The Social Security System is a vital part of Philippine society. It serves as a safety net that provides financial protection to workers and their families in the event of death, disability, sickness, and old age. In addition to providing financial assistance, the SSS also promotes social cohesion and economic stability because it pools resources from both employers and employees.

Also Read: How to Get a Loan from SSS

Workers must keep track of their SSS contributions to receive the benefits they are entitled to. By checking their contributions online, workers can easily monitor their compliance with the law and ensure that they receive all of the benefits they are due. Doing so will help them safeguard their future security and financial stability. In addition, employers are encouraged to keep track of their employees’ SSS contributions to ensure that they comply with the law and pay their obligations to workers. This will help employers maintain a healthy relationship with their workers – especially in cases where employees need to claim certain benefits or avail of social protection programs.

How to Check Your SSS Contributions Online in Easy Steps

There are two ways to check your SSS contributions online: through the Member Portal, or the Mobile app.

To check your contributions through the Member Portal:

1. Go to the SSS website and log in to your account.

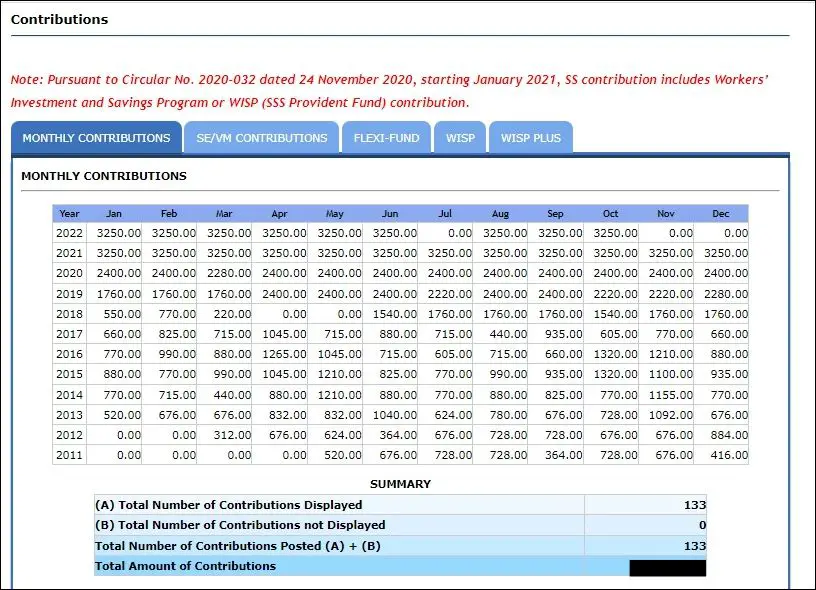

2. On the top menu, hover over “INQUIRY” and click on “Contributions.”

3. Your contributions will be listed by month, along with the total amount for that year.

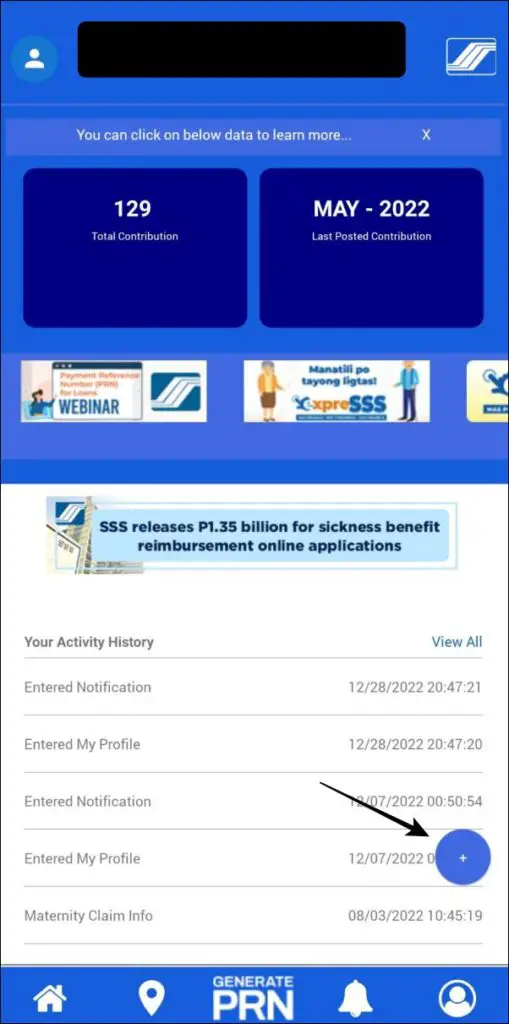

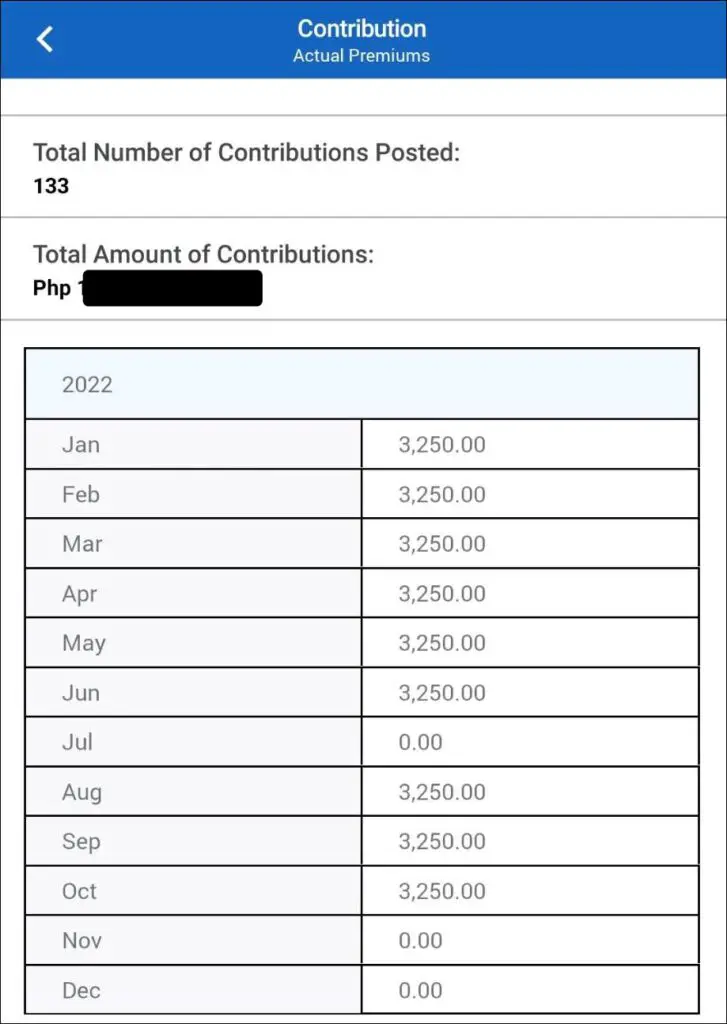

To check your contributions through the Mobile app:

1. Download the app from Google Play Store or Apple App Store.

2. Open the app and log in using your SSS Online account credentials.

3. Tap on the plus sign at the bottom of the screen, then select “Actual Premiums.”

4. Your contributions will be listed by month, along with the total number of contributions and the total amount of contributions.

