The Social Security System (SSS) offers a retirement benefit program that serves as a financial safety net for retired workers who have reached the stipulated age of retirement. This program is a testament to the years of hard work and dedication put in by individuals throughout their careers. The provision of a monthly pension becomes a supportive measure to manage living costs after retirement.

Also read: How to File for SSS Unemployment Benefit

In today’s digital age, the convenience of applying for this benefit online is a significant advantage. This feature not only saves time but also allows applicants to submit their requests without leaving their homes. Being aware of and leveraging the SSS Retirement Benefit is something every worker should consider as they approach retirement age. It is indeed a rewarding incentive that acknowledges their years of service and contribution.

What is SSS Retirement Benefit?

The Social Security System (SSS) offers a retirement benefit to qualified members who have reached the retirement age of 60 years old or above. This benefit provides regular monthly payments to help with living costs and is available for as long as the member lives. The amount of benefit received depends on the number of years that the member has contributed to SSS, and will be adjusted if the amount of contributions changes over time.

Who are the Qualified Members?

Members who qualify for the SSS benefits include:

1. Self-Employed Members

- Those who are between the ages of 60 and 64 at the time of retirement.

2. Voluntary Members

- Individuals who are between the ages of 60 and 64 at the time of retirement.

3. Employed Members

- Members who are employed and are between the ages of 60 and 64 at the time of retirement.

4. All SSS Members

- To be eligible for retirement, an individual must be at least 65 years old, regardless of their employment status.

Pre-requisites for Online Filing

- Registered My.SSS Account: The member must have a registered account on the My.SSS portal.

- Disbursement Method: The member should either have a UMID card enrolled as an ATM or an approved disbursement account such as any PESONet-accredited bank, E-wallet, or Remittance Transfer Companies/Cash Payout Outlets enrolled in the Disbursement Account Enrollment Module (DAEM) on the My.SSS portal.

If applying for specific benefits:

- Monthly Pension: The member must have contributed for at least 120 months prior to the semester of the month of Retirement Claim Application (RCA) submission.

- Lump Sum Benefit: The member must have at least one month’s contribution.

These requirements ensure that the application process is smooth and that the member is eligible for the benefits they are applying for.

Also read: How to Get a Loan from SSS

Steps on How to File a Retirement Claim Application Online

Here’s a clear step-by-step guide on how to file your Retirement Claim Application online:

Step 1: Login

Access your My.SSS member account via the SSS website.

