Are you tired of the hassle and inconvenience of traditional banking? Do you want a bank that truly understands your needs and empowers you to take control of your finances? Look no further than GoTyme Bank! With its revolutionary digital banking services, GoTyme Bank offers an unparalleled banking experience that will transform the way you manage your money. Imagine having the power to access your accounts, make transactions, and track your spending 24/7, right from the palm of your hand.

Also Read: How to Apply Cebu CFI Coop Membership

GoTyme Bank, the epitome of innovation and digital excellence in the banking realm, is a trailblazing financial institution that has redefined the way we approach banking in the digital age. As a cutting-edge digital bank, GoTyme Bank prides itself on its seamless integration of technology, empowering customers with unparalleled convenience and control over their financial journey. With a steadfast commitment to financial inclusion and personalized experiences, GoTyme Bank has emerged as a frontrunner in the ever-evolving landscape of modern banking.

Main Features and Benefits of GoTyme Bank

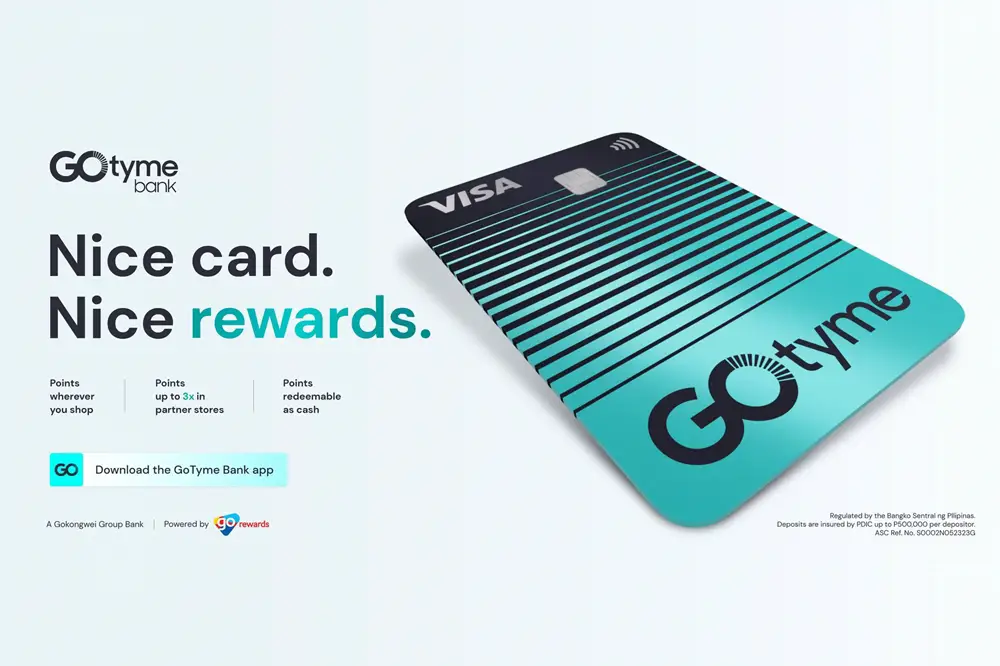

- Rewards Mechanics: GoTyme Bank’s best feature is its ability to earn rewards points. When they started doing campaigns inside Robinson’s Malls, a customer could earn three times the rewards towards their GoRewards account. It will greatly benefit the account holders to apply for a GoTyme Bank Account.

- Free Visa Debit Card: Once you’ve complied with the requirements, you can get your card instantly at the kiosk. There are GoTyme Ambassadors available for you all throughout the process of applying and getting your card within a few minutes.

- Convenience: Digital banking offers unmatched convenience, allowing customers to access their accounts and conduct financial transactions anytime, anywhere. With online and mobile banking, customers can check account balances, transfer funds, pay bills, and manage their finances without the need to visit a physical branch.

- 24/7 Access: Unlike traditional banking, digital banking provides 24/7 access to your accounts and services. Whether it’s during business hours or in the middle of the night, you can monitor your account activities and make transactions at your convenience.

- Enhanced Security: Reputable digital banking platforms implement robust security measures to safeguard customer information and financial transactions. Encryption, multi-factor authentication, and biometric login options are some of the advanced security features that protect against unauthorized access and ensure the safety of your funds.

- Speed and Efficiency: Digital banking streamlines financial processes, resulting in faster and more efficient transactions. Money transfers, payments, and account updates are processed in real time, minimizing delays and ensuring that your financial needs are met promptly.

- Access to Financial Tools: Digital banking often provides access to a range of financial tools and resources to help customers manage their money effectively. Budgeting apps, spending trackers, financial calculators, and personalized insights are some of the tools available to enhance financial planning and decision-making.

Also Read: Cebu Rental Motorbikes Services: Affordable Scooters for Rent

Where and How to Apply for a GoTyme Bank Account

Applying for a GoTyme Bank Account is very simple. Go to the nearest location where a GoTyme Bank Kiosk will be available. There are currently selected locations where a kiosk is available here in Cebu, Philippines. You can open an account at the kiosk, collect your free ATM Debit card, and talk to a Bank Ambassador, You may ask for assistance in opening your GoTyme Bank account and ask for details about how to manage your account or ask bank-related queries you may have.