The Importance of Tracking Your SSS Contributions

The Social Security System (SSS) is one of the most important social institutions in the Philippines. It provides social protection to workers and their families in the event of death, disability, sickness, and old age. Workers who are members of the SSS contribute a portion of their monthly salaries to the system, which is then used to finance the benefits that they may claim in the future. Employers also contribute to the SSS on behalf of their employees.

Aside from its primary function of providing financial protection to workers and their families, the SSS also helps promote social cohesion and economic stability. By pooling resources from workers and employers, the SSS provides a safety net that can be used in times of need. Given its importance, workers must keep track of their SSS contributions. This can be done by logging into their online account or by requesting a contribution history from their employer. Tracking one’s contributions is important not only for ensuring that benefits are properly received but also for monitoring compliance with the law.

Tips for Using the SSS Online Portal

The SSS Online Portal is a great tool for students to use to keep track of their loans and other important information. Here are some tips for using the portal:

1. First and foremost, be sure to register for an account on the portal. This will allow you to access your account information and make changes as needed.

2. Once you have registered for an account, take some time to explore all of the features that the portal has to offer. Familiarize yourself with where everything is located so that you can easily find what you’re looking for when you need it.

3. One of the most important features of the portal is the Loan Repayment Calculator. This tool can help you estimate your monthly loan payments, based on different repayment plan options. Be sure to use this tool when making decisions about your repayment plan.