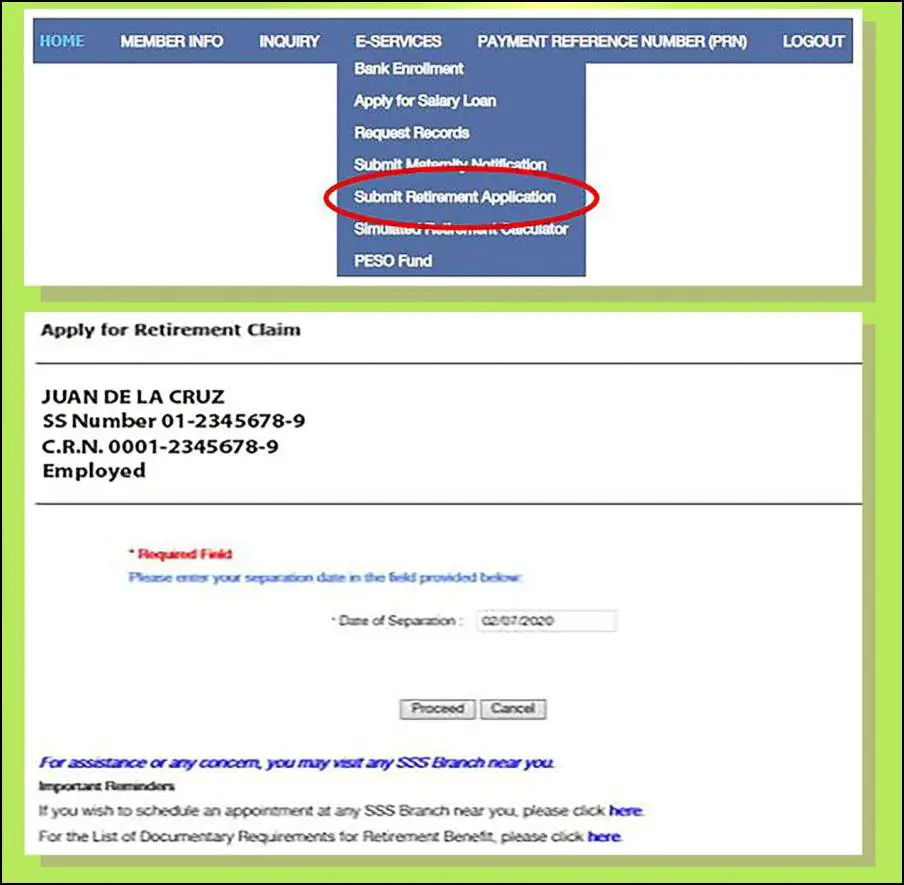

Step 2: Navigate to Retirement Application

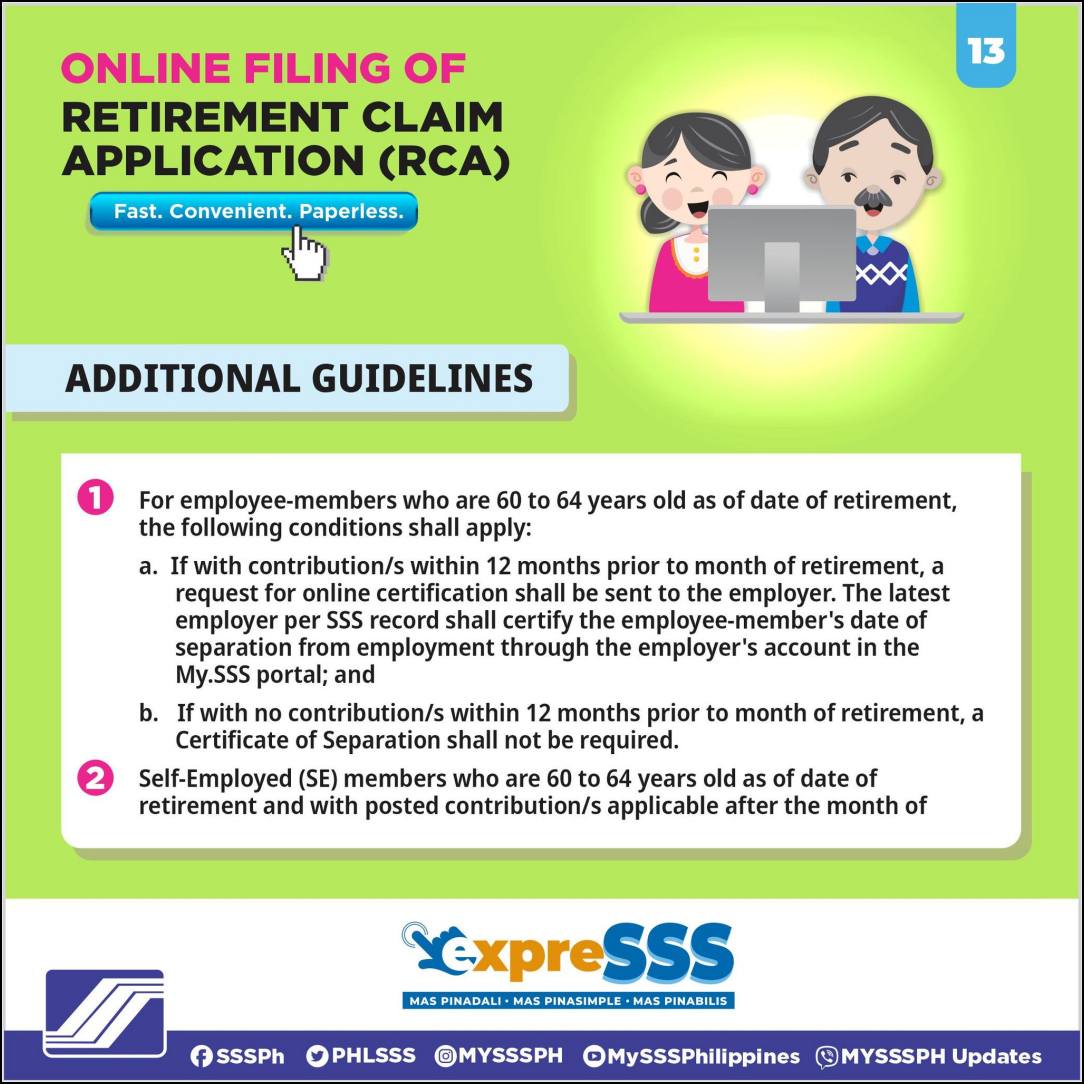

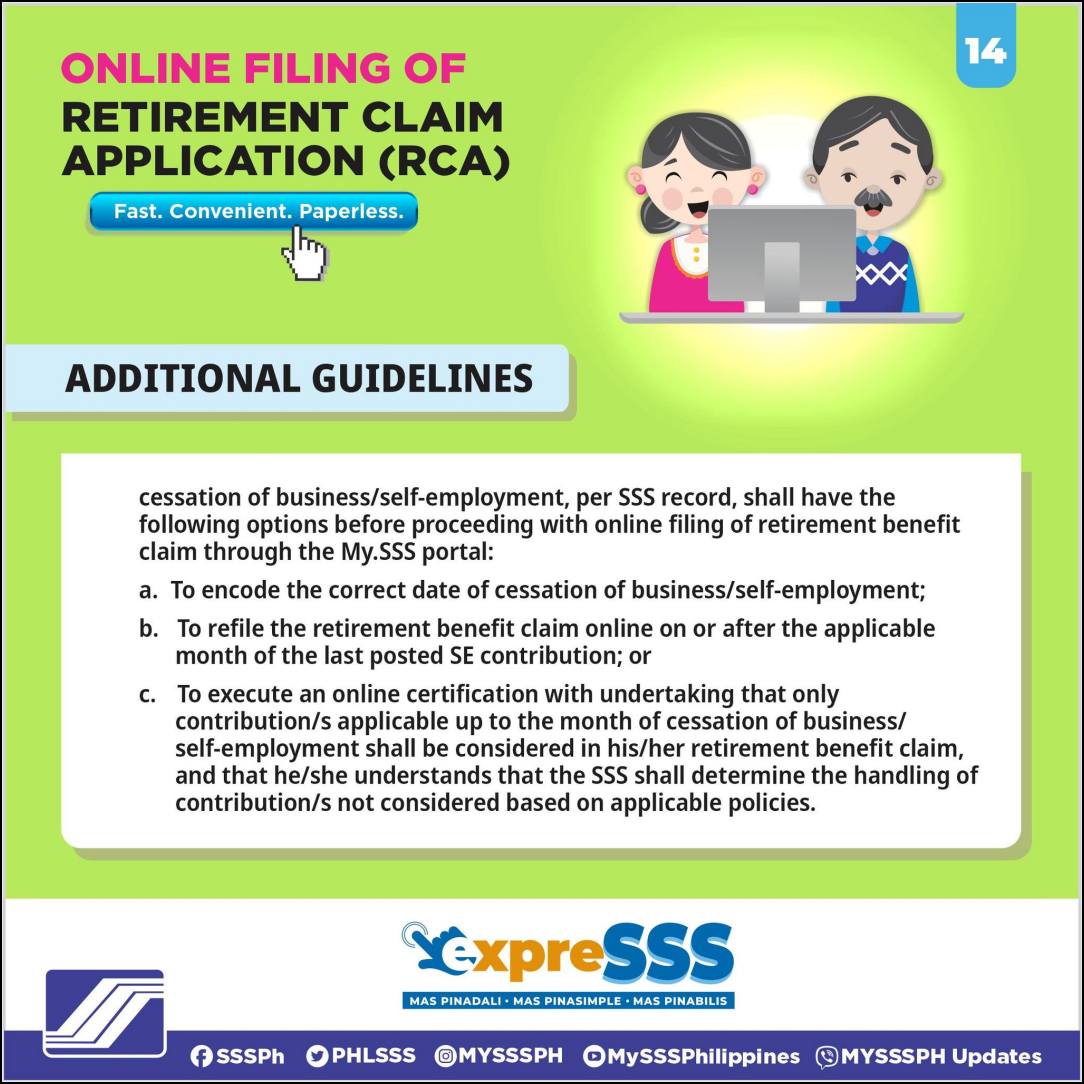

Click on “Submit Retirement Application” under the E-services tab. For employed members, the date of separation from employment is required. For self-employed members, the date when the business or self-employment ceased is required.

