Are you or a family member in the pursuit of higher education, but grappling with the financial burden of tuition fees? The GSIS Education Loan could be the solution you need. This loan program is designed specifically for the dependents of active GSIS members who are currently enrolled in college. It operates on a “study now, pay later” model, providing much-needed financial support for your educational journey.

Also read: How to Be a Part of DSWD Sustainable Livelihood Program

This initiative allows you to concentrate on your academic pursuits, relieving you of the immediate stress of financing your education. The GSIS Education Loan is not just a financial aid, but an investment in your future career. With its convenience and easy accessibility, it paves the way for you to achieve your academic aspirations without the constant worry of financial constraints.

What are the Benefits of GSIS Financial Assistance-Educational Loan?

The GSIS GFAL – Education Loan offers several benefits to its beneficiaries:

- Financial Assistance: The program provides financial aid for tuition fees and other education-related expenses, alleviating the financial burden on families.

- Study Now, Pay Later Scheme: This scheme allows students to focus on their education without worrying about immediate repayment. The loan repayment starts only after the completion of education, giving borrowers ample time to secure a job and settle into their careers.

- Easy Application Process: The application process is straightforward and can be done online or through GWAPS Kiosks, making it accessible and convenient for GSIS members.

- Flexible Repayment Terms: Borrowers can choose between different repayment terms based on their financial situation. They can opt for fixed monthly payments or have the loan balance deducted upon renewal, maturity, or termination of their policy.

- Low Interest Rates: Compared to traditional loans, the GSIS GFAL – Education Loan offers competitive interest rates, making it a more affordable option for many families.

- Multiple Beneficiaries: A GSIS member can nominate up to two beneficiaries for the loan, providing educational support to more than one family member.

Remember, while these benefits are substantial, it’s important to thoroughly understand the terms and conditions before applying for the loan.

Who are the Qualified Borrowers?

To qualify for the GSIS GFAL – Education Loan, you must be an active member and meet the following criteria:

- Should have at least 15 years of service.

- Must have paid the latest three (3) monthly premium contributions for both Personal Share and Government Share at the time of application.

- Should not be on a leave of absence without pay at the time of application.

- Should have no pending administrative and/or criminal case at the time of application.

- Should have no past due GSIS loans, including housing loans.

- Agency status should not be “suspended.”

- Must meet the net take-home pay (NTHP) requirement as stipulated under the General Appropriations Act.

By meeting these requirements, you ensure that your application process goes smoothly and increases your chances of approval for the loan.

Who are the Qualified Student – Beneficiaries?

To qualify as a student-beneficiary for the GSIS GFAL – Education Loan, the following criteria must be met:

- Nationality and Residence: The student must be a Filipino citizen and a resident of the Philippines.

- Relationship to the Borrower: The student must be related to the GSIS member (the borrower) up to the third degree of consanguinity or affinity. This means they could be a child, grandchild, sibling, niece/nephew, or cousin of the borrower, or related by marriage up to the same degree.

- Course of Study: The student must be enrolled in an undergraduate course with a maximum study period of five (5) years.

- Co-Maker Agreement: Upon reaching the legal age, the student must agree to act as a Co-Maker on the loan. By doing so, they bind themselves to the terms and conditions of the loan.

Each qualified borrower can nominate up to two (2) student-beneficiaries. This allows a single GSIS member to support the education of more than one family member through this loan.

Requirements Needed for the GFAL-Education Loan

To apply for the GSIS GFAL – Education Loan, you must prepare and submit the following requirements:

1. Application Form (Annex A): This form should be properly filled out by both the borrower and the co-maker (if applicable). It must be endorsed by the Authorized Agency Office (AAO).

