I received a text message on my phone saying that I was eligible to apply for a REVI credit line. This is a new type of credit that is powered by CIMB Bank. I was a little hesitant at first, but after doing some research, I decided to apply.

The process was very simple and only took a few minutes. I just had to enter some basic information and then wait for approval. Within a few days, I received a notification that my application had been approved.

The REVI credit line gives you access to credit and financial flexibility at your fingertips. You can use it for anything you need, such as emergencies, bills, or travel. It’s a great option for people who want more flexibility in their finances.

If you’re interested in applying for a Revi credit line, follow the steps below.

What is REVI Credit from CIMB Bank

REVI Credit is the first of its kind, all-in-one revolving credit line that gives Filipinos access to credit and financial flexibility at their fingertips. This is Powered by CIMB Bank and it is a type of credit or loan that you can apply online.

You can apply for a REVI Credit line through the CIMB Bank website or through the REVI Credit app. The application process is very simple and only takes a few minutes. Just enter some basic information and wait for approval.

Benefits

REVI Credit provides benefits such as:

- Credit line up to 250,000 pesos

- Interest rates as low as 1% per month.

- Through your mobile phone, you may get instant approval.

- Convert your unused credit line to cash (up to 70 percent of your entire credit limit).

- No annual fees

- Credit Life Insurance will help you get additional protection on your REVI Credit Line powered by PRU Life UK.

Requirements

- 2 Valid IDs

- Proof of income – The applicant should have a minimum gross monthly income of 10,000 pesos

- Download the REVI Credit app

- Must have an active Philippine mobile number

- Must have a Philippine mailing address

Qualifications

- Philippine citizen

- Existing CIMB Bank customers only

- Applicant must be 21-65 years old

Step by Step Procedure: How to sign up REVI Credit online

Here are the steps to sign up for REVI Credit online:

Step 1 – Download the REVI Credit App and Log in using your CIMB Bank credentials if you are a existing CIMB Bank Customer. If you do not have CIMB Bank account yet, download the CIMB Bank Ph App and open an account. Once done, open the REVI Credit App and tap Register an account.

Step 2 – Check your eligibility to apply and prepare your Valid ID and required documents to proceed.

Step 3 – Click on “lets begin” to give CIMB bank access to the necessary data for your account opening. Your information will be used only for verification purposes only. data privacy and security is Banks top priority.

Step 4 – Enter your desired REVI Credit Limit, which will subject for approval, and press Continue.

Step 5 – You will be required to provide some personal details.

Step 6 – Input the details of your Emergency Contacts and Employer to continue.

Step 7 – Your submitted documents will be verified, which may take up to 2 banking days.

Step 8 – Congratulations, your REVI Credit line has been approved! You can now use REVI Credit for your bills payments, shop online, convert to cash, and more!

Above are the steps in order for you to get and enjoy REVI Credit. Be sure to check out the REVI Credit website or app for more information.

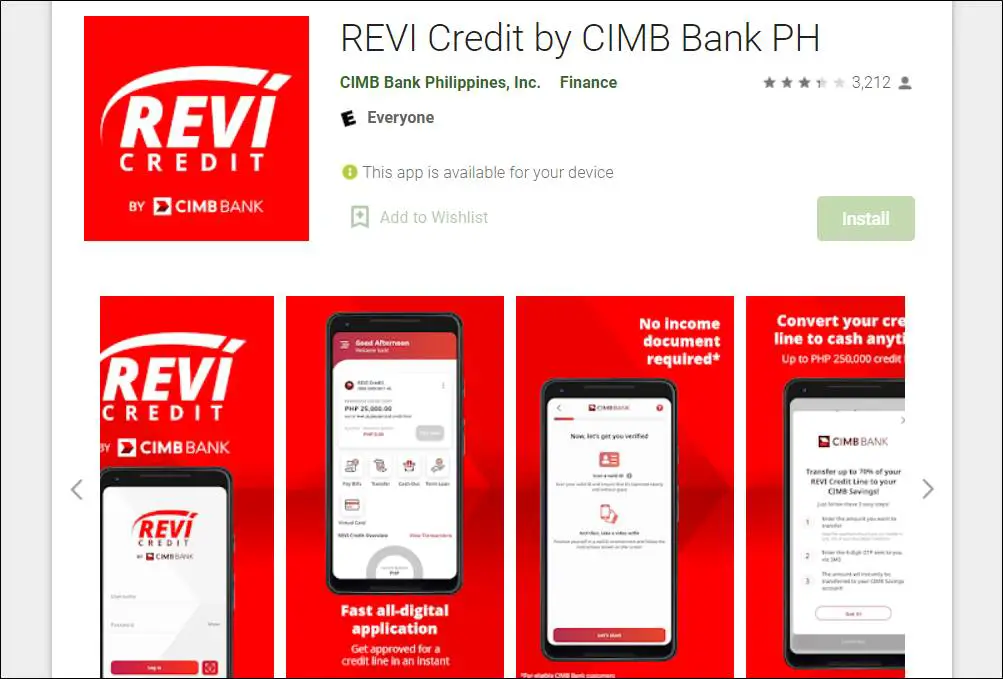

Download the REVI Mobile App

In case you are wondering how to download kindly click the links below.

Google Play on android – https://play.google.com/store/apps/details?id=com.cimbph.app.a2021&hl=en&gl=US

Apple App Store – https://apps.apple.com/ie/app/revi-credit-by-cimb-bank-ph/id1551996011

Video: Instant Approval REVI Credit Account

Check out this video uploaded on youtube by a Filipina who shares her experience applying for REVI Credit . She applied for a REVI Credit of Php 50,000 and was approved instantly.

Frequently Asked Questions

Below are some asked questions about the REVI Credit in the Philippines:

1. What are the benefits of having a REVI Credit Line?

You can use the REVI Credit for anything, from bills to emergencies. Traditional banks typically only offer one product and require extensive paperwork that may take days to process. It is also more convenient because you can apply using your smartphone

2. What are the requirements/qualifications?

To be eligible for REVI Credit, you must meet the following requirements: be a Philippine citizen, 21-65 years old, have a minimum gross monthly income of 10,000 pesos, existing CIMB Bank customer or open an account with CIMB Bank.

3. What is the credit limit for REVI Credit?

250,000 is the credit limit for REVI Credit in Philippine Peso terms. Be advised that this amount is dependent on your salary so the actual credit limit may vary. In my case I received a credit limit of 50,000 pesos.

4. What is the interest rate for REVI Credit?

The interest rate for REVI Credit is as low as 1% per month.

5. How do I convert my unused credit into cash?

Download the REVI Credit app and there is an option to convert 70% of your credit to cash.

6. How do I pay with REVI credit?

Go to REVI Credit app and choose CIMB bank PH. You will have the option to make a payment in the app.

Summary

REVI Credit is a type of credit or loan that you can apply online for Filipinos who are looking for financial flexibility. The requirements are 2 Valid Id, Proof of income, and an active Philippine mobile number. You will also need to have a Philippine mailing address. Qualifications include being a Philippine citizen and existing CIMB Bank customers only . The age requirement is 21-65 years old. Once you are approved, you can use your REVI Credit Line for anything from bills payments to emergencies.

I applied for this credit just to have extra cash and got approved for 50,000 pesos. I used it to pay some bills and it worked out great for me. This is a good credit to have if you need some extra cash. The interest rate is low and there are no hidden fees. Be sure to watch the video above on how to apply.