4. Another great feature of the portal is the Documents section. Here, you can upload and view important documents related to your student loans. This is a great way to keep all of your information organized in one place.

5. Lastly, be sure to check out the News and Events section of the portal. Here, you can stay up-to-date on important news and events related to student loans and financial aid. This is a great resource for staying informed about changes that could affect your loan repayment plans or eligibility for certain programs.

Frequently Asked Questions

1. How do I know if my SSS contributions are up to date?

A: You can check the status of your SSS contributions online through the SSS website. The website will display a summary of your payments and other important information such as your SSS number, total monthly contributions, and cumulative balance. You can also check the status of your contributions by calling the SSS hotline or visiting any nearest SSS branch.

2. What if I forget my password?

A: If you forget your password, you can reset it online through the SSS website or contact the SSS hotline for assistance. You will be asked to provide some information such as your birthdate, email address, and SSS number to verify your identity.

3. What should I do if I encounter an error while trying to check my SSS contributions?

A: If you are experiencing difficulty accessing the SSS website or receiving an error message when attempting to view your contributions, try refreshing the page or clearing your browser’s cache. You can also contact the SSS hotline for assistance. Be sure to provide as much information about the problem as you can so that they can help you resolve it quickly.

4. Can I check my SSS contributions using my mobile phone?

A: Yes, the SSS website is mobile-friendly and can be accessed using most mobile phones. Additionally, you can also download the SSS Mobile app to check your contributions and manage other related services.

5. How often should I check my SSS contributions?

A: It’s a good idea to check your contributions at least once a month to make sure that they are up to date. This allows you to stay on top of any discrepancies or errors and take the necessary steps to resolve them quickly. Additionally, you can also set up reminders on the SSS website or SSS app so that you don’t forget to check regularly.

6. What information do I need to check my SSS contributions?

A: To access the SSS website, you will need your username and password. If you don’t already have an account, you can register for one online. Once logged in, you can view a summary of your payments and other important information. You can also call the SSS hotline or visit any nearest SSS branch for assistance.

7. What should I do if I find that my contributions are not up to date?

A: If you find that your contributions are not up to date, you can contact the SSS hotline for assistance. They can help you understand why your contributions are late and advise you on the best course of action to ensure that they remain up to date. You can also make payments online through the SSS website or SSS app.

8. What happens if I don’t pay my SSS contributions?

A: Failing to pay your SSS contributions on time could result in penalties. It is important to ensure that your contributions are up to date so that you can enjoy the benefits of being an SSS member. If you have any questions or need assistance with your payments, contact the SSS hotline for help.

9. Is there a penalty for late payments?

A: Yes, there is a penalty for late payments. The amount of the penalty depends on when the payment was made and how long it has been overdue. To avoid incurring penalties and fines, make sure to pay your contributions on time every month. If you are having difficulty making payments, contact the SSS hotline for assistance.

10. What are the benefits of checking my SSS contributions regularly?

A: Checking your SSS contributions regularly can help ensure that you remain up to date and avoid penalties for late payments. Additionally, it allows you to stay abreast of any discrepancies or errors and take the necessary steps to resolve them quickly. It also helps you understand how much you have contributed and how much more is needed to enjoy the full benefits of being an SSS member.

By following these steps and keeping your contributions up to date, you can ensure that you are a fully-contributing member of the SSS and will be able to take full advantage of all the benefits it offers. With just a few clicks, you can stay on top of your payments and manage your SSS account easily. So, make sure to check your contributions regularly.

Summary

Understanding your Social Security System (SSS) contributions is a crucial part of providing yourself with the financial security you need for retirement. Keeping track of your Social Security contributions lets you see how much money you are setting aside regularly, and how it grows over time. They represent a large portion of savings and investments, so tracking contributions is essential in being able to plan and save for retirement, as well as having access to Social Security benefits when needed. Keeping up with Social Security System Contributions also helps ensure that you are getting the most out of your Social Security benefits and can help alleviate future stress.

When it comes to Social Security System Contributions, taking the time to keep track of them can make a world of difference down the line. Knowing this information can help to ensure that you are in the best possible position financially when it comes to retirement. It also gives peace of mind knowing that all the necessary steps were taken for creating a safe financial future for yourself and your family. Tracking your SSS contribution is an important step toward creating financial stability and security in your life.

SSS Contact Information

Customer Service: 1-800-10-2255777

Email: member_relations@sss.gov.ph

Website: https://member.sss.gov.ph/members/