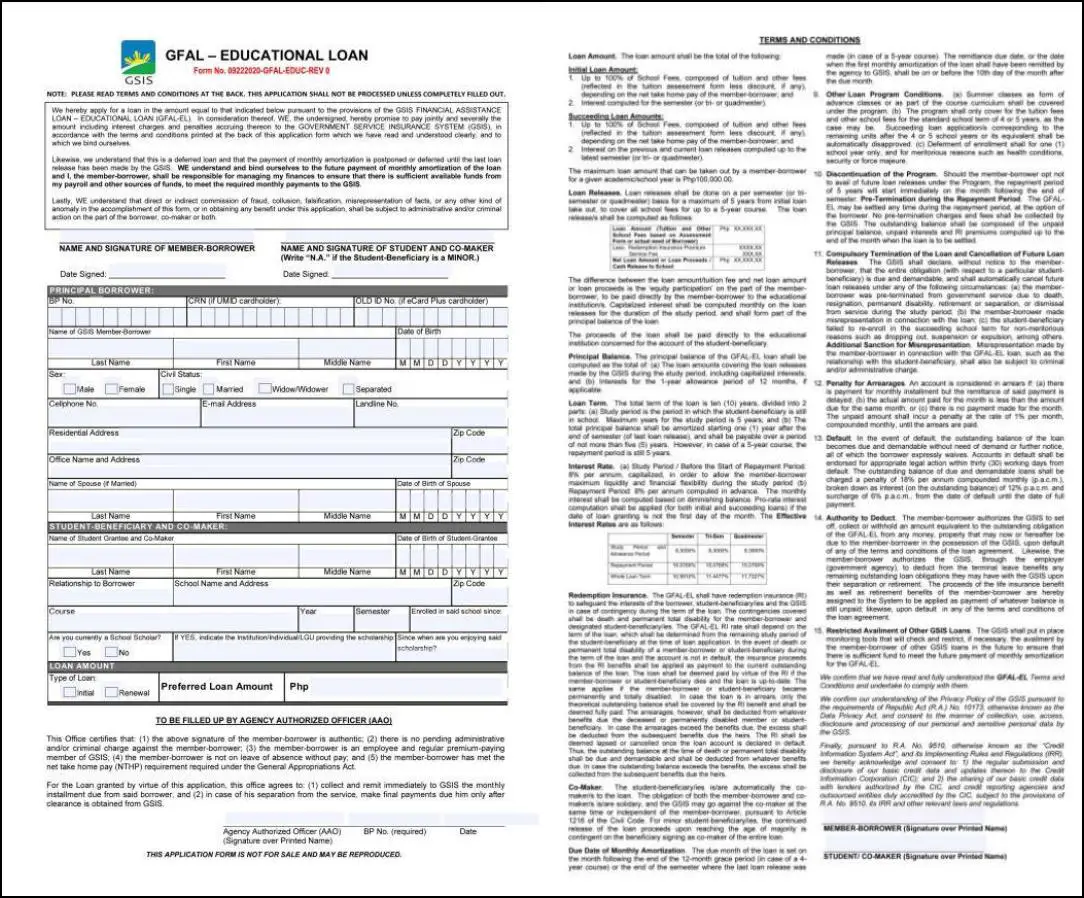

Here is the sample form:

2. Tuition Assessment Form: A photocopy of the latest Tuition Assessment Form is required. The original form should be presented for verification.

3. School ID: A photocopy of the front and back of the School ID, with three signatures of the student on the same page. In case the school ID is not available, any valid IDs showing the date of birth, picture, and signature of the student can be used. If there is a second student beneficiary, the same requirements apply. However, this will be considered as a separate loan application under this program.

Remember to fill out all forms accurately and completely to avoid any delays or issues with your application.

Also read: DSWD Program Pantawid Pamilyang Pilipino Program (4Ps): Helping Filipino Families in Need

Application Process: Step-by-Step Guide

Applying for the GSIS GFAL – Education Loan can be done through two methods: via eGSISMO or via Email.

Here are the step-by-step procedures for each method:

a. Via eGSISMO

Step 1: Log in to your eGSISMO account using your BP number and password.

Step 2: Click the Loans Application icon and choose GFAL-EL as the loan type. Specify whether it’s a new application or a renewal.

Step 3: Upload a picture of yourself holding your UMID/Temporary Card or two valid government IDs if your UMID/Temporary Card is lost. The file should be in JPEG or PDF format. Also upload a photocopy of the latest tuition assessment form and a photocopy of the school ID (front and back) with three signatures of the student-beneficiary on the same page.

Step 4: Confirm the Loan Agreement and click SAVE.

Step 5: Wait for an email confirmation from GSIS for tentative loan computation and a loan counselling session via video conference.

Step 6: Submit the original copies of the documents previously uploaded through eGSISMO.

b. Via Email

Step 1: Fill out the Educational Loan Application Form and take a scan of your GSIS UMID Card.

Step 2: Save the Application Form and the scan of your UMID Card as JPEG or PDF files.

Step 3: Email the following documents to your GSIS handling branch

Step 4: Accomplished/endorsed application form for GFAL-Educational Loan

Step 5: Photocopy of the latest tuition assessment form

Step 6: Photocopy of school ID (front and back) with three signatures of the student-beneficiary on the same page

Step 7: Wait for an email confirmation from GSIS for tentative loan computation and a loan counselling session via video conference.

Step 8: Submit the original copies of the documents previously submitted via email.

Following these steps should guide you through the application process smoothly.

