As a retiree or a recipient of Total Disability or Survivor Pensioners from the Social Security System (SSS), it is essential to keep your disbursement accounts updated. Ensuring that your information is correct and up-to-date is crucial to avoid erroneous payments and delays in receiving your pension benefits.

Also read: Guide to Applying for an SSS Pension Loan: Online and Manual Processes

By regularly updating your account, you can guarantee that your pension payments are received on time and that any changes to your account are accurately recorded. Remember, taking the time to maintain your disbursement account is an excellent investment for your future and can give you peace of mind knowing that you’ll receive your pension benefits without any complications.

Benefits of Updating Pensioner’s SSS Disbursement Account

Updating a pensioner’s SSS disbursement account can have several benefits:

- Convenience: With an updated disbursement account, pensioners can receive their monthly pensions directly into their chosen bank account or e-wallet, eliminating the need to visit an SSS branch or wait for a check in the mail.

- Timely Receipt of Benefits: Regularly updating account information ensures that there are no delays in the disbursement of pension benefits due to outdated or incorrect account details.

- Increased Security: By enrolling in an online disbursement system, pensioners can reduce the risk of fraud or theft that could occur with physical checks.

- Ease of Tracking: It’s easier to monitor and manage pension benefits when they’re directly deposited into a bank account or e-wallet. With online access, pensioners can check their balance, review transactions, and manage their funds at any time.

- Flexibility: Pensioners can enroll up to three disbursement accounts, allowing them more flexibility in managing their benefits.

Remember, it’s important to keep your disbursement account details up-to-date to enjoy these benefits fully.

What are the Required Documents for Updating SSS Disbursement Account?

When updating your SSS Disbursement Account, the following documents are required:

a. Identification Purposes

- One primary ID Card/Document or two valid ID cards/documents. Both of these should have your signature, and at least one should have your photo.

b. Additional Documents

If you’re using a PesoNet-participating bank, you need to provide:

- A photocopy of a validated deposit slip and

- Your passbook or a statement of account.

Please note that these documents must show your name, the bank’s name, and your savings account number.

c. For e-wallet/RTC/CPO Users

- You’ll need to provide a screenshot of your mobile app account.

Please ensure all the information in these documents is accurate and up-to-date to prevent any issues with your disbursement account update.

Steps on How to Update SSS Disbursement Account

Here’s how to update your SSS Disbursement Account online, whether you’re a retiree, Total Disability Pensioner, or a Survivor Pensioner:

A. For Retiree and Total Disability Pensioners

Step 1: Register or log in to the My.SSS Portal.

Step 2: Enter your new account details in the Disbursement Account Enrollment Module (DAEM) found under the E-services menu.

