3: Select ‘Policy Loan’ from the list of transactions.

Step 4: Confirm the loan application by placing your finger on the biometric scanner.

Step 5: Once you’re done with the transaction, press ‘Logout.’

b. Via eGSISMo

Step 1: Log in to your eGSISMO account using your BP number and password.

Step 2: Click on the ‘Loans Application’ icon and choose either ‘Regular‘ or ‘Optional‘ Policy Loan. Select the Loan Type (New or Renewal) and Payment Scheme (Monthly payments or payment upon maturity or termination of policy).

Step 3: Upload a picture of yourself holding your UMID/Temporary CARD or two valid government IDs if your UMID/Temporary CARD is lost. Save the file as JPEG or PDF.

Step 4: Confirm the Loan Agreement and click ‘SAVE.’

Step 5: Wait for an email confirmation from GSIS with further instructions.

c. Via E mail

Step 1: Fill out the Policy Loan Application Form* and prepare your GSIS UMID Card.

Step 2: Save the Application Form as a JPEG or PDF file and scan your UMID Card.

Step 3: Email the documents to your respective GSIS handling branch. (You can find a list of branches and their contact details on the GSIS website.)

Step 4: Wait for an email confirmation from GSIS with further instructions.

It’s important to provide accurate information during the application process to avoid any delays or rejections. If you have any questions or concerns, don’t hesitate to reach out to GSIS.

GSIS Policy Loan Payment Term

The GSIS Policy Loan provides you with flexible repayment options. You can choose to make fixed monthly payments, spreading out the cost of your loan over an agreed-upon period. Alternatively, you can elect to have your outstanding loan balance deducted from the value of your policy upon its renewal, maturity, or termination. Regardless of the repayment plan you opt for, the loan carries a competitive annual interest rate of 8%. It’s important to select a payment term that aligns with your financial circumstances to ensure comfortable repayment without causing financial strain.

Tips for Availing GSIS Policy Loan

Here are some tips for availing a GSIS Policy Loan:

- Understand Your Needs: Before applying for a loan, clearly identify your financial needs. This will help you determine the amount of loan you require and reduce the risk of borrowing more than necessary.

- Know the Terms and Conditions: Before applying, ensure you understand the terms and conditions of the loan. Familiarize yourself with the interest rates, repayment terms, and any penalties for late or non-payment.

- Check Your Eligibility: Make sure you meet all the eligibility criteria before applying. This includes being insured for at least a year, being in active service with an active insurance policy, holding an activated GSIS eCard, and having no pending administrative or criminal cases.

- Choose Your Repayment Term Wisely: Decide whether you want to make fixed monthly payments or have your loan balance deducted upon renewal, maturity, or termination of your policy. Consider your financial situation and choose the option that’s most convenient for you.

- Follow the Application Procedure: Follow the step-by-step procedure for applying, whether it’s via the GWAPS Kiosk, eGSISMo, or email. Make sure to provide accurate information to avoid delays or rejections.

Apolicy loan is a financial commitment. Make sure you’re able to repay the loan within the stipulated period to avoid future financial difficulties.

Summary

If you need financial support, a GSIS policy loan could be a viable option for you. This loan facility allows you to borrow money against your existing GSIS life insurance policy, which can either be a Life Endowment Policy or an Enhanced Life Policy. You have the option to choose between a fixed monthly payment or have your loan balance deducted from your policy upon renewal, maturity, or termination. Plus, the loan has a reasonable 8% interest rate. So if you’re in need of additional funds, consider exploring the possibility of a GSIS policy loan to help you achieve your goals.

Contact Information

Address: Leon Kilat St., Brgy. Kalubihan, Cebu City, 6000

Email: mvpeenriquez@gsis.gov.ph, gsiscebu@gsis.gov.ph

Website: gsis.gov.ph

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers)

or 1-800-10-8474747 (for Smart subscribers)