For individuals looking to apply for a personal loan, Right Choice Finance offers flexible repayment terms that can be tailored to fit your budget. Depending on the amount you are borrowing, there are different minimum repayment periods that can range from 12 to 48 months. Right Choice Finance also offers competitive interest rates which will be discussed upon applying.

Right Choice Finance has been helping small businesses and individuals in the Philippines for over 50 years with smart financial solutions. Right Choice Capital exclusively trains and certifies all of our employees to provide top-tier service.

Also Read: How to Apply Millennium Cash Finance Company Loan

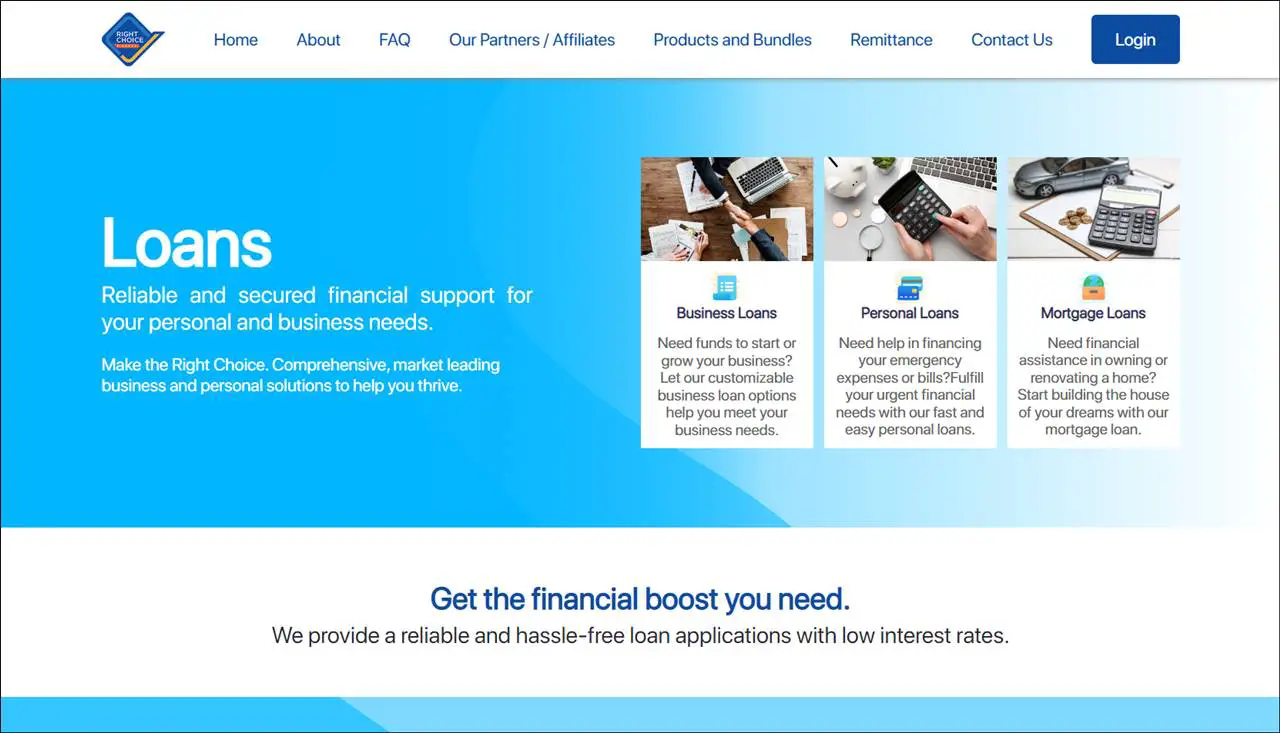

Right Choice Finance is a one-stop shop for all types of loan needs in Cebu. They provide a variety of different loans, such as personal loans, business loans, and vehicle loans. They have experienced staff who will help you determine the best type of loan to fit your needs.

What is Right Choice Finance Lending?