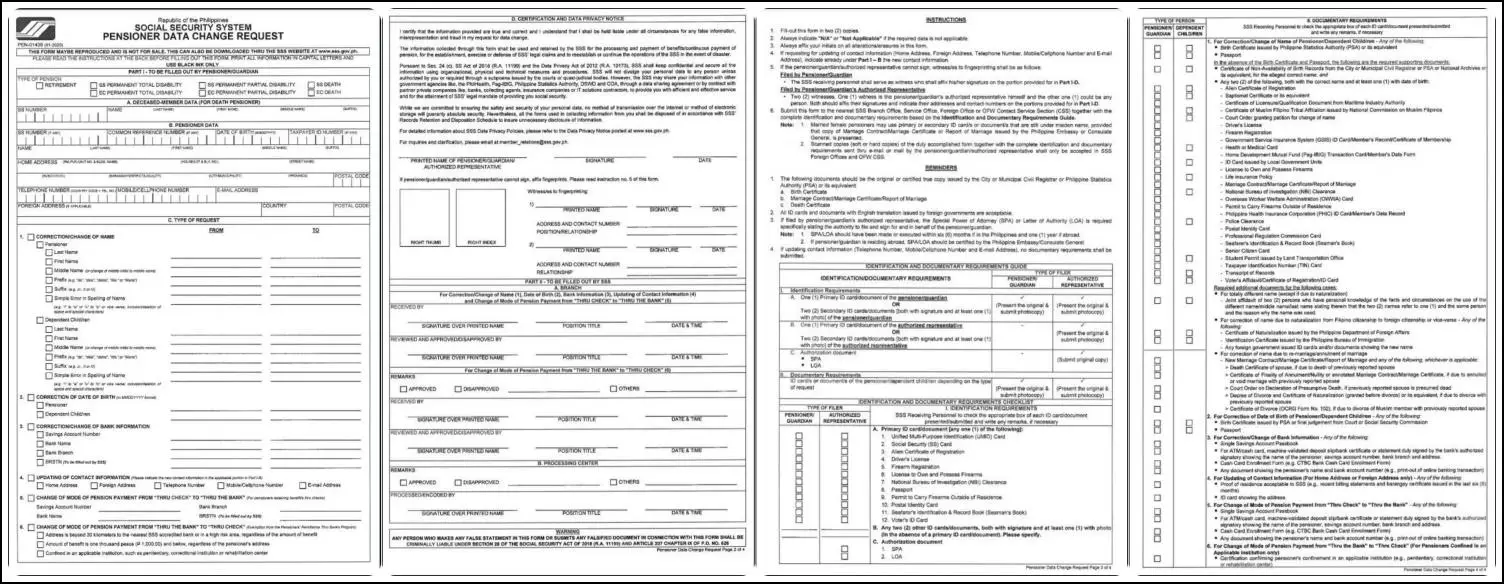

Step 3: Download the Pensioner Data Change Request (PDCR) Form and fill it out.

Step 4: Submit the completed PDCR Form along with the required supporting documents to the nearest SSS branch. Alternatively, you can also send them through the SSS corporate email.

B. For Survivor Pensioners

Step 1: Download the PDCR Form and fill it out.

(You can download this form at https://www.sss.gov.ph/sss/DownloadContent?fileName=Pensioner_data_change_request2020.pdf)

Sample PDCR Form:

Step 2: Submit the completed PDCR Form and the necessary supporting documents to the nearest SSS branch. You also have the option to send them through the SSS corporate email.

Remember to double-check all the information you’ve entered and ensure that all the documents you submit are completed accurately.