Kiosk Locations

The Marketplace Galleria Cebu

Address: Robinsons Place – General Maxilom Avenue, Brgy. Tejero, Villagonzalo, Cebu City Capital, Cebu, Philippines, 6000

Robinsons Supermarket Robinsons Place Cebu

Address: Fuente Osmena cor. F. Ramos St., Sta. Cruz, Cebu City, Cebu, Philippines, 6000

Robinsons Supermarket Banilad Cebu

Address: Basement, Banilad Town Center, Gov. Cuenco Ave., Banilad, Cebu City, 6000

Robinsons Department Store Robinsons Place Cebu

Address: Levels 1 2 & 3 Robinsons Fuente Sta. Cruz Fuente Osmena Blvd. Cebu City

The Marketplace Ayala Center Cebu

Address: Basement 1, Ayala Center Cebu, Cebu Business Park Luz, 6000, Cebu City, Cebu Capital, Philippines

Robinsons Supermarket Baseline Center Cebu

Address: Baseline Center, Juana Osmena St., Capitol Site, Cebu City, Cebu

Shopwise Basak Cebu

Address: Cebu South Road, Basak Pardo, 6000, Cebu City, Cebu, Philippines

Robinsons Department Store Robinsons Galleria Cebu

Address: Levels 1 2 & 3 Robinsons Galleria Cebu General Maxilom Ave. cor. Sergio Osmena Blvd. Brgy. Tejero Cebu City

Robinsons Easymart Cabahug Cebu

Address: Unit BDB 1-1 to 1-6, F. Cabahug, Kasambagan, Cebu City, 6000, Cebu, Philippines

Robinsons Easymart Platinum Plaza Pardo Cebu

Address: Cebu South Road cor. Sunrise Village, Pardo Pob., 6000, Cebu City Capital, Cebu, Philippines

The Marketplace Banawa Cebu

Address: Paseo Arcenas, R. Arcenas St, Cebu City, 6000 Cebu Cebu City – Cebu Philippines

Requirements for Applying a GoTyme Bank Account

- Registered SIM Mobile phone number.

- Valid Philippine ID. Or any of the following IDs are acceptable:

- Passport

- UMID

- SSS ID

- Postal ID

- PRC

- Driver’s license

- Voter’s ID

- PhilSys ID

- And your personal information like Name, Address, Occupation.

Also Read: Cebu City’s Vibrant Colon Night Market

FAQs of GoTyme Bank Account

-

How many Go Reward points will be earned when you scan to purchase items?

GoTyme Bank will give 1 point for every PHP600 spent on QR Ph Payments. If the merchant is a partner store, they can earn additional points from Go Rewards granted they present their Go Rewards QR code to the merchant at their standard earn rate.

-

What is GoTyme Bank?

It is a new digital bank for the Philippines, with its mission to bring better financial inclusion for Filipinos. It is a partnership between the Gokongwei Group, which is one of the biggest conglomerates in the Philippines.

-

Is GoTyme Bank real and legit?

Yes, GoTyme Bank is fully licensed and regulated by the BSP or Bangko Sentral ng Pilipinas.

-

Will my money be safe with GoTyme Bank?

Yes, with GoTyme Bank you will be protected as it is a licensed bank regulated by BSP and all deposits are insured by Philippines Deposit Insurance Company (PDIC) up to PHP 500,000 per depositor.

-

Who can open A GoTyme Bank account?

Filipino citizens are eligible to open GoTyme Bank accounts that have a valid Philippine address, ID, and a registered SIM mobile number. Also, you must be at least 18 years old.

-

What are the documents and information needed to open a GoTyme Bank Account?

Sim Registered Mobile Phone numberPhilippine ID (Passport, UMID, SSS ID, Postal ID, PRC, Driver’s License, Voter’s ID, PhilSys ID.

Personal Information such as your Name, DOB, and Address. -

Is there a fee to put money in your GoTyme Bank account?

Cash-in is free to any of Robinsons Retail locations.

-

Do I earn interest with GoTyme Bank?

Yes, there is no minimum or maximum deposit balance requirement to earn interest. You can get 5% interest per year, credited monthly to your Go Save account.

-

How can I send money from a GoTyme Bank account to another GoTyme Bank account?

You will need your GoTyme Bank mobile number, email address, or account number to the sender. They can easily transfer money, and transfers between GoTyme Bank customers are instant and free.

-

Is there an option to send money from my GoTyme Bank account to another bank or e-wallet?

Yes, you can send money to another Bank via PESONet and Instapay. Simply log in to your account, and fill out the recipient’s bank or wallet information. You will be asked to enter your passcode or a quick facial ID check to approve the transfer for security purposes.

-

Is there an option to purchase mobile data or other telco products or vouchers in the GoTyme Bank App?

Yes, you can look for the “Buy Load” button from the Home Page. Follow the on-screen instructions to purchase the desired product or vouchers.

-

Can I cash out of my GoTyme Bank account?

Yes, you can cash out for Free from any of the partner Robinsons retail locations.

-

Will the funds be returned back to the account owner if it was not credited to the recipient?

Yes, it will be credited back to the GoTyme Bank account the next banking day if the transfer is not successful.

-

Where can we download the GoTyme Bank Application?

You can download the app through the Google Play Store or Apple Store. There’s no option to download from the Huawei App Gallery yet.

-

Is there a customer service or customer support?

Yes, the Customer Success team will be able to assist you with any concerns like requesting a bank statement. Please call #GO8888 or email help@gotyme.com.ph.

Conclusion

Applying for a GoTyme Bank account is the smartest choice for modern-day banking needs. With its innovative digital banking services, GoTyme Bank offers unbeatable convenience, enabling you to manage your finances on your terms, anytime, and anywhere. GoTyme Bank ensures that your financial information and transactions remain safeguarded at all times. Additionally, GoTyme Bank’s commitment to financial inclusion ensures that everyone, regardless of their background, can access reliable banking services and embark on a path towards financial empowerment. Say farewell to the limitations of traditional banking and embrace the future of finance with GoTyme Bank. Don’t miss this opportunity to take charge of your financial journey and experience the ultimate ease, efficiency, and support that only GoTyme Bank can provide. Apply now and discover the true potential of digital banking!