Since 1997, Right Choice Payments (formerly known as Brunphil Express Pte Ltd) offers flexible remittance platforms to provide fast and AML/CFT-compliant money transfer services for the various segments of the population. The money transfer services that they offer, whether in the short or long term, are based on mutual understanding, a thorough KYC assessment of the sender’s and receiver’s information, and the prevailing interest rate levels in the market as regulated by relevant authorities.

The platform offered by Right Choice Payments is designed to meet the needs of a wide variety of customers, ranging from corporate organizations in need of payroll services and online businesses requiring secure payment gateway options to individuals remitting funds abroad.

Benefits

- Find a loan that works for you

- Applying for a loan is easy and can be done online.

- Evaluate progress regularly

- You can expect a quick response to your application.

- The funds will be sent to you electronically.

- Your account executive is solely dedicated to your application process.

Qualifications

- Filipino Citizen

- 20 – 60 years old

- Regular Full-time employee for at least 1 year

- Has at least a minimum income of 12000 per month

Requirements

- Certificate of Employment

- Payslip (3 months)

- Proof of Billing

- 2 Valid IDs

- Location Selfie (w/ residence facade that includes house number as background)

- Bank statements via BRANKAS for faster processing within 24 hrs. (accredited banks BDO, RCBC, PNB, Metrobank & BPI) or manually upload the bank statements (latest 6 mos.)

- Post Dated Checks (PDCs)

Steps in applying for a Personal loan through Right choice Finance

Step 1: Download the Right Choice Finance App on Your Mobile. To apply for a personal loan, you’ll need to download their app by clicking on this link through Google Play: https://play.google.com/store/apps/details?id=ph.rightchoicefinance.app&pli=1 and click here for Apple app store: https://apps.apple.com/pk/app/myrcf/id1531321927

Step 2: Create RCF Wallet Account and Get Verified

Step 3: Select Your Loan (Personal Loan)

Step 4: Upload Your Requirements to the App

Step 5: Wait for Loan Approval

Step 6: Receive Funds in Your RCF Wallet

Tips for Salary Loans

1. Understand What Salary Loans Are

Salary loans in the Philippines are designed to be used as a short-term means of supplementing your income until the next time you receive a payment. These loans differ from a property or personal loans, as they do not require collateral and can be obtained more quickly.

2. Only Ever Borrow What You Need

To prevent your interest from spiralling out of control, focus on this transaction as if you were borrowing from yourself. Make sure that you use as much of your salary as possible to make repayments, starting with your next paycheck.

3. Make a detailed plan of what the money will be used for

To make your salary work for you, be intentional about where every Peso goes. The more mindful you are about conserving finances, the less chance there is that you will have to take out loans with high-interest rates.

4. Compare Lenders in Detail

Every lender has different benefits and drawbacks.

If you find an offer or an interest rate that seems unusually low, always check that you’re dealing with a legitimate, legal lender. Illegal money lenders use unscrupulous practices to trick customers into agreeing to terms that are unfair and are also potentially dangerous.

5. Understand Penalty Charges

Some people are surprised when they realize they can’t afford to repay their loans. They may have taken out the loan without truly thinking it through first. If you’re unsure about a company’s policies, always ask them directly. A good and honest business will have no problem explaining its procedures to you.

6. Never Borrow When You’re Out of Work

As their name suggests, payday or salary loans should never be considered as a replacement for income if you are currently unemployed. If you can’t show that you have a dependable income, most lenders won’t be willing to give you a loan. Fewer people are willing to lend money and those who are often charged higher-than-average interest rates. If you can, explore alternative options; remember, though, that taking on more debt won’t help you pay off existing debt.

Video: Right Choice Lending Mobile Application

Check out this video which provides an overview of the Right Choice Lending Mobile Application. It explains how you can apply for a loan on-the-go and even shows you how to check your loan status in real-time.