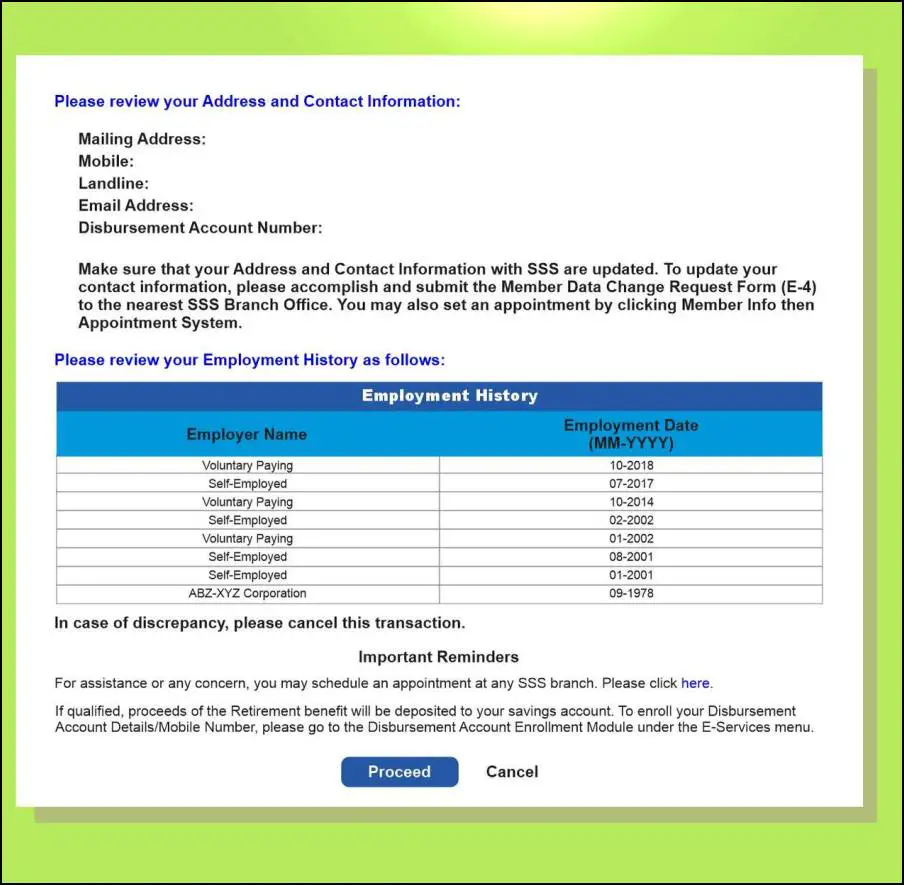

Step 3: Review Details

Check your address, contact information, and employment history. If all the details are correct, you can proceed to verify your eligibility for retirement benefits.

Step 4: Answer Additional Questions

Respond to some specific questions about your employment history, such as whether you’ve worked as a mineworker or racehorse jockey, and if you have any dependent children.