SSS Important Reminders to All SSS Pensioners

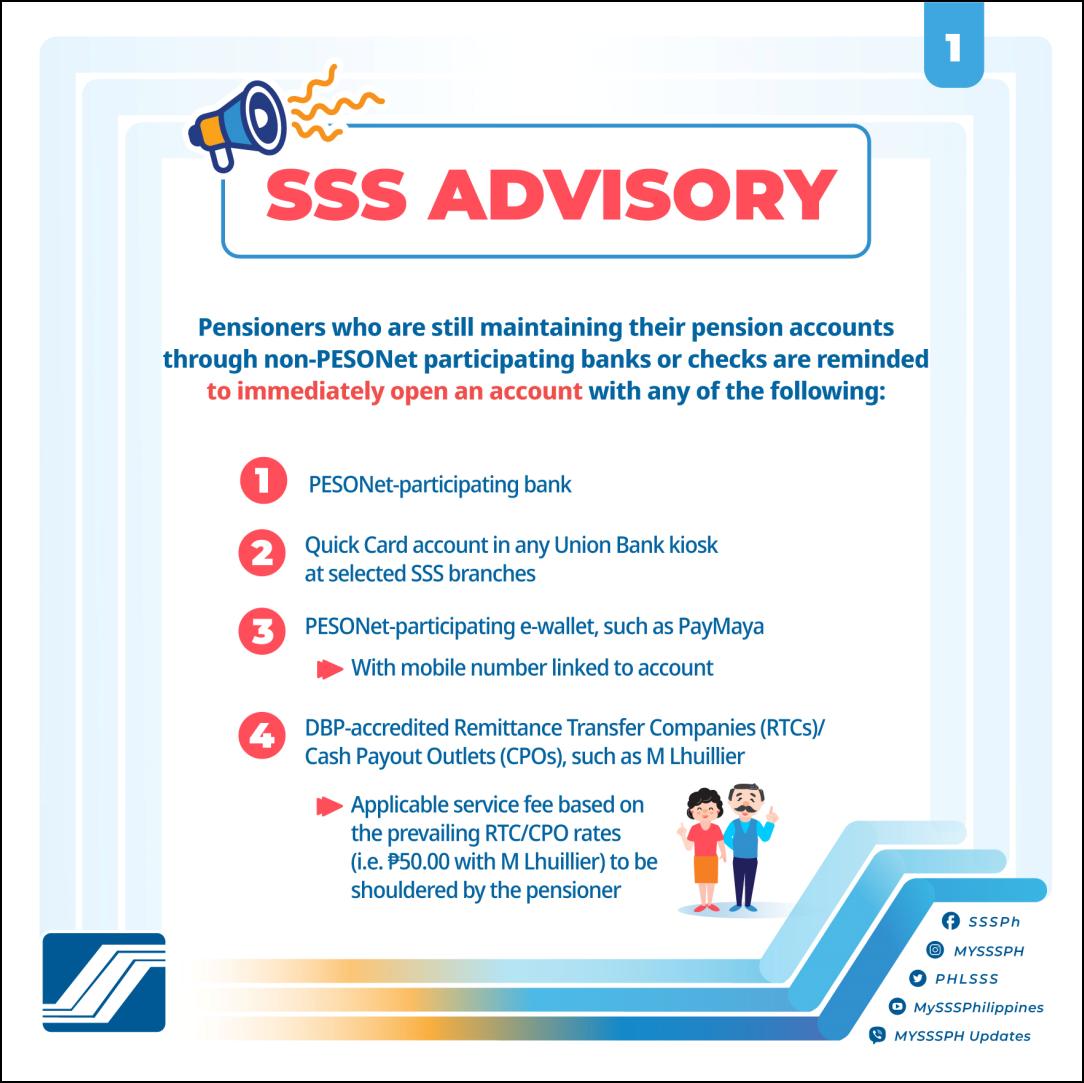

Pensioners who are currently managing their pension accounts through non-PESONet participating banks or checks are advised to promptly open an account with one of the following:

- A bank that participates in PESONet.

- A Quick Card account, which can be created at any Union Bank kiosk located at selected SSS branches.

- An e-wallet that participates in PESONet, like PayMaya, ensuring the mobile number is linked to the account.

- Remittance Transfer Companies (RTCs) or Cash Payout Outlets (CPOs) accredited by DBP, such as M Lhuillier.

Note: Please be aware that if you select the fourth (4th) option, there will be a service fee based on the current RTC/CPO rates (e.g. PHP 50.00 with M Lhuillier) added to your total cost. This fee will be paid for by the pensioner.

Also read: How to Apply SSS Maternity Benefit Online: A Step-by-Step Guide

Tips for Pensioners Who Wants to Update their SSS Disbursement Account

Here are some tips for updating your SSS disbursement account as a pensioner:

- Keep Your Information Handy: Make sure to have all your necessary documents ready before you start the process. This includes your identification documents, bank details, and any other required information.

- Check Your Details Carefully: Double-check all the information you enter to avoid any mistakes that might delay the process. Ensure that your name and account number match exactly with what’s on your bank records.

- Choose the Right Disbursement Option: SSS offers several disbursement options including PesoNet-participating banks, e-wallets, and RTC/CPO. Choose the one that best suits your needs for easy access to your pension.

- Regular Updates: Keep your disbursement account details updated regularly, especially when there are changes in your bank details or personal information.

- Secure Your Information: Be cautious when entering or sharing your account details. Only use secure and official SSS platforms to update your information.

- Seek Assistance if Needed: If you’re unsure about any step in the process, don’t hesitate to reach out to SSS customer service. They can guide you through the process and help resolve any issues you encounter.

Keeping your disbursement account updated not only ensures timely receipt of your pension but also helps maintain an accurate record of your transactions.

Frequently Asked Questions

1. Where can I update my disbursement account?

A: You can update your account at your local SSS branch or through the SSS website if you have registered for an online account.

2. Why hasn’t my pension been disbursed after updating my account?

A: There could be a delay due to the processing time. If the delay persists, contact SSS.

3. Is it safe to update my account online?

A: Yes, as long as you use the official SSS website or app and ensure your internet connection is secure.

4. Can someone else update my account for me?

A: For security reasons, it’s best that you update your own account.

5. What happens if I don’t update my account?

A: Failure to update your account could lead to delays in receiving your pension benefits.

6. Do I need to pay any fees to update my disbursement account?

A: Generally, there are no fees for updating your account, but it’s best to check with SSS to confirm.

Also read: Easy Steps to Check Your SSS Contributions Online

Summary

In order to ensure the smooth disbursement of pension loans, it is important for pensioners to keep their SSS Disbursement Accounts up-to-date. Aging can make it harder for seniors to keep track of all the necessary paperwork and documents required to maintain the accuracy and accessibility of their accounts, but with the help of the Social Security System, retirees can be confident that they will receive the financial benefits they need to live a comfortable and secure life.

Whether you are a current or prospective beneficiary of pension loans, it is crucial that you take the time to update your SSS Disbursement Account in order to avoid delays or complications in receiving your hard-earned pension. Don’t let bureaucracy get in the way of your peace of mind – update your account today and rest assured that your financial future is in good hands.

Contact Information

Customer Service: 1-800-10-2255777

Email: member_relations@sss.gov.ph

Website: https://member.sss.gov.ph/members/