Frequently Asked Questions:

1. How much can I borrow?

The loan amount you’re eligible to receive from us depends on your loan application and our credit review process but will fall somewhere between Php20,000 – Php3,000,000.

2. What happens if I am unable to make a payment?

If you are worried about making a payment on time, contact Right Choice Finance before your due date so we can help make arrangements. Remember, your loan repayment agreement is legally binding. Applicable penalty fees shall apply to all missed payments by our loan agreement.

3. What if the funds were not transferred to my bank account?

If the funds were not transferred to your bank account, email RightChoice Finance at support@rightchoicefinance.ph with a screenshot of your bank account details showing that the funds were not credited on the date of the transaction. We will investigate this immediately and give you feedback within 24 to 48hrs.

4. When will the requestor receive the funds?

Upon confirmation from the recipient, funds will be credited instantaneously. Both parties will receive an email notification after the transfer is complete.

5. Is there a daily minimum or maximum amount I can transfer?

The maximum amount for RCF to RCF transfers is Php20,000 per transaction. The minimum amount you can send for eGC transfers is Php500 and the maximum is Php10,000 per transaction. If you want to change the withdrawal limit, please send us a request at support@rightchoicefinance.ph and our team will get back to you as soon as possible.

6. How can I pay my bills?

If you want to pay your bills through RCF, simply log in to your wallet and click on ‘Bills Payment.’ From there, select the recipient from the drop-down menu. After that, include your reference number as well as any memos or transaction notes before inputting the amount and hitting send.

7. Is there a fee to apply for a loan?

You will not be charged anything for applying for a loan. The processing fee only applies to the principal amount of your approved loan that is given to you.

8. Is there a limit to the amount that I can withdraw?

You are allowed a maximum of Php20,000 in withdrawals or transfers per day, and no more than Php100,000 within one month. When you first set up your account, a withdrawal limit was created. If you want to change the amount of that limit, send us a request at support@rightchoicefinance.ph and our credit team will take a look at it.

9. How can I withdraw funds from my RCF account?

To take out money from your RCF account, follow these steps:

1. Log into your RCF wallet

2. Select ‘Withdraw Funds

3. Choose either Fund Transfer or Payment to the bank

4. Enter your bank account information and hit submit

10. How long will it take for the approval process of a personal loan?

Your application results will take 24 to 48 hours

11. How can I request funds?

To request funds, go to your dashboard and click ‘Request Funds.’ Enter the amount you would like to receive then select the email address of the person from whom you are requesting funds before clicking ‘Request.’ To confirm this action, click ‘Confirm.’

12. How much is the interest rate?

With an interest rate of 1.5% to 5% and a rebate of up to 1.5%, this offer is subject to meeting certain terms and conditions.

13. How can I access and manage my funds?

Launch your e-wallet and log in to access and manage your funds. From the menu options, you can choose what you want to do next such as bills payment, fund withdrawal or request for more funds.

Summary

Right Choice Finance is a great way for Filipinos to be able to get cash loans. Applying for a loan is easy and can be done online. It also offers a quick response time to your application, and the funds are sent electronically. The system is equipped with a software bundle for cash advances so that employees can easily apply for and receive them. In other words, employers can manage, approve, and disburse loan requests with just a few taps on their computers.

Employees can also make loan requests and receive their money without having to go to work. When applying for a salary loan, make sure you understand what it is and only borrow what you need. Compare lenders in detail, understand possible penalty charges and never borrow when you’re out of work.

Contact Information

Right Choice Finance Cebu

Address: Cebu Office Address: 20th Floor ACC Tower Cebu Business Park Ayala Access Rd., Cebu City, 6000

Chat: https://www.rightchoicefinance.ph/contact#hs-chat-open

Email: info@rcf.ph

IMPORTANT: If anyone contacts you claiming to be from Right Choice Finance and asks for money or anything else in exchange for approving your loan, please do not engage with them. This is not a practice that we condone. Please do not click on any links asking for any valuable information such as bank information, etc.