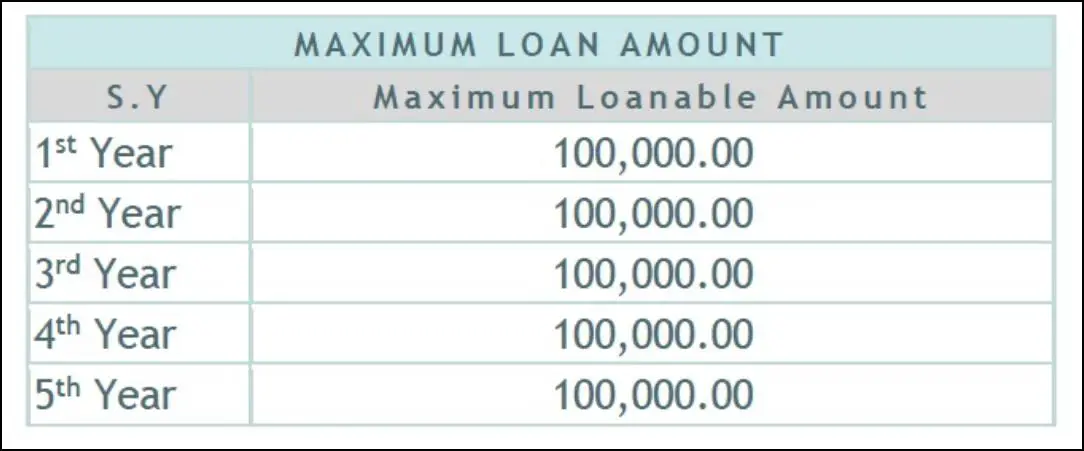

How Much is the Loanable Amount?

The GSIS GFAL – Education Loan program offers a maximum loanable amount of ₱100,000.00 for each School Year. For a five-year college degree, the maximum loanable amount increases to ₱500,000.00. This helps provide significant financial assistance to families and students aiming to pursue higher education, making it a valuable resource for those eligible.

Remember, it’s essential to plan your finances carefully and only borrow what you need and can afford to repay.

What are the Payment Terms?

The GSIS GFAL – Education Loan program offers a loan term of 10 years, including a grace period of five (5) years. This means that borrowers will only start repaying the loan from the sixth year onwards. The interest rate for the loan is set at 8% per annum.

This extended grace period allows borrowers to focus on the student’s education without the immediate pressure of repayments. However, remember that interest will still accumulate during this period. It’s important to plan ahead and ensure you can meet the repayment requirements when they begin in the sixth year.

Tips for Easy and Convenient Availing of GSIS Financial Assistance-Educational Loan

Availing the GSIS GFAL – Education Loan can be a smooth process if you follow these tips:

- Understand the Terms: Before applying, make sure you fully understand the terms of the loan, including the interest rate, grace period, repayment plan, and other details. This will help prevent any misunderstandings or issues down the line.

- Prepare Documents Early: Gather all necessary documents as early as possible to avoid delays. Make sure all forms are filled out correctly and completely.

- Check Eligibility: Ensure that you meet all the eligibility requirements for the loan. This includes being an active GSIS member with at least three years of premiums paid and having a net take-home pay not lower than the required minimum after all required monthly obligations have been deducted.

- Choose Your Beneficiary Wisely: Remember, you can nominate up to two student-beneficiaries. Choose students who are committed to their studies and can make the most of this financial assistance.

- Apply Early: Apply for the loan well before the funds are needed to allow sufficient time for processing and approval.

- Stay in Contact: Keep in touch with your GSIS handling branch for updates on your application status. Respond promptly to any requests for additional information or documentation.

- Plan for Repayment: While there is a five-year grace period, it’s important to start planning for repayment as soon as you take out the loan. This will ensure you’re prepared when repayments begin..

Remember, the GSIS GFAL – Education Loan is a commitment. Make sure you’re ready to meet the obligations associated with it before applying.

Frequently Asked Questions

1. Who can apply for the GSIS Education Loan?

Active GSIS members who have paid at least three years of premiums, are not on leave without pay, have no due and demandable loan account, and have a net take-home pay not lower than the required minimum after all required monthly obligations have been deducted.

2. How much can I borrow?

The maximum loanable amount is ₱100,000.00 per school year or up to ₱500,000.00 for a five-year course.

3. When do I start repaying the loan?

The loan repayment starts on the sixth year of the loan, after a maximum grace period of five years.

4. What is the loan term?

The loan term is 10 years, including the five-year grace period.

5. How many student-beneficiaries can a borrower nominate?

A borrower can nominate up to two student-beneficiaries.

6. Who can be a student-beneficiary?

The student must be a Filipino citizen, resident of the Philippines, related to the borrower up to the third degree of consanguinity or affinity, enrolled in an undergraduate course with a max study period of five years, and agree to act as co-maker upon reaching legal age.

7. Can I renew my loan?

Yes, you can renew your loan every school year up to a maximum of five years. The total loanable amount should not exceed ₱500,000.00.

Summary

The GSIS Education Loan program is a great resource for those looking to pursue a college degree. Children and relatives of active GSIS members are eligible for this financial assistance, which helps break down the financial barriers that often hinder educational pursuits.

By offering low interest rates and flexible repayment terms, the GSIS Education Loan program ensures that those pursuing a college degree don’t have to sacrifice their educational goals due to financial obstacles. So if you’re an eligible member seeking financial assistance, be sure to take advantage of this program and put yourself on the path to success.

Contact Information

Address: Leon Kilat St., Brgy. Kalubihan, Cebu City, 6000

Email: mvpeenriquez@gsis.gov.ph, gsiscebu@gsis.gov.ph

Website: gsis.gov.ph

For Provincial Calls: 1-800-8-847-4747 (for Globe subscribers)

or 1-800-10-8474747 (for Smart subscribers)