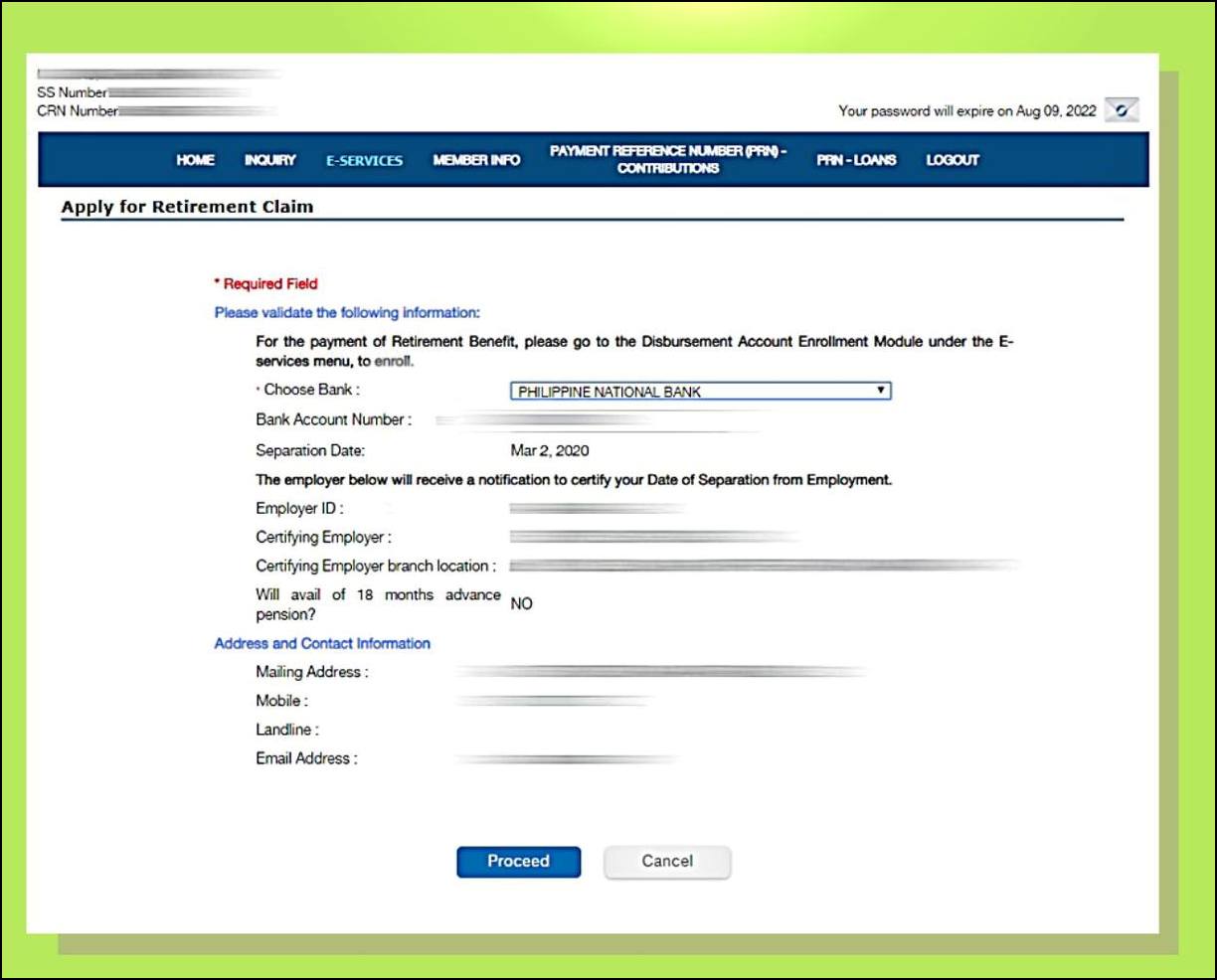

Step 5: Disbursement Method

If you’re eligible, the proceeds will be deposited by default to your UMID-ATM. If you don’t have one, it will be deposited to your preferred disbursement account enrolled through the Disbursement Account Enrollment Module (DAEM).

Step 6: Choose Pension Option

Decide if you want to avail of the advanced 18 months retirement pension. This option is not available for retirees with more than 15 months of accrued pension benefits.

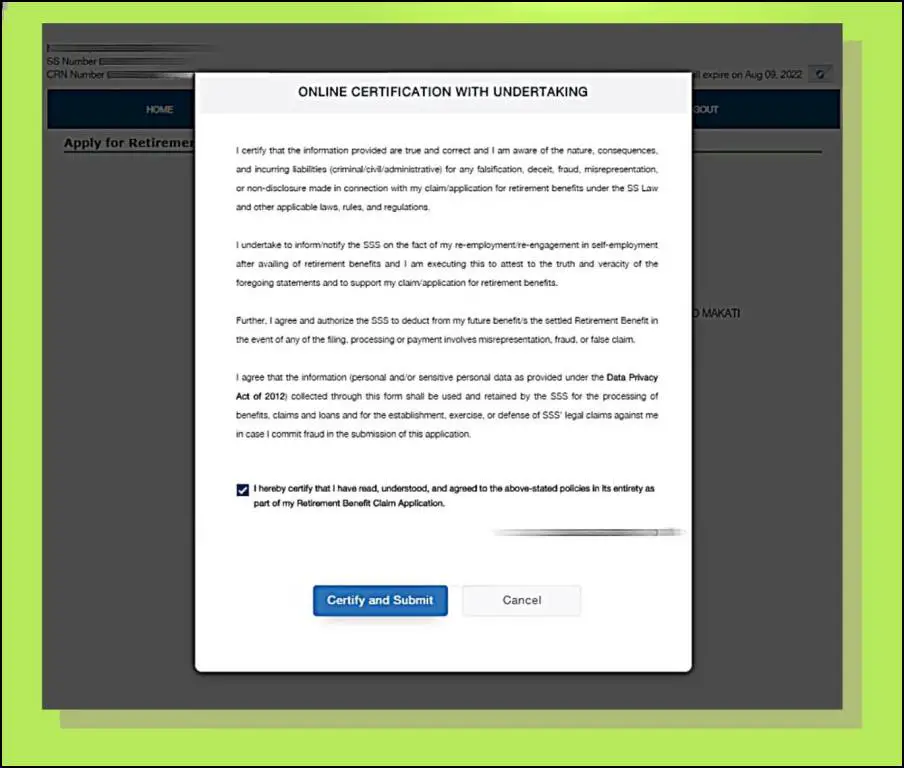

Step 7: Certify and Submit

Read the Online Certification with Undertaking carefully and click on the “Certify and Submit” box to agree and proceed.

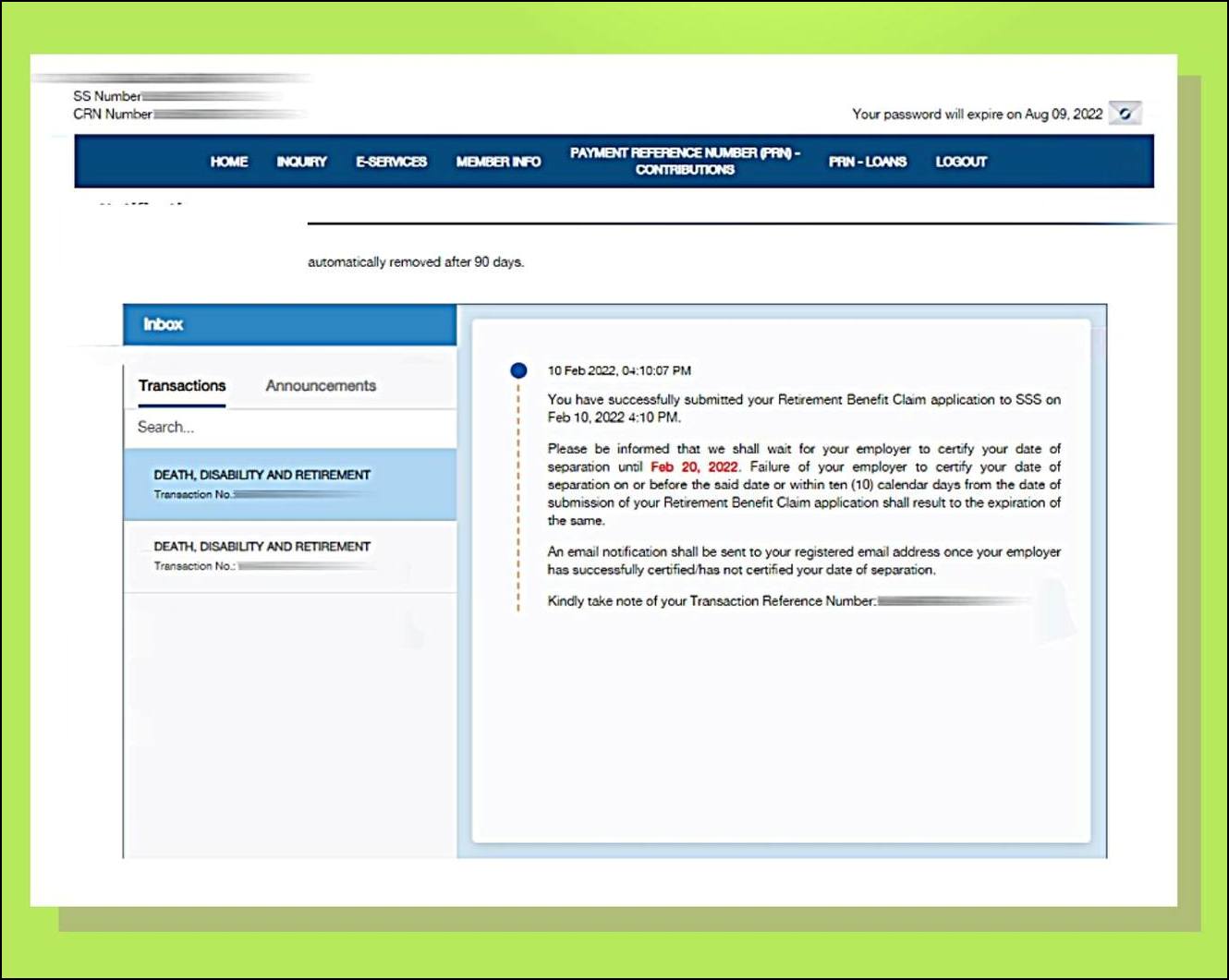

Step 8: Confirmation

Note down the transaction number and check your email and push notification inbox in your My.SSS account for updates from SSS regarding the status of your Retirement Claim Application.

Who is Ineligible to File a Retirement Claim Online?

Certain members are unable to apply for retirement benefits online due to specific conditions. In these cases, the retirement benefit claims must be filed at any SSS branch office or foreign representative office:

- Outstanding Loans: Members with outstanding balances on Stock Investment Loan Program (SILP), Privatization Loan Program, Education Loan, or Vocational Technology Loan cannot apply online.

- Guardianship of Dependents: If a member has dependent child/children under their guardianship, they cannot apply online.

- Incapacity or Institutional Confinement: Members who are incapacitated, under guardianship, or confined in an institution such as a penitentiary, correctional institution, or rehabilitation center, are not eligible for online application.

- Portability Law or Bilateral Social Security Agreements: Applications under the Portability Law or Bililateral Social Security Agreements cannot be made online.

- Claim Adjustment or Re-adjudication Application: Members who have an ongoing application for adjustment or re-adjudication of a claim cannot apply online.

- Unclaimed Benefit from a Deceased Member: Members who have unclaimed benefits from a deceased member are ineligible for online application.

These members will need to apply in person at an SSS office to receive their retirement benefits.

Also read: How to Apply SSS Disability Claim Online

MUST READ GUIDELINES

Tips When Applying for SSS Retirement Benefits

When applying for SSS retirement benefits, it’s important to be well-prepared and informed.

Here are some useful tips to help you navigate the process:

- Know the Requirements: Familiarize yourself with the eligibility criteria and necessary documents for the application. This includes understanding the age requirements and having the necessary proof of employment or self-employment.

- Prepare Your Documents in Advance: Gather all required documents beforehand. This may include your birth certificate, employment records, and other relevant identification documents.

- Leverage Online Services: Utilize the My.SSS portal for a convenient and efficient application process. This allows you to submit your application from the comfort of your home.

- Check Your Eligibility Carefully: Ensure you meet all the requirements before applying. Generally, you should be at least 60 years old and no longer employed, or 65 years old, whether still employed or not.

- Plan Your Claim: The timing of your claim can impact the amount you receive. Strategically plan when to file your claim based on your personal circumstances and needs.

- Monitor Your Application: Keep track of your application’s status through your My.SSS account. This helps you stay updated on any progress or required actions.

- Seek Assistance When Needed: If you encounter any issues or have questions during the application process, don’t hesitate to reach out to SSS for help.

Remember, everyone’s situation is different, so it’s beneficial to consult with a professional or directly contact SSS for personalized advice and information.

Video: How to apply SSS Retirement benefit online? 2023 update

Summary

As individuals approach retirement age, they often begin to consider their financial security. One important aspect of retirement planning is submitting a Social Security System (SSS) Retirement Claim. This claim allows eligible individuals to receive monthly financial assistance from the government when they reach the age of 60 or older.

While the process of submitting a claim can seem daunting, the SSS offers assistance and guidance to ensure applicants receive the benefits they are entitled to. Taking the time to submit a Retirement Claim can provide peace of mind and financial stability during retirement years.

Contact Information

Customer Service: 1-800-10-2255777

Email: member_relations@sss.gov.ph

Website: https://member.sss.gov